Impact Of GST On The Power Sector

Rajib K Mishra & Senior Advocate Ashok Panda

19 May 2017 5:55 PM IST

Abstract

The central theme of this paper is an analysis of the impact of tax on fossil fuel electricity production in India. This presentation attempts to sequentially examine the existing tax structure, and draw a parallel to the new GST structure. As an economy about to embark revolution, it becomes vitally significant to understand the approach adopted by other GST countries, whose experience can be considered as reliable precedents to India’s evolution. Hence, this paper takes an evaluative approach towards other significant GST regimes. The Power Sector in India is as complex and chaotic as the near infinite, tangled, electricity lines that connect the homes of India. This paper deliberates on the crucial cogs in the power sector machinery, which are power production, transmission and distribution. Each component is vital to not only to the power sector, but to sustaining the Indian economic powerhouse. Each component is intricate in their own right, and face fundamentally specific challenges.

Development of The Indian Power Sector

Almost one and a half decades ago, the Government of India propelled an ambitious National Electricity Policy. It envisioned for “electric power for all by 2012”. The policy came and the year, 2012 has gone by, however, electricity has not reached all the homes as promised. Rather, this policy missed the mark by nearly 60%. Though India is the world’s third largest electricity producer, after U.S., China and Japan, its per capita consumption fares amongst the lowest in the world.

This dismal performance has not gone without notice or action. The statistics do not reflect the transformation and evolution of the energy sector. Since the passage of the Electricity Act, 2003, the industry witnessed an unprecedented shift, from sluggish and listless direction to an active, motivated and goal oriented drive. The industry was able to match five decades worth of infrastructure development in just one. Numerically represented, the combined plant capacity base of 1,00,000 MW in 2001, grew to 2,07,006 MW by 2012. The development since 2012 to 2016 is even more impressive, as shown by a mammoth capacity addition of 1,01,713 MW. The present capacity stands at 3,08,719 MW.

