News Updates

Hybrid Hearings Are Here To Stay, AI Cannot Replace Human Adjudication : Judges At Chandigarh Panel Discussion

A panel discussion on “Judges: Present and Future” was organised by the Chandigarh International Arbitration Centre in collaboration with Indian International Disputes Week at the Punjab and Haryana High Court.The discussion brought together members of the judiciary from India and abroad to deliberate on the evolving role of judges amid rapid technological advancements in the legal system.The panel featured Justice Arun Monga from Rajasthan High Court, Justice Vinod S. Bhardwaj, Justice Harkesh...

Republic TV Journalists Booked For Filming Iranian Ship In Cochin Port Move Kerala Court Seeking Bail

Sankar C.G. and Mani S., the journalist and cameraman for Republic TV, who were arrested on March 7 (Saturday) for allegedly filming an Iranian vessel in a restricted zone, have moved the Judicial First Class Magistrate Court - 1, Kochi seeking bail.The prosecution allegation is that the accused entered the high security area of the Southern Coal Berth (SCB) of Cochin Port and captured photos and videos of an Iranian ship, which had allegedly been docked there for security reasons. It is further...

Court Grants Interim Bail To Sharjeel Imam In Delhi Riots Larger Conspiracy Case

A Delhi Court on Monday granted interim bail to Sharjeel Imam in relation to the 2020 North-East Delhi riots larger conspiracy case.Additional Sessions Judge Sameer Bajpai of Karkardooma Courts granted interim bail to Imam to attend his brother's wedding. Imam has been granted interim bail for 10 days, from March 20 to March 30.The accused, who were student activists in the forefront of organising anti-Citizenship Amendment Act protests in 2019-2020, are facing charges under the Unlawful...

Kerala Court Grants Anticipatory Bail To 'Manjummel Boys' Director Chidambaram In Sexual Assault Case

The District and Sessions Court, Ernakulam on Saturday (March 7) granted anticipatory bail to Manjummel Boys fame film director and screenwriter Chidambaram S. Poduval.Sri. K.K. Balakrishnan, District Judge passed the order granting bail to Chidambaram on conditions.The prosecution allegation is that in the first week of May, 2022, Chidambaram trespassed into the bedroom of the de facto complainant with an intention to outrage her modesty and that he pressed on her breast. On February 28...

Senior Advocate Abhishek Manu Singhvi Declares ₹ 2800 Crore Assets, Income In Last 5 Years Over ₹ 1500 Crore

Congress Rajya Sabha candidate and senior Supreme Court advocate Abhishek Manu Singhvi has disclosed assets worth over Rs 2,860.36 crore jointly held by him and his wife in the election affidavit filed for the Rajya Sabha polls from Telangana, as reported by The New Indian Express.As per the affidavit, his income for the five-year period exceeds Rs 1,516 crore.His declared income was over Rs...

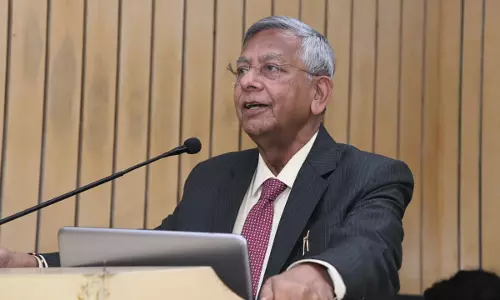

Former NUJS Vice-Chancellor & Eminent Legal Scholar Professor M.P. Singh Passes Away

Professor Mahendra Pal Singh, a distinguished constitutional law scholar and former Vice-Chancellor of the West Bengal National University of Juridical Sciences (NUJS), passed away on March 7, 2026, at the age of 85.Born on July 15, 1940, Prof. Singh was widely regarded as one of India's leading scholars of constitutional and administrative law. Over several decades, he taught and held...

Kerala Youth Congress Secretary Moves Private Complaint Before Magistrate Court Against 'Kerala Story 2' Movie Makers

State General Secretary of the Kerala State Indian Youth Congress Advocate Abid Ali has moved a private complaint before the Chief Judicial Magistrate, Ernakulam against the director and the producer of the newly released film 'The Kerala Story 2 - Goes Beyond'.Chief Judicial Magistrate Smt. Selmath R. M. on Thursday (March 5) heard the complainant and perused the private complaint. A copy of...

Delhi Court Grants Interim Bail To Al Falah Group Chairman In ED Case Noting Wife's Stage-IV Cancer Treatment

A Delhi Court today granted interim bail to Al Falah Group chairman Jawad Ahmed Siddiqui in a money laundering case, noting that his wife is suffering from Stage-IV metastatic ovarian cancer and is undergoing chemotherapy.Additional Sessions Judge Sheetal Chaudhary Pradhan at the Saket Courts said that interim bail on medical grounds is a legal concept that allows a prisoner to be released...

Justice Vivek Rusia Inaugurates 3-Day Community Mediation Training Programme For Retired Officers At M.P. State Legal Services Authority

Under the visionary leadership of Justice Sanjeev Sachdeva, Chief Justice of the High Court of Madhya Pradesh and Patron-in-Chief of the M.P. State Legal Services Authority, and under the guidance of Justice Vivek Rusia, Executive Chairman of the M.P. State Legal Services Authority, a 3-day “20 Hours Community Mediation Training Programme for Retired Officers/Professionals/Experts” has...

NALSA Constitutes Committee To Revisit Legal Aid Defense Counsel System (LADCS) Scheme And Policy

The National Legal Services Authority (NALSA) has constituted a committee to revisit the Legal Aid Defense Counsel System (LADCS) Scheme and Policy. According to a press release dated March 6, 2026, the decision was taken by the Chief Justice of India and Patron-in-Chief, NALSA, in consultation with the Executive Chairman, NALSA, upon receipt of representations from advocates from the State...

Institutional Arbitration Can Only Be Strengthened Through Collective Will And Adaptability: Gujarat High Court Conference Highlights

The two-day conference on “Institutional Arbitration at a Crossroads: Challenges and the Way Forward,” organised by the Arbitration Centre (Domestic & International), High Court of Gujarat, in collaboration with the Gujarat State Legal Services Authority, brought together leading judges, senior advocates and arbitration experts to deliberate on the future of institutional arbitration...

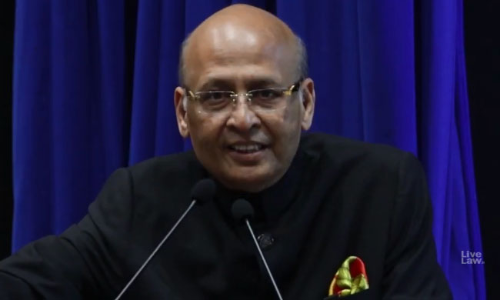

Attorney General R. Venkataramani Highlights Significance Of Nari Shakti Vandan Adhiniyam At ILI Symposium

The Indian Law Institute (ILI), in collaboration with the Commonwealth Legal Education Association (CLEA), commemorated International Women's Day by organising a National Symposium on “Nari Shakti Vandan Adhiniyam and its Implementation: 106th Constitutional Amendment Act, 2023.” The symposium brought together members of the Bar, academia, and students to deliberate on the constitutional...