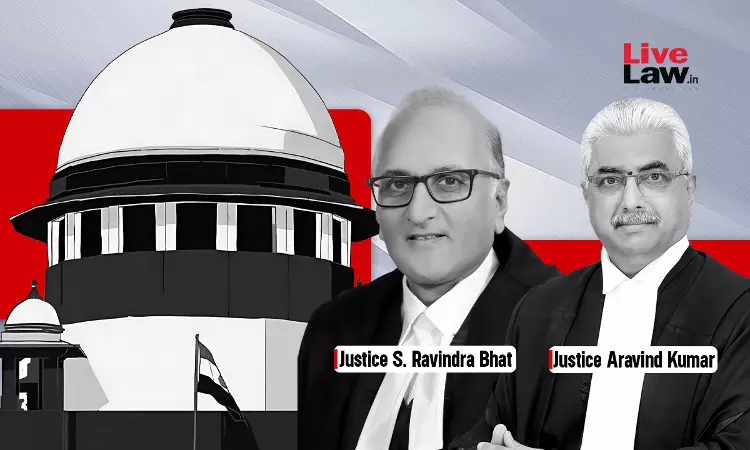

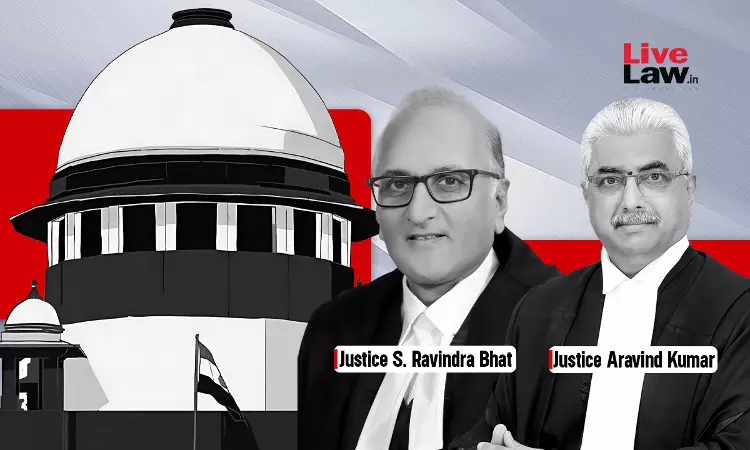

The Supreme Court on Wednesday(August 23) emphasised that bail with onerous conditions should only be granted under exceptional circumstances and not in ordinary matters. The bench asserted that pre-trial detention should only be employed when there is a clear threat to society or a genuine concern that the accused could tamper with evidence or influence witnesses. The court also referred to...