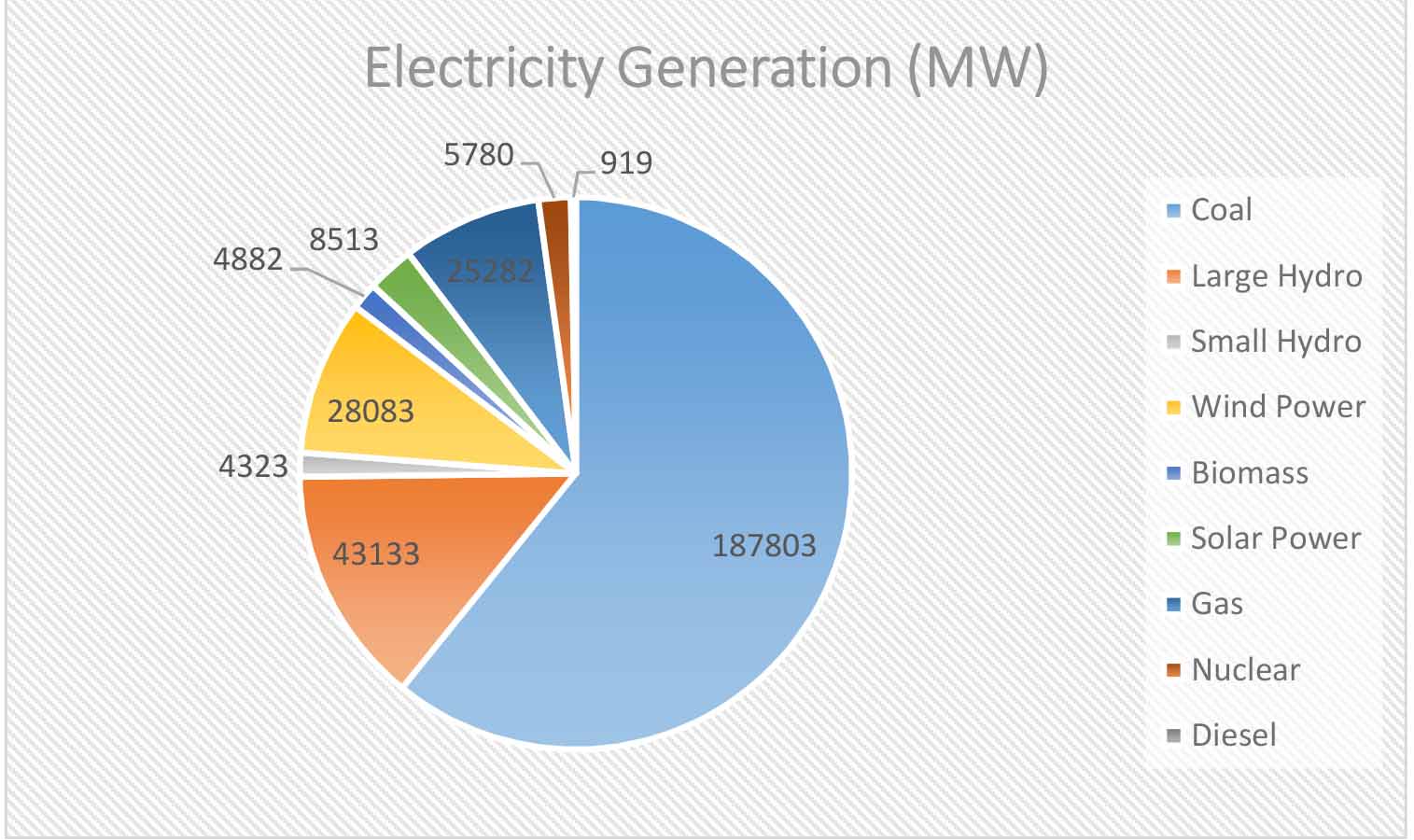

Figure 1: Sectoral Generation of Electricity

Table 1: Sectoral Generation of Electricity

| Type of Fuel | Generation (MW) | Segment Share (%) |

| Coal | 187803 | 60.8 |

| Large Hydro | 43133 | 14.0 |

| Small Hydro | 4323 | 1.4 |

| Wind Power | 28083 | 9.1 |

| Biomass | 4882 | 1.6 |

| Solar Power | 8513 | 2.8 |

| Gas | 25282 | 8.2 |

| Nuclear | 5780 | 1.9 |

| Diesel | 919 | 0.3 |

| Total | 308719 MW | 100 % |

All sectors in power generation have grown. Concentration is being shifted from fossil fuel power to renewable sources of energy. This is reflected in growing share of the renewable energies in present power generation.

The National Electricity Policy of 2016, is ambitious in shifting focus from Fossil Fuel production to Renewable Energy. The ambitious GST may now possibly shift the trajectory of Indian Power Sector and its growth.

With the proposed GST, the power sector is once again about to enter into unchartered territory. In order to minimize the transitional labour pains, the industry requires to be well prepared by developing an effective impact model, and adjusting for the change concurrently with the passage of the GST Bill. In absence thereof, the new NEP will stand as another unfulfilled ambition marked in the pages of Indian History.

The fossil fuel power generation sector, whilst being the core component in the industry, is connected by two vital limbs, electricity transmission and electricity distribution. Thus, the impact of the GST on these two sectors also requires meticulous consideration.

Demand for Electricity

Great strides have been made by the industry in developing the base power generation capacity. The objective to ensure electricity for all of India is clashed by the India’s monstrous demand for electricity. The coal-based power generation would increase by the

Even in 2016, the installed power capacity is not sufficient to quench the power thirsty demand. In order to match this untamed demand for power, the Industry still needs massive addition to the power base, as emphasized in the NEP, 2016 as well as the 2015-16 Economic Survey of India.

Considered in terms of time, money and convenience, the primary driver of base capacity addition is power generation through thermal energy.

Breakups of the Industry

The power industry is run by a network of integral components. At a basic level, the industry operates as:

Fuel à Generation à Transmission à Distribution

The industry is a mixture of goods and services. In thermal electricity production, the fuel typically used is coal, diesel and other petroleum products. They are input goods. They are used to produce electricity, as a final good.

Current Framework of Laws on the Power Sector

The Power Industry currently enjoys a multitude of tax concessions and exemptions. The Union and States have incubated the industry in order meet the larger Central and State objective of reliable and consistent supply of electricity for everyone. Through minimizing indirect taxes, the industry has been able to keep the cost of electricity down, and thereby ensuring reach to all segments of Indian Society.

From the Fuel Aspect, producers are entitled to a reduced tax rate on raw material. Excise Duty on Coal, for example, is levied at 6%, and a nominal Central Sales Tax (CST) rate of 2%. The Freight Charges on Coal receive 70% service tax abatement, resulting in an effective rate of 4.5%. For related procurement services, 15% service tax is levied.

On the aspect of Capital Costs, a uniform excise duty of 12.5% is charged, and the same 12.5% rate is matched for the import of Capital Goods, through BCD and CVD.

On imported coal, producers are only levied Basic Customs Duty (BCD) of 2.5% and a Countervailing Duty (CVD) of 2%, making the effective customs tax at 4.5%.

Power producers also pay a concessional tax of 6% on Engineering, Procurement & Construction Contracts for the development of power plants, transmission grids and distribution networks.

The Foreign Trade Policy as notified by the Directorate General of Foreign Trade allows Mega Power Projects to claim exemptions or refunds on selected imported goods notified by the Ministry of Finance.

Electricity Duty is levied by State Governments against consumption by the user. The user includes not only the final consumer, but also captive consumption. Thus, the Power Generator is liable to pay duty on operational electricity. Presently, there is not uniform rate amongst States. Furthermore, differential duty is charged based on the consumer type and consumption amount. In addition to duty, the certain States charge cess and surcharges. The broad total tax range is from 0% to 22%. The average duty may be estimated at 7%.

To Balance the Duty, most States apply a concessional rate of VAT, and even allow for a refund in special cases.

GST: Introduction

The 101st Constitution Amendment Act was promulgated on 8th September, 2016. The amendment paves the path for the Government to reconstruct the present indirect tax law regime into a single tax structure through a Goods & Services Tax Act.

On trajectory, the President constituted the GST Council on 12 September, 2016

The GST Council, through their meetings, have begun the process of transforming the GST vision into concrete policies. Thus far, the Council has been successfully in proposing the compensation formula for State revenue loss and determining the rate structure of the GST. The Council had also published the revised GST Laws on 25th November, 2016.

