High Courts

Centre Notifies Permanent Appointments For 7 Additional Judges Of Kerala High Court

The Central Government on Monday (March 2) notified permanent appointments for seven additional judges to the Kerala High Court. The notification reads as follows:"In exercise of the power conferred by clause (1) of Article 217 of the Constitution of India, the President is pleased to appoint S/Shri (i) Mullappally Abdul Aziz Abdul Hakhim,(ii) Syam Kumar Vadakke Mudavakkat,(iii) Harisankar Vijayan Menon,(iv) Manu Sreedharan Nair,(v) Easwaran Subramani,(vi) Manoj Pulamby Madhavan and(vii)...

Karnataka High Court Grants Bail To Ex-MP's Son Booked In CBI Case Over Alleged Counterfeiting & Forgery Of Govt Stamps

The Karnataka High Court recently granted bail to DA Srinivas, son of late former MP D.K. Adikesavulu, who has been booked in a case registered by the CBI over alleged counterfeiting and forgery of government stamps and documents. The case was lodged after a complaint was filed by Sub-Registrar, Gandhinagar alleging that he came to know through a newspaper report that forged documents were prepared using a machine which belongs to his office and 08 documents of Yelahanka Sub-Registrar...

Karnataka High Court Quashes Case Against Congress Leader Booked For Blocking Train At Station During Protest

The Karnataka High Court quashed criminal proceedings lodged against Congress leader Mohammed Haris Nalapad who was booked in 2022 for squatting infront of a train at a station in Bengaluru resulting in its detention, noting that none of the ingredients alleged were made out. The petitioner had approached the high court against a trial court order taking cognizance of offences in an FIR registered under Sections 145(c)(If any person in any railway carriage or upon any part of a railway...

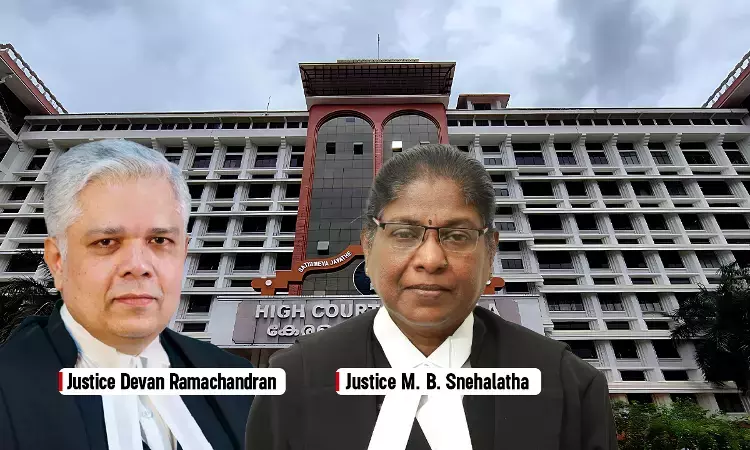

Kerala High Court Seeks Reports From Immigration & Police On Suraj Lama Missing Case; Flags Lapses From Authorities

The Kerala High Court has expressed serious concern over multiple procedural lapses by authorities in connection with the late Suraj Lama, an Indian citizen who was deported from Kuwait but went missing after arriving at Kochi.The Division Bench comprising Justice Devan Ramachandran and Justice M B Snehalatha was considering the matter in which it had earlier directed the Special Investigation Team (SIT) to continue its investigation, to document the sequence of events from the time of Lama's...

Acquittal In Criminal Case No Bar On Employer To Conduct Departmental Proceedings: MP High Court Denies Relief To Cop

The Madhya Pradesh High Court has dismissed an appeal filed by an Assistant Sub Inspector of Police challenging the order dismissing him from service, emphasizing that mere acquittal from criminal proceedings does not bar an employer from initiating departmental proceedings. The division bench of Justice Anand Pathak and Justice Anil Verma reiterated that mere acquittal by Criminal Court would not debar an employer from exercising the power to conduct departmental proceedings in...

Meghalaya High Court Upholds Shillong Club's Century-Old Lease, Says Admitted Deed Cannot Be Questioned Over Mere Non-Production

The Meghalaya High Court has dismissed the Second Appeal filed by the Shillong Club Ltd., holding that once both parties admit the execution and existence of the lease deed, the First Appellate Court can't invalidate it merely because the original document was not produced. Justice W.Diengodh remarked that: “In view of the admission of the parties as to the existence or authenticity of the said lease deed 20.03.1923, the learned First Appellate Court could not have come to a finding that the...

