Top Stories

Complete Supreme Court Annual Digest 2025 [Part-VIII]

Legal Services Authorities Act, 1987Importance of legal representation and particularly for those economically or socially less fortunate – Discussed. (Para 23) Sovaran Singh Prajapati v. State of Uttar Pradesh, 2025 LiveLaw (SC) 213 : 2025 INSC 225Sections 21 and 22E — Challenge to Lok Adalat Award — Maintainability of Writ Petition — Held, the statutory finality attached to a Lok...

Supreme Court Issues Contempt Notice To 51 Delhi Hospitals Over Not Meeting Requirement Of Free Treatment To Weaker Sections

The Supreme Court recently issued contempt notice to 51 hospitals in Delhi over non-compliance with the condition to provide minimum 10 percent IPD (Inpatient Department) and 25 percent OPD (Outpatient Department) for the weaker sections, free of cost.The Court called on the hospitals to show cause as to why contempt proceedings be not initiated against them and concessions granted by the Delhi government (towards land allotment) withdrawn. The hospitals which have been issued notices include -...

Supreme Court Rejects Ex-Chhattisgarh CM's Dy Secretary Saumya Chaurasia's Plea Against Sanction Notices In Tax Evasion Case

The Supreme Court recently dismissed a plea filed by Saumya Chaurasia, former Deputy Secretary to ex-Chhattisgarh Chief Minister Bhupesh Baghel, challenging sanction notices issued under the Income Tax Act authorizing her prosecution in a tax evasion case.A bench of CJI Surya Kant and Justice Joymalya Bagchi heard the matter and rejected Chaurasia's challenge to the Delhi High Court order which dismissed her petition on the above issue.It however added that she would be at liberty to raise all...

Supreme Court Monthly Digest: January 2026

Administrative Law — Doctrine of Legitimate Expectation — Policy Change — Lack of Probity and Transparency - Service/Education Law — Alteration of the "Rules of the Game" - Supreme Court found that the policy modification was prompted by an undisclosed representation from the father of a high-ranking candidate who failed to disclose his private interest - Such a change, introduced...

Supreme Court Weekly Digest January 11 - 20, 2026

Arbitration and Conciliation Act, 1996; Section 11(6-A) — Appointment of Arbitrators — Scope of Judicial Review — The Supreme Court or High Court, while considering a Section 11 application, must strictly confine its examination to the existence of an arbitration agreement - The use of the word "examination" indicates a limit to the court's jurisdiction, intended for a...

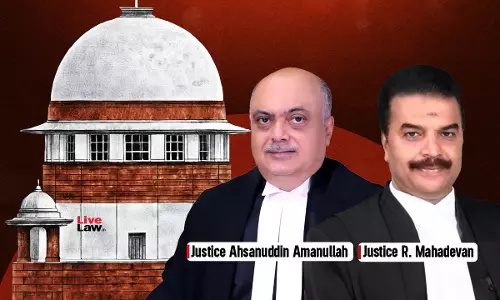

Non-Parties Liable For Contempt If They Knowingly Aid Disobedience Of Orders: Supreme Court

The Supreme Court has clarified that even persons who were not parties to the original proceedings can be held liable for contempt if they knowingly aid or facilitate the disobedience of a court order. The Court emphasised that once a person or authority becomes aware of a judicial order, deliberate inaction or assistance in non-compliance can amount to contempt of court.A bench of...

“No Application Of Mind”: Delhi High Court Stays Sessions Court Order Halting Bail To Uday Bhanu Chib In AI Summit Protest Case

In granting interim relief to Uday Bhanu Chib, President of the Indian Youth Congress, the Delhi High Court on Monday stayed a Sessions Court order which had put on hold the bail granted to him by a Magistrate in connection with the shirtless protest at the recent India AI Impact Summit, observing that the impugned order reflected no application of mind.Justice Saurabh Banerjee said prima...

![Complete Supreme Court Annual Digest 2025 [Part-VIII] Complete Supreme Court Annual Digest 2025 [Part-VIII]](https://www.livelaw.in/h-upload/2026/03/03/500x300_659492-complete-supreme-court-annual-digest-2025-1.webp)