GST: Rates

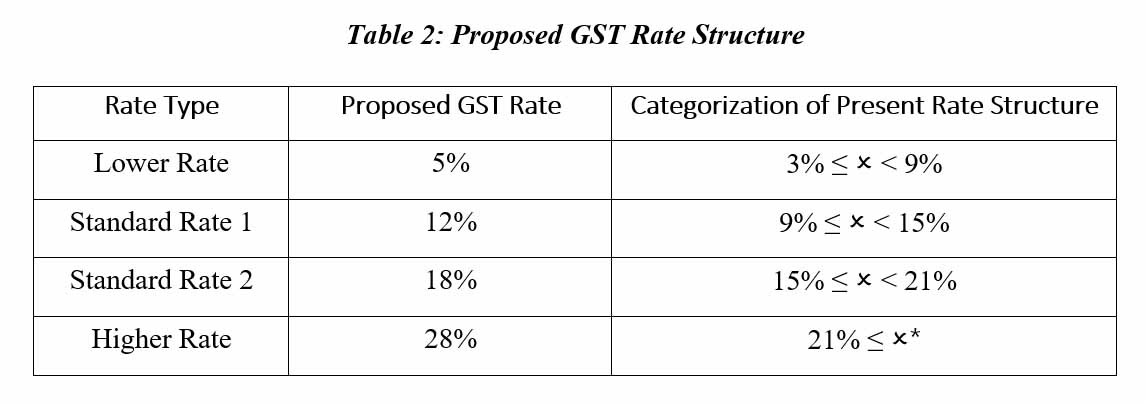

In the Third Meeting of the GST Council, held on 18th October, 2016, a four tier rate structure for GST was proposed to be implemented into the GST. The Finance Ministry amended the proposal with the consensus of the Council and released the following tax structure on 3rd November, 2016:

Table 2: Proposed GST Rate Structure

*Subject to additional cess on demerit goods set to match the present final taxation rate

The proposed absorption structure is still rudimentary in nature, and intricacies involved in determination of the present net rate as applicable to goods and services have not been defined by the Council. Thus far, the Council has only made broad statements on characterizing goods and services into the four slabs. It is further noted that the Council has not released the schedule of rates or a harmonized classification code of goods and services. Therefore, the rate structure does not per se aid in the determination of GST of goods and services predominantly used in the power industry.

Through the course of this paper, certain assumptions will be made regarding the GST rate as may be applicable to the industry specific goods and services.

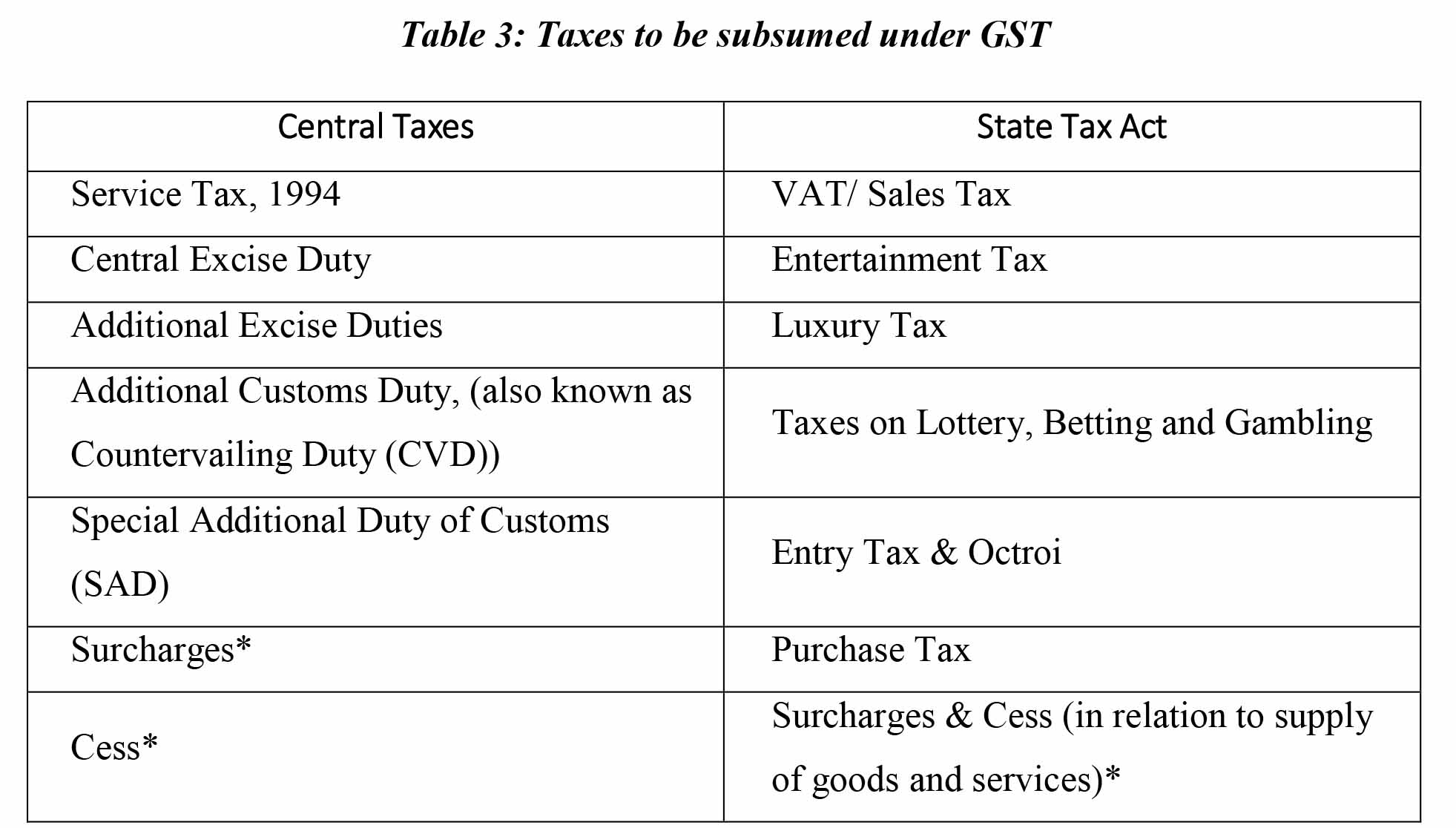

Taxes subsumed

The GST Law would attempt to subsume a variety of indirect taxation laws on goods and services that form part of a transaction chain commencing from the import, manufacture or production of goods and terminating at final consumption. This subsumation should ultimately result in a free flow of tax credit, and thereby mitigate the present cascading effect of indirect taxation.

