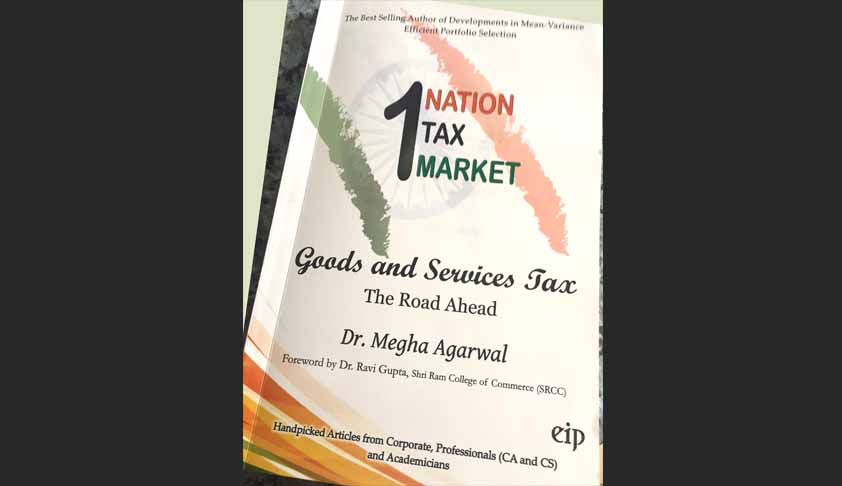

Book Review: 1 Nation, 1 Tax, 1 Market - Goods and Services Tax - The Road Ahead

Aniruddha Purushotham

18 May 2017 2:25 PM IST

Next Story

18 May 2017 2:25 PM IST

Dr. Megha Agarwal has recently published “Goods and Services Tax – The Road Ahead”. This book is structured as a compilation of individual focused pieces that as a whole, stand to provide the reader a well laid and thorough understanding of how GST would transform the economic landscape of India. The author has carefully curated material and has brought in the best into this...