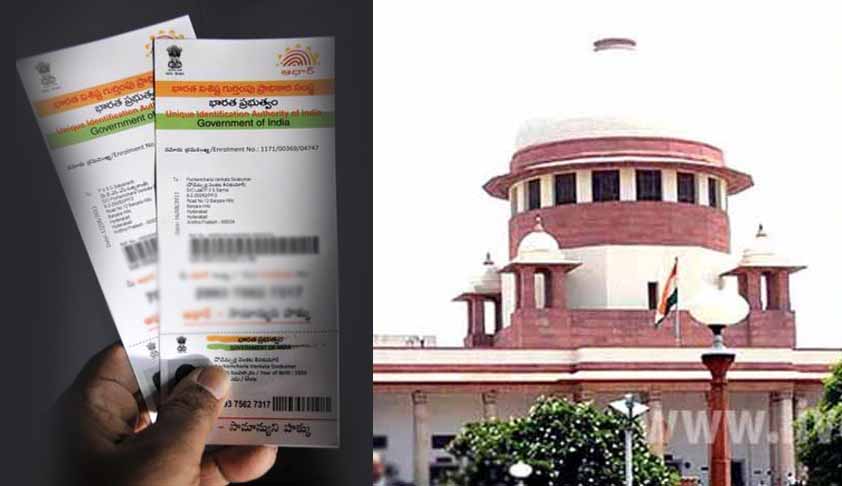

Challenge Against Linking Aadhaar With PAN; Hearing Progressing In SC

Prabhati Nayak Mishra

26 April 2017 2:21 PM IST

Next Story

26 April 2017 2:21 PM IST

Supreme Court of India has started hearing on a batch of petitions challenging S.139AA of Income Tax Act which made mandatory linking of Aadhar with IT Returns.Appearing for one of the Petitioner Senior Advocate Aravind Datar has started his argument saying that Section 139AA of Income Tax Act is contrary to the orders of the Supreme Court.He also said S.139AA is violative of Article 14...