Article 279A(4) of the Constitution empowers the GST Council to recommend the taxes, cesses and surcharges (as levied by the Union, State and local bodies) that may be subsumed under GST. The Council is further empowered to recommend specific goods and services that may be either subject to or exempt from GST.

The Constitution Amendment Act, 2016 has amended the VII Schedule, and brought in the major indirect taxes under the purview of GST. This has been in line with the taxes enumerated in the ‘First Discussion Paper on Goods and Services Tax In India’. The GST Council, as of date, has not proposed any further taxes that will be subsumed into the GST. However, the current impression is that Surcharges and Cess will also be subsumed into the GST Framework. The taxes subsumed into GST have been tabulated as:

*Surcharges and Cess are anticipated to be subsumed into GST, as per the representations of the Finance Minister made when announcing the Tax Slab Rates.

It is not yet clear whether the Clean Energy Cess (CEC) levied at Rs. 400/Metric Ton (MT) will be subsumed into the GST. If incorporated, the nature of the CEC levy (whether it would be expressed as a fixed rate or as a percentage) requires deliberation by the GST Council.

Certain fuels such as diesel and natural gas are also kept out of the ambit of GST through the amendment of the VII Schedule, List – I, Entry 84. Thus, this loosely translates into maintaining the present status quo for diesel and gas operated thermal plants. Therefore, these plants may not be adversely affected by an increase in fuel costs through taxation under GST.

Electricity As A Good

The authors share the consensus that electricity is presently kept out of the scope and ambit of the model GST Laws. Admittedly, there is a lack of clarity on the applicability of the proposed GST on the electricity sector. However, the conclusion that electricity, as a good or commodity, is excluded from the ambit of GST is derived from a careful analysis of the Constitutional Amendment Act.

The Constitution of India, 1949, treats taxes on electricity separately from taxes on goods and services. Entry 53, List - II of the VII Schedule covers taxes on the consumption or sale of electricity. The Constitutional Amendment Act whilst omitting certain entries, such as Entry 92C (Taxes on services) of List – I, does not omit Entry 53 of the State List. A further examination of the Model GST Laws reveals that there is no prescribed treatment, discussion or mention of electricity and the allied services.

Further substantiation may be derived from the Parliamentary Standing Committee on Finance Report wherein, while highlighting the design parameters of GST, the Report states that:

“State excises on alcohol for human consumption and electricity duty on sale and consumption of electricity would not be subsumed under GST to begin with.”

Therefore, based on a substantive analysis of the provisions of the Constitution, the Amendment Act and the Model Laws, the natural conclusion appears to be that the subject of electricity is presently kept out of the GST domain.

Through the powers conferred under Art. 279A of The Constitution, the GST Council, may recommend for the inclusion of electricity into the scheme of GST. Presently, the Council has made no such recommendation to the Government.

The primary effect of not including electricity in the scope of GST is that the electricity producer is not entitled to claim tax credit against the inputs utilized for the generation of electricity against the output tax typically paid by the generator, by way of electricity duty. This translates into an increased cost of production for the generator. This inference will be explored in detail in the latter part of this paper.

Electricity As A Service

The Council has to further classify the services provided by the Transmission and Distribution Entities in the value chain. The transmission and distribution of electricity presently stands in the negative list, under S. 66D of the Finance Act, 1994. The consequent treatment of the allied services in GST is shrouded in speculation. Considering that electricity, as a good, is presently out of the ambit of GST, it may be axiomatic to consider that the allied services will be exempt, and thus stand out of the purview of GST.

However, if the services stand exempt, the transmission and distribution companies may also not be able claim input credit, and the cascading effect of taxation may linger in these segments of the industry as well.

If the services are brought into the scheme of GST, and charged, for argument’s sake, the lower rate of 5%, the service providers may offset their input taxes, but a situation of double taxation arises. One set of taxes levied by the State through Duty, Surcharge, Cess and Other Taxes, and the second through the GST. The Union had previously allowed the State dominion over electricity taxation by maintaining the services in the negative list.

Through the GST, the complication regarding the treatment of electricity service providers may arise, and would seek reconciliation.

Standing Laws After GST

The GST rate matrix appears to be prima facie high. However, after a closer inspection, considering that the major indirect taxes such as VAT and Excise are subsumed, and that the cascading effect will stand to be mitigated, the proposed rates may be reflected as reasonable, from a general point of view.

However, the proposed GST matrix is not necessarily ideal for the Power Industry, as it has enjoyed a multitude of benefits including marginal CST rates, concessional excise rates and exemptions, service tax exemptions, etc. The combined effective indirect taxation rate under the present system is comparably lower than that of other production industries.