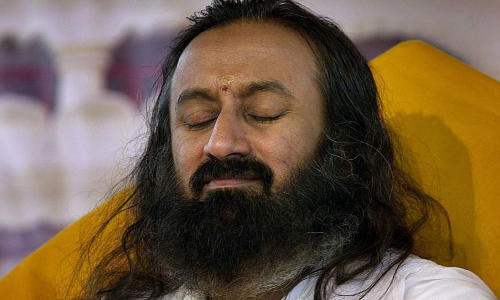

Karnataka High Court Reserves Verdict In Sri Sri Ravishankar's Plea To Quash FIR Over Alleged Land Encroachment

The Karnataka High Court on Tuesday (March 3) reserved its verdict in spiritual guru Sri Sri Ravishankar's plea challenging an FIR over alleged encroachment of public lands in Bengaluru.On January 13 the court had stayed the investigation against the petitioner.After hearing all the parties Justice M Nagaprasanna orally said, "Heard...reserved. Interim order subsisting would continue till the disposal of the petition". The senior counsel appearing for the petitioner submitted that there...

'Bamboo Stick Or Rod Not An Instrument Likely To Cause Death': Calcutta High Court Reduces Man's Sentence

The Calcutta High Court has held that while a fracture injury squarely falls within the definition of “grievous hurt” under the Indian Penal Code, an assault with a bamboo stick or rod cannot automatically attract the offence of causing grievous hurt by a “dangerous weapon” under Section 326 IPC. Modifying the conviction of six persons, the Court ruled that such objects are not inherently instruments “likely to cause death”, and therefore altered their conviction to Section 325 IPC and reduced...

Deity Cannot Be Left Remediless Merely Because It Doesn't Vote: Madras High Court Flags Delay In Removing Encroachment On Temple Land

The Madras High Court has criticised the delay on the part of the state in complying with court orders and removing encroachment of around 507 acres of temple land. The bench of Justice P Velmurugan and Justice B Pugalendhi observed that constitutional governance should not be subordinate to electoral expediency. The court remarked that merely because a deity did not have voting rights, it should not be left remediless. The court added that it had a parens patiae jurisdiction, and when...

Delay In Filing Complaint No Ground To Discard Matrimonial Cruelty Case; S.498A IPC Is Continuing Offence: Kerala High Court

The Kerala High Court recently passed a judgment wherein it refused to set aside the conviction of a husband under Section 498A of the Indian Penal Code on the ground that there was delay in filing complaint by wife.Justice M.B. Snehalatha remarked: “Matrimonial cruelty is a continuing offence, as the suffering of the victim does not end with a single isolated incident but continues so long as oppressive conduct persists. Harassment and cruelty within the marriage cannot be viewed in isolation,...

Kerala High Court Monthly Digest: February 2026 [Citation: 63 - 121 ]

Nominal Index [Citations: 2026 LiveLaw (Ker) 63 - 121Kamal Kumar Mandal v. State of Kerala and Anr, 2026 LiveLaw (Ker) 63Suo Motu v Union Government and Ors, 2026 LiveLaw (Ker) 64Lunar Rubbers v Kerala Head Load And Timber Workers And Factory Workers Union(KTUC and ors and connected matter, 2026 LiveLaw (Ker) 65M R Ajayan v Union of India, 2026 LiveLaw (Ker) 66Susan K. John v. National Board...

S.35(3) BNSS | Asking Accused To Appear Before Police In Regular Intervals Such As Every 15 Days Not Proper: Orissa High Court

The Orissa High Court has held that while the police has power to issue notice to the accused to appear when required for investigation under Section 41A(1) CrPC/Section 35(3) BNSS , it however said that requiring the accused persons to appear every 15 days is not proper. Clarifying this significant procedural aspect vis-à-vis arrest, the Bench of Justice Savitri Ratho notably observed–“As it is provided in Section 41 A that the police officer is to, “issue a notice directing the person...

![Kerala High Court Monthly Digest: February 2026 [Citation: 63 - 121 ] Kerala High Court Monthly Digest: February 2026 [Citation: 63 - 121 ]](https://www.livelaw.in/h-upload/2024/09/03/500x300_559124-750x450519604-750x450456553-408710-kerala-high-court-monthly-digest.webp)