All You Need To Know About Insolvency Professional Examinations

Pranav Khatavkar

31 March 2017 11:04 AM IST

Introduction

The Insolvency and Bankruptcy Code, 2016, has been introduced with the primary intention of improving India’s ranking in the ease of doing business index, increasing lender’s confidence and facilitating expansion of the credit market in India.

As the Code is largely executed through insolvency professionals, its success hinges on their skills and competence. Insolvency professionals (IPs) are licensed professionals authorised by insolvency professional agencies (IPAs) and the Insolvency and Bankruptcy Board of India (Board) which take up the roles of interim resolution professional/ resolution professional/liquidator/bankruptcy trustee in insolvency resolution and liquidation/bankruptcy process of different entities (as the case may be) as have been envisaged under the Code.

Considering the powers and duties conferred on insolvency professionals under the Code, it is clear that the entire insolvency resolution process revolves around them.

With the primary intent of producing quality IPs, the Code, through the Insolvency and Bankruptcy Board of India (Insolvency Professionals) Regulations, 2016 (IP Regulations), has prescribed qualifying examinations for insolvency professionals i.e., insolvency professional examinations. In this article, I am going to throw light and elucidate on all that one needs to know about insolvency professional examinations.

What are Insolvency Professional Examinations?

Regulation 3 of the Insolvency and Bankruptcy Board of India (Insolvency Professionals) Regulations, 2016, deals with insolvency professional examinations. The said Regulation 3 has been reproduced as under:

- (1) The Board shall, either on its own or through a designated agency, conduct a ‘National Insolvency Examination’ in such a manner and at such frequency, as may be specified, to test the knowledge and practical skills of individuals in the areas of insolvency, bankruptcy and allied subjects.

(2) The Board shall, either on its own or through a designated agency, conduct a ‘Limited Insolvency Examination’ to test the knowledge and application of knowledge of individuals in the areas of insolvency, bankruptcy and allied subjects.

(3) The syllabus, format and frequency of the ‘Limited Insolvency Examination’, including qualifying marks, shall be published on the website of the Board at least one month before the examination.

Regulation 3 enables the Board to conduct on its own or through a designated agency two qualifying examinations for insolvency professionals i.e. Limited Insolvency Examination (LIE) and National Insolvency Examination (NIE).

Further Regulation 5 of the Insolvency and Bankruptcy Board of India (Insolvency Professionals) Regulations, 2016, states passing the LIE/NIE as one of the criteria for being registered as an insolvency professional. The said Regulation 5 has been reproduced as under:

- Subject to the other provisions of these Regulations, an individual shall be eligible for registration, if he

(a) has passed the National Insolvency Examination;

(b) has passed the Limited Insolvency Examination, and has 15 years of experience in management, after he received a Bachelor’s degree from a university established or recognised by law; or

(c) has passed the Limited Insolvency Examination and has 10 years of experience as -

(i) a chartered accountant enrolled as a member of the Institute of Chartered Accountants of India,

(ii) a company secretary enrolled as a member of the Institute of Company Secretaries of India,

(iii) a cost accountant enrolled as a member of the Institute of Cost Accountants of India, or

(iv) an advocate enrolled with a Bar Council.

Hence in order to be eligible for registration as an Insolvency Professional, an applicant has to fulfill the following criteria:

- Register with an IPA.

- Appear for and clear the LIE or NIE.

- Have a work experience of 15 years as a management professional after having received a bachelor’s degree from a university established or recognised by law.

- Have a work experience of 10 years post enrollment as a chartered accountant/ company secretary/ cost accountant/ advocate.

Further, the Ministry of Corporate Affairs vide press release dated 23rd November 2016, stated that the following categories of individuals are eligible for registration as insolvency professionals:-

- Advocates, chartered accountants, company secretaries and cost accountants with 10 years’ of post-membership experience (practice or employment) or a graduate with 15 years’ of post-qualification managerial experience, on passing Limited Insolvency Examination.

OR

- Any other individual on passing National Insolvency Examination

At the outset, it can be deduced that a work experience requirement has been specified for applicants appearing for the LIE, and not for applicants appearing for the NIE.

On 30th November 2016, the Board notified the syllabus for the LIE.

As far as the NIE is concerned, the examination has not been notified as of date. However, as per the press release made by the Ministry of Corporate Affairs on 23rd November 2016, the details of the NIE will be specified through regulations.