The GST attempts to bring uniformity and remove profiling and special treatments given under the present system. The biggest disadvantage for the power sector is that this indoctrination translates into a tax hike for the industry when compared with the present rates. The fear is that the concessions and exemptions enjoyed by the Power Industry will vanish as India transitions into the GST Regime. The industry is left further helpless by being out of the purview of GST, therein forcing the industry to absorb a bombardment of tax.

Thus, there are two major ill effects for the industry:

- Increase in the tax rate

- Cascading effect of taxation.

This translates into an increase of costs for the generator, transmitter and distributor of electricity.

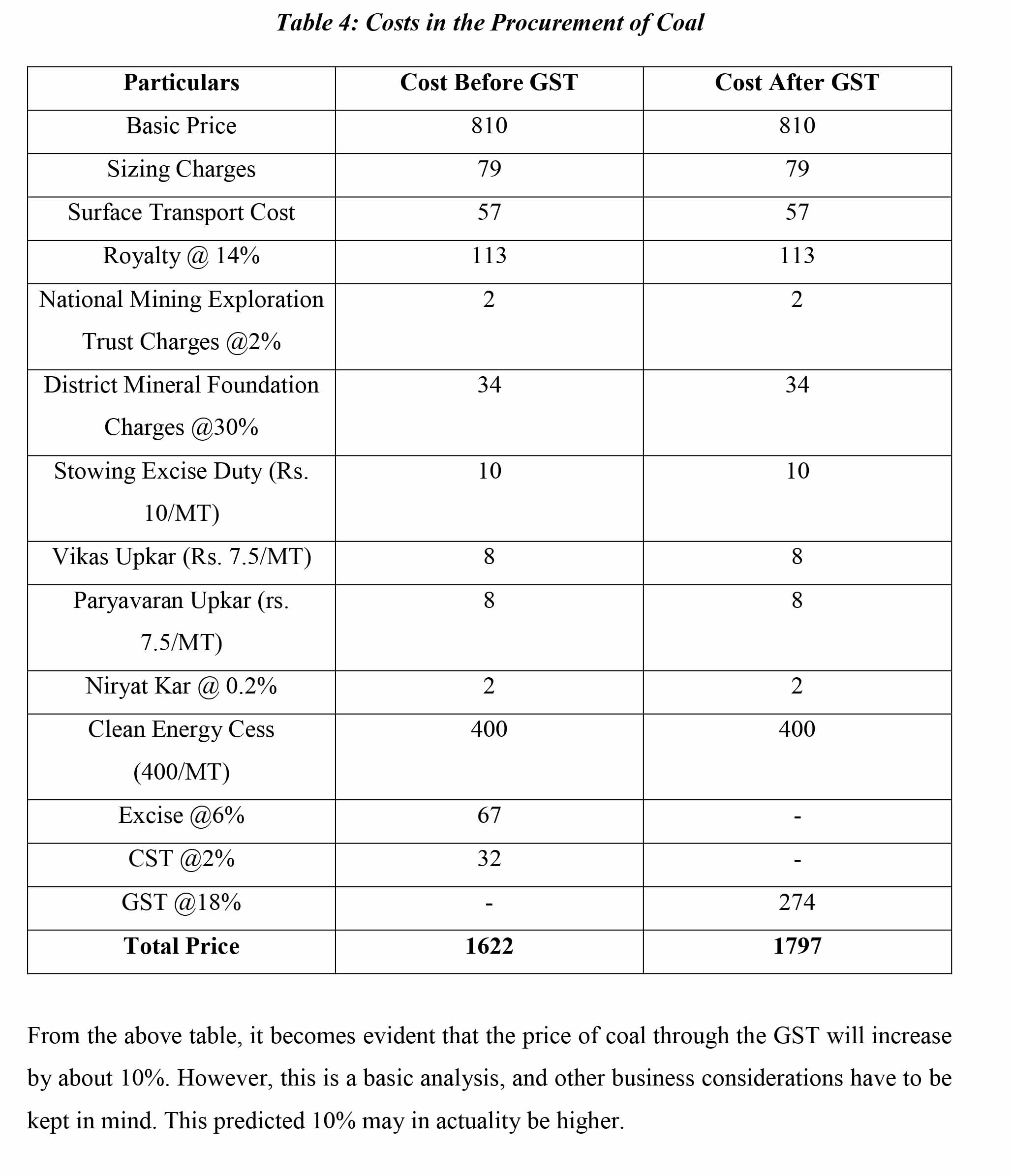

Incidence of Cost: Domestic Coal

In the current indirect law system, electricity is exempted or subject to nil rate under Central excise and VAT & CST laws. The distribution and transmission of electricity is not liable to service tax.

In addition to the above, various benefits on raw materials are available. Such include, a reduced rate on raw materials. The excise duty on coal is presently kept at a marginal 6%. Furthermore, concessions and exemptions are allowed for the import of Capital Goods. Presently on domestic coal, excise duty is at the rate of 6% and CST is at the rate of 2%. In addition to this, there is a levy of Rs. 400 per MT as clean environment cess. On freight charges there is a Service tax abatement of 70% resulting into an effective rate of 4.5%.

The effective rates under the present system and expected impact in the proposed GST regime have been illustrated below:

Table 4: Costs in the Procurement of Coal

From the above table, it becomes evident that the price of coal through the GST will increase by about 10%. However, this is a basic analysis, and other business considerations have to be kept in mind. This predicted 10% may in actuality be higher.

Impact of Capital Costs on the Power Sector

The Capital Costs involved in the development of power plants, transmission lines and distribution centres are huge.

The proposed GST offers a favourable position to contractors. The GST treats ‘works contract’ as services. This, coupled with subsume of various taxes, such as CST, Entry Tax, etc. would ideally increase cost side efficiency in infrastructure development. ‘Work Contracts’ encompass Engineering, Procurement and Construction Contracts. Thus, the construction of any component in the value chain would appear to be prima facie beneficial. As with a single rate of tax against the contract, the cascading effect of procurement costs will decrease. This may translate into a lower development cost for participants in the electricity value chain.

On the other side of the scale, with electricity being exempt from the GST net, the producer will not be able to adjust the service tax levied against the contract with output. While on one hand, work contracts may become cheaper, the producer will not gain from the service tax levied against the contract. Therefore, the net effect on the capital development remains up to conjectures. The extent of the change in the cost of work contracts is not only limited within the taxes against the procurement of goods, but also becomes subject to the anticipated cost of litigation that generally ensues in tax adjudication proceedings.

However, the scale may still tip against the power producer, as in present system, a power generator enjoys a concessionary service tax rate of 6% in EPC Contracts. Therefore, the decrease in costs through simpler GST laws for Contracts would have to fall below the former net cost of contract. In simpler terms, the contract price should fall more than 12% for the producer to gain a competitive advantage in the set-up of power plants. At the same time, it should be noted that the producer will still not be able to offset the service tax.

Possibility of Absorption of Costs

The NTPC Model & Reliance Power Model

The National Thermal Power Corporation (NTPC) is India’s largest producer of fossil fuel electricity, with the majority of its power production arising from the combustion of coal. To gain a comprehensive understanding of the effects of GST, it is important to analyse the financial statistics of a model power producer. As per the financial statement of NTPC, the Corporation reported operational revenue of Rs. 70,506.80 Crores in 2015-16. Its major cost is fuel, accounting for Rs. 43,793.25 Crores (approximately 62% of its revenue). It has reported its profit after tax to be Rs. 10,046 Crores (approximately 14% of its revenue).

The profit margin is considerably lower, when perusing through the financial data of Reliance Power Ltd., India’s largest private electricity generator. The consolidated revenue of RPL stood at Rs. 11,038 Crores in 2015-2016. Out of this, the profit after tax was only Rs. 1,361 Crores (approximately 12% of its revenue).

Two things become crystal clear from this. Firstly, the profit margin in electricity production is relatively low, when considered in light of the fact that NTPC is India’s largest company, and due to its size and capital investment, it enjoys economies of scale. The second facet is that the capital investment required to enter the power industry ranks amongst the highest in India. For such substantive investment, the return on investment, expressed as a percentage, is relatively low. Therefore, substantive profit is linked to the sale of a substantive volume of electricity.

As profit is linked to volume, and fuel is a major cost in production, the rise in fuel input may be forcibly transferred over to the end user. The low margin rate restricts the producer from absorbing the tax incidence.

An increase of 10% in the fuel cost translates as 6% of revenue. Considering that the profit margin is 14%, the increase of 6% in tax represents 45% of the profit margin. Therefore, such absorption is not possible for even a PSU. It must then naturally follow that the incidence will be borne by the consumer.

Electricity Distribution: Impact on Discoms

Electricity distribution is the final component of the value chain. It is the pivotal point, as it connects the end users with the rest of the value chain. The actual working of this component is inherently complex, but in simple terms, the Discoms operate as a market intermediary, purchasing electricity at wholesale rates and marketing it to retail consumers. They charge a mark-up over the wholesale rate before supplying it to the consumer. The entire cost is reflected in terms of tariff as regulated by State Electricity Regulatory Commissions.

Thus far, the distribution of electricity stood in the negative list, under S. 66D of the Finance Act, 1994. It is not yet clear about the treatment of electricity services under the proposed exemption list. However, it may be assumed that as electricity is kept out of the ambit of GST, the distribution thereof may also be kept of this net.

As will be discussed, the increase in the cost of fuel may be translated over to the end consumer, by way of the Fuel Surcharge Levy and Tariff Revision. The question would stand with regard to the treatment of this cost by the Discoms. The treatment of this added cost has to be viewed in the light of UDAY Scheme as well as the current business probabilities of the government.

Electricity Exchanges

Electricity is traded as a commodity on power exchanges, and operate similarly to stock exchanges. Presently, there are two predominant power exchanges in India, namely, the Power Exchange of India Ltd (PXIL) and the Indian Energy Exchange (IEX). In 2015-16, 70.43 BU of electricity was transacted through power exchanges and Electricity Traders. The total traded electricity accounts for 6.4% of the total electricity generation in 2015-16.

Initially, the trade and exchange of electricity was not taxable. However, through Notification No. 24/2010-ST on 22 June, 2010, the trade of electricity has been deemed as a taxable service, defined as:

“any service provided or to be provided to any person, by an electricity exchange, by whatever name called, approved by the Central Electricity Regulatory Commission constituted under Section 76 of the Electricity Act, 2003 (36 of 2003), in relation to trading, processing, clearing or settlement of spot contracts, term ahead contracts, seasonal contracts, derivatives or any other electricity related contract.”

As per the Notification, electricity trading and exchange attracted service tax at a rate of 10% from 22 June, 2010. With the proposed GST, the service tax for exchange and trading may increase to 12% or 18%. The electricity is normally traded to the distributor or in certain cases, to the final consumer under the Open Access Customer Scheme.