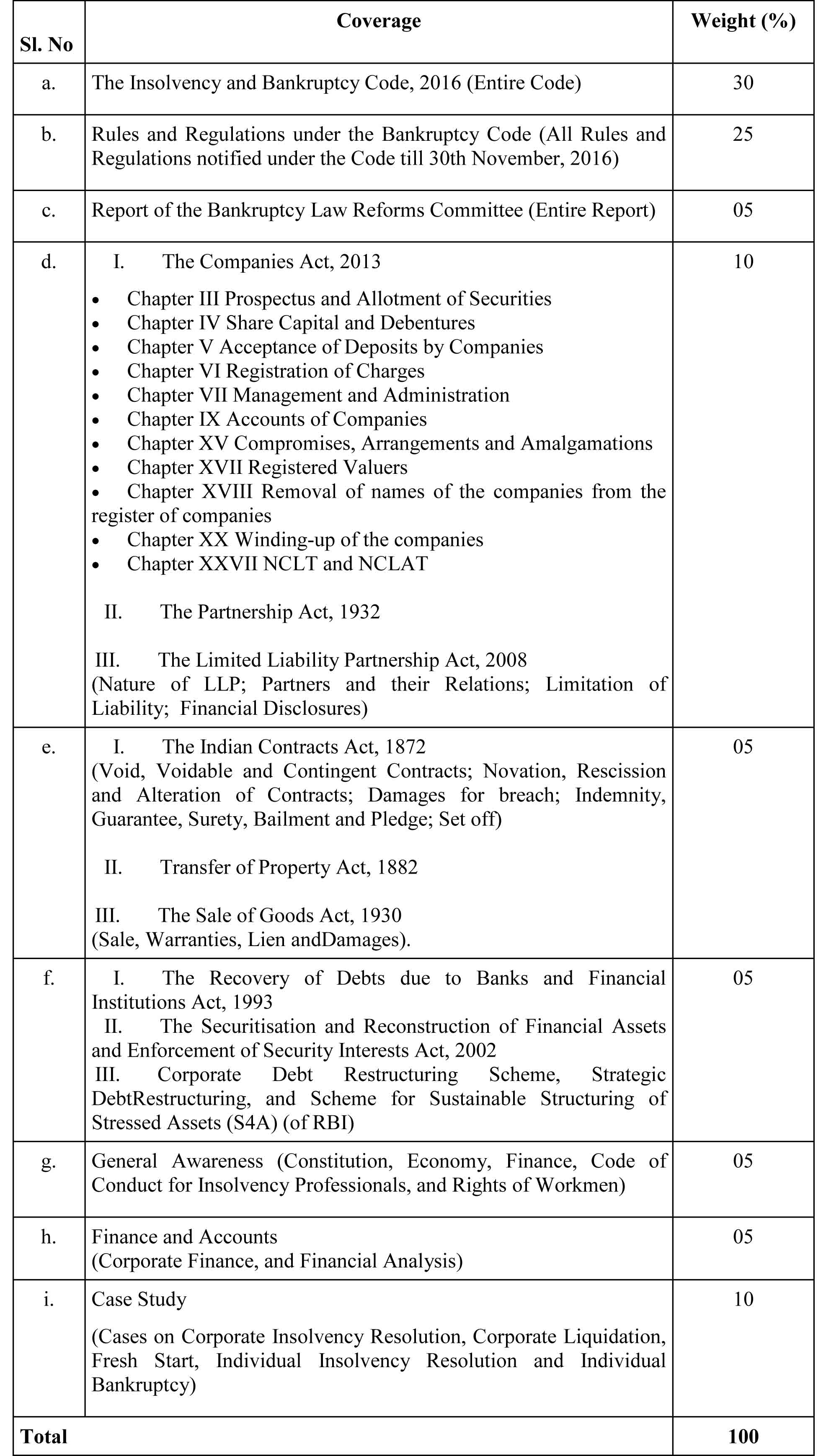

Syllabus of the Limited Insolvency Examination

Format of Limited Insolvency Examination

- The examination will be conducted online (computer-based in a proctored environment); with objective multiple choice questions.

- The duration of the examination will be two hours.

- A candidate will be required to answer 90 questions in two hours for a total of 100 marks.

- There will be negative marking of 25% of the marks assigned for the question.

- Passing mark for the examination is 60%.

- Passing candidates will be awarded a certificate by the Board.

- A candidate will be issued a temporary mark sheet on submission of test paper.

- No workbook or study material will be provided.

Frequency of Limited Insolvency Examination

- The examination will be available from 100 + locations in the country.

- The examination will be available from 31st December, 2016, between 9:30 am and 5:30 pm.

- The enrollment for examination will be open from 15th December, 2016.

- A candidate needs to enroll for examination at www.nism.ac.in. He needs to select IBBI-Limited Insolvency Examination and enroll himself for the examination by choosing the time, the day and the examination centre for his examination.

- A candidate needs to provide PAN and Aadhaar to enroll for the examination.

- A candidate needs to pay examination fee of Rs. 1,000 online on every enrollment.

The Board has also released a set of frequently asked questions in relation to the Limited Insolvency Examination. Those are available here.

Pranav Khatavkar is a Mumbai-based advocate, who has penned a commentary on the Insolvency and Bankruptcy Code, 2016. In continuation of his mission of developing India’s re-written bankruptcy framework, Pranav recently wrote a book titled Guide to Insolvency Professional Examination that aids and assists candidates to appear for the insolvency professional examination.

Pranav Khatavkar is a Mumbai-based advocate, who has penned a commentary on the Insolvency and Bankruptcy Code, 2016. In continuation of his mission of developing India’s re-written bankruptcy framework, Pranav recently wrote a book titled Guide to Insolvency Professional Examination that aids and assists candidates to appear for the insolvency professional examination.

[The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of LiveLaw and LiveLaw does not assume any responsibility or liability for the same]