The scope for offset is not prima facie clear. If the distributors are brought in the scope and ambit of GST, they may enjoy the offset of the service tax. However, it is important to bear in mind that the electricity exchange only accounts for about 6.5% of the power generation industry. Thus, the offset, in broader terms, will only be marginal.

If the distributors are kept outside the ambit of GST, this immediately translates into an increase in input costs for the distributors acquiring through the exchange.

The silver lining may be that the Exchanges may fall in the ambit of GST value chain, and may be able to reduce their costs by offsetting input tax with GST on output. The silver lining may be further extended to open access consumers, who purchase through the exchange, may be able to offset the service tax by claiming input tax credit, assuming that their industry falls in the scope of ambit of GST. This may have a corollary effect of instigating a greater segment of industries to consume electricity as Open Access Customers.

Transfer of Costs

The value chain in the power industry is connected by Power Purchase Agreements, wherein the producer contracts with the distributor for fixed supplies and rates. From a macroscopic view, the PPA is a standard boilerplate contract. In this contract, the producer is protected from the incidence of the GST through the ‘Change of Law’ clause, which forms part of the contract in nearly all PPAs. Thus, from the perspective of the electricity producer, the increase in costs will be seamlessly be transferred over to the distributor, who will have to make the ultimate decision regarding the cost of distribution.

In case of producers supplying electricity on the exchange, or through non-PPA basis, the decision will lie on them with regard to the treatment of cost and its subsequent absorption.

The incidence in the transfer of cost may be best epitomized through the case study:

- Mundra Ultra Mega Power Project

Through a two stage International Competitive Bidding (ICB) process, the Ministry of Power awarded an Ultra Mega Power Project to Tata Power. The Coastal Gujarat Power Limited (CGPL) was a special purpose vehicle created by Tata Power to develop the Mundra Ultra Mega Power Project (MUMPP), a 4000 MW coal fired power plant in Tunda Village of Mundra.

At the time, Indonesia was exporting coal at extremely cheap rates. Considering this, the thermal power plant was designed to operate on coal imported from Indonesia. In calculating the cost of generation, the then coal cost was incorporated, from which progressive cost projections were made.

After the cost calculation and subsequent tariff approval of the CERC, Tata Power entered into Power Purchase Agreements with multiple State DISCOMs, quoting a levelised tariff of Rs. 2.26/kWh.

In September, 2011, the Indonesian government changed its policy and began to match international coal prices, thereby increasing the cost of generation greatly beyond the assumed parameters, and therein threatening the project viability.

In order to adjust for this, the Tata Power invoked the Change of Law and Force Majeure Clauses in the PPAs. The company also invoked the CERCs power to regulate the tariff under S.79(1)(b) of the Electricity Act, 2003.

The CERC recalculated the compensatory tariff adjusting for the change in fuel prices and made provisions for the recovery of arrears from the DISCOMs. It allowed the power producer to recover Rs.0.29/kWh for FY13-14. However, even in the revised formula, the power generator assumed a significant incidence of the cost.

Even after five years since the change in cost, the new tariff has yet to be implemented. Presently, the matter is sub judice in the Supreme Court.

What this reveals is that a change in tariff is a time consuming process riddled with bureaucratic approvals and subject to litigation. This dissuades the proposition that the GST will cause an instantaneous change in the tariff structure of the power generator. The time frame may be further extended considering that the Regulatory Commissions may be accosted by multiple tariff revisions as soon as the GST is implemented. The losses of the power generators, may however, be recovered over the long run.

Fuel Surcharge Levy

Coal, along with other fuels, is not a static price commodity. The prices of fuel commodities are highly volatile. To bring stability and consistency between the electricity producer and distributor, a fuel surcharge adjustment (alternatively known as a fuel adjustment charge) clause is included in the power purchase agreement under the variable tariff component. Under the said clause, the agreed sale rate is subject to the levy of a fuel surcharge reflective of the fuel rates. The distributors have the discretion as to whether to charge the fuel surcharge to the consumer or bear the cost themselves. Thus, to the extent of the increase in cost attributable to coal, the same may be seamlessly transferred over to the consumer.

To the extent attributable to capital and operation and maintenance costs, the revision of tariff route may be adopted by the industry segments.

Transfer of Increased Cost of Electricity Amongst Consumers

The Business Model of the Power Industry in unique, in the sense that it offers the flexibility in transfer of costs to consumers. The Tariff system implemented by the Government allows for the delivery of electricity to various categories of consumers at different rates. In simpler terms, whilst electricity, as the final product, is the same for all consumers, the price of the commodity differs between domestic consumers and industrial consumers. Furthermore, the rate of the commodity also fluctuates based on usage. The Tariff system, may be loosely categorized as a cross subsidy, or alternatively, from the perspective of the consumer, a regressive tax.

This gives the flexibility for the Government to adjust the incidence of tax on the various consumers. Therefore, the incidence of tax may not necessarily be transferred to all consumers uniformly. Some consumers, especially rural and low usage consumers may not be affected by the higher cost of production of electricity. This, in a sense, safeguards the Government’s objective of ‘Electricity for All’. The contra effect is that industrial consumers and heavy usage consumers may witness a substantial increase in their electricity cost, as they would not only be covering their personal incidence, but also may be subject to cover the incidence of other consumers.

Electricity is an essential commodity. A higher cost of the product will have repercussions on industrial cost of productions. A domino effect may be anticipated, as the cost of production of a good will progressively increase until the good reaches finality. Ultimately, the consumer will face the impact through a surge in the price of the good. Without deviating from the scope of this paper, it may be noted that the economy may face consequent inflation.

Inflation may be naturally deduced, due to the fact that the impact of an increase in electricity would uniformly affect all industries and businesses so contained with them. There is no substitute good for electricity, and therefore, the costs for all manufacturers and business concerns will increase as a result of electricity consumption. The consumer will witness an increase in the prices of both, competitive goods as well as substitute goods. Thus, the consumer will be force fed the increase in the general prices of goods.

Challenges Ahead: Improvement of Transmission & Distribution

India has comparatively the worst transmission and distribution efficiencies in the world. This is in comparison with all three, LDC, MDC and DC. The primary object of India’s NEP was to ensure that electricity was connected to each and every household. In this drive, for greater electricity distribution, an important factor, namely, T&D loss remained untouched. As the country has approached electric unification, the goal will slowly shift towards improving the infrastructure and minimizing transmission and distribution loss. This will require a wide scale revamp of the current infrastructure.

The question that now arises is whether the GST will hamper or promote this infrastructure advancement.

Comparison with other GST Countries

As India embarks on a monumental transformation, it may be significant to understand and appreciate how other GST countries have adopted and treated electricity.

Figure 2: Effective GST Rates on Consumption of Electricity by GST Adopted Countries

Malaysia

Malaysia introduced the GST with effect from 1 April, 2015. Under their new GST law, electricity is a supply and falls within the ambit of GST. Malaysia has applied a dual rate treatment on electricity. For domestic customers, the first 300 kWh of electricity is subject to 0% GST. The subsequent supply is subject to GST at 6%. For industrial and commercial users, a flat 6% is charged regardless of usage. The dual rate protects the poorer segment of the population, while still allowing the government to earn tax revenue on the supply of electricity. Electricity has found its place in the GST chain, therein removing the cascade of taxes.

Singapore

In Singapore, Electricity is a Standard Rated Supply, and is liable to a 7% GST against the consumer. It is does not distinguish it an essential commodity. Like other GST countries, electricity does not face a cascade of taxes.

Australia

Australia also Levies a GST on Electricity, at a rate of 10%. electricity falls in the broad range bracket of goods and services. It is not distinguished as a special good and thus not attract zero rating or concessional rating.

Canada

Canada has a slightly more complex indirect tax system, comparable to the India’s CGST, SGST and IGST system. In Canada, GST is levied by the Federal Government and PST (Provincial Sales Taxes) are levied by the provinces. Certain Provinces have adopted a single tax system, termed as the Harmonized Sales Tax (HST), wherein a single taxation rate is adopted and taxes collected are apportioned between the federation and the Provinces. What is unique in Canada is that although a single tax rate exists, the rate fluctuates between the provinces. The average rate is from 13-15%, while some provinces maintain a marginal rate of 5%. Electricity is also kept within the GST (or HST) framework, and on average, is levied at a rate of 13%.

New Zealand

New Zealand has adopted a 15% GST rate. New Zealand has also considered electricity as a good and placed it within the ambit of GST and thus, levy 15% on the consumption of electricity. Although an essential commodity, there is no shortage of supply, and as a developed country, the general population have the capability to pay, which is not presently the situation in India. Furthermore, by including electricity in the supply chain, it prevents the cascade of taxes.

Lessons to Be Learned

Presently, all countries that have adopted GST have included electricity in their ambit. A developing country such as Malaysia has attempted to maintain a dual rate to protect the lower segments. Singapore, a more advanced but still a developing country has implemented a relatively low GST rate of 7%. Australia, Canada and New Zealand adopt a higher GST rate, ranging from 10-15%. However, these are developed countries.

This trend shows that that Electricity, as a basic good, should be maintained within the purview of GST, and that appropriate credit set off should be allowed. As the stage of development of a country progresses, the GST rate consequentially also increases.

Conclusion & Recommendations

India stands at unique to all other GST countries. It aims to institute four GST slabs, but at the same time, keep an essential commodity out of its purview. The cascade of taxes is propelled, and its impact will ripple through the Indian Economy.

India, perhaps, does not intend to model its Laws and Procedures with any other country. While it is revolutionizing the Tax System, the question still remains as to whether it will have a positive outcome or not. The Power Industry, a crucial element in the Indian Economic Structure, will stand to face severe complications, both on a procedural aspect as well as in terms of costs. With Distribution Agencies riddled with debt, it becomes difficult for the State Distribution Agencies to subsume to incidence of cost. A certain portion will have to be transmitted to the consumers.

The easiest route for the government would be to include electricity and its allied services in GST. The cascading effect of taxation would be mitigated, at cost of the Government losing revenue from breaking the supply chain as proposed in the present GST system.

Failing this, the government should subsidize the cost of production at source, in order to mitigate tariff revisions and increases in fuel surcharge levy. If concrete steps are not taken by the Government in reconciling these major issues in the proposed GST Model Laws, the Power Industry, the Indian Economy and the finally the Indian will be adversely hit.

Rajib K Mishra is a Director, PTC India Limited and Ashok Panda is a Senior Advocate in Supreme Court of India.

The Authors acknowledge the valuable assistance of Mr. Aniruddha Purushotham, Advocate in preparing this article.

[The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of LiveLaw and LiveLaw does not assume any responsibility or liability for the same]