Evolution Of Law Of Corporate Insolvency [PART -II] Formation Of NCLTs And Evolution Of Insolvency Jurisprudence

mukesh chand

11 Feb 2018 11:35 AM IST

![Evolution Of Law Of Corporate Insolvency [PART -II] Formation Of NCLTs And Evolution Of Insolvency Jurisprudence Evolution Of Law Of Corporate Insolvency [PART -II] Formation Of NCLTs And Evolution Of Insolvency Jurisprudence](https://www.livelaw.in/cms/wp-content/uploads/2017/12/Insolvency-and-Bankruptcy-code-1.jpg)

Law Commission of India vide its 124th Report[1], while highlighting the issues of multiplicity of jurisdictions with High Courts, pendency of cases, multiplicity of stages of appeal/ review/ revision under the Code of Civil Procedure, and need of having specialized bodies to deal with specialized matters, recommended for setting up of specialized Tribunals. This paved way of setting of various Tribunals.

NCLTs were set up under section 408 of the Companies Act, 2013 w.e.f. 01st June 2016. Eleven Benches have been set up with one Principal Bench at New Delhi and ten Benches at New Delhi, Ahmadabad, Allahabad, Bengaluru, Chandigarh, Chennai, Guahati, Hyderabad, Kolkata and Mumbai. NCLT enjoy corporate jurisdiction of the Company Law Board, Board for Industrial and Financial Reconstruction (BIFR), The Appellate Authority for Industrial and Financial Reconstruction (AAIFR) and the powers relating to winding up or restructuring and other provisions vested in High Courts.

The notification of transfer of cases from Company Law Board (CLB) to NCLT was issued on the1st June 2016, all the proceedings which were pending before CLB were transferred to NCLT. NCLTs now have jurisdiction to deal with the case of Class Action under Section 245 of Companies Act, 2013. NCLT are also empowered to deal with issues ranging from registration to dissolution of Companies/ refusal to register transfer of shares under section 58 and 59 of the Companies Act, 2013/ Reopening and Revision of Financial Accounts under Section 130 and 131 /Power to order investigation/ Power to freeze assets of the company/ Conversion of public company into private company under section 13 to 18 of the Companies Act, 2013 / powers to call for general meeting under section 97 and 98 of the Act of 2013 /Corporate Debt Restructuring etc.

Under IBC, NCLTs have been conferred with jurisdiction relating to powers and functions of Adjudicating Authority for corporate and subsequently for guarantors for such corporates. All proceedings under the Act, including proceedings relating to arbitration, compromise, arrangements and reconstruction, other than proceedings relating to winding up on the date of coming into force of Companies (Transfer of Pending Proceedings) Rules, 2016, stood transferred to NCLTs. All petitions relating to winding up under clause (e) of Section 433 of the Companies Act, 1956 on the ground of inability to pay its debts pending before a High Court where the petition was not served on the respondent, also stood transferred to NCLT.

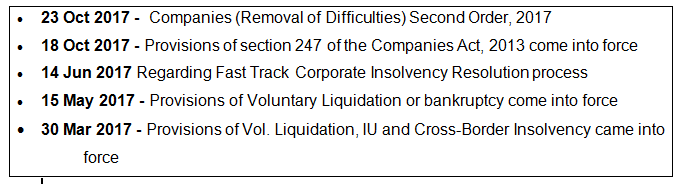

Following is the time line relating to effective dates:

With large number of cases filed / transferred to NCLT under IBC, it was challenging task for NCLTs to follow the strict time schedule as laid down under the Code, accordingly, NCLTs have their share of credits and debits. As law was at its nascent stage with very few experts in the field, each proceeding was a challenge for the applicant as well as for the other concerned including NCLTs.

The challenge started with the very first case filed under IBC and resulted in requirement for Financial Creditor to serve a copy of application on the opposite party. Subsequently, in the case of Sree Metaliks Limited v. Union of India[2], the Calcutta High Court held that the Adjudicating Authorities must adhere to the principle of natural justice while deciding application under section 7. This principle was reiterated by National Company Law Appellate Tribunal (NCLAT) in the case of ICICI Bank v. Innoventive Industries Ltd.[3]

Controversy also erupted with first case of approval of resolution plan in the case of Synergies Dooray Automotive Ltd[4] because of role of an alleged related party in resolution plan and Committee of Creditors which resulted in huge hair cut of about 94% by financial creditor and lead to filing of complaint against the Insolvency Professional and appeal to NCLAT by Edelwisess Assets Reconstruction Company.

Another controversy surfaced with another order of NCLT in the case involving Kamineni Steel Power India Pvt. Ltd[5], where NCLT approved a resolution plan which did not have support of 75% of voting power of Committee of Creditors (the case since stayed by NCLAT).

NCLAT, in J K Jute Mills Company Limited vs. M/s Surendra Trading Company[6], decided on 1st May, 2017, while considering various timelines under the Code, held that, the period 14 days for admission of application is not mandatory. As regards, the period of 7 days given to applicant to cure the defects in such application was held to be mandatory and failure to remove such defects entails rejection of application. However, the issue was finally settled by the Apex Court in appeal in Surendra Trading Company vs Juggilal Kamlapat Jute Mills[7], where it was held that considering the time period of 7 days given to an applicant to cure the defects, is not mandatory and is merely directory and the failure to cure the defects in 7 days' time period would not entail dismissal of application, however, this was with a caveat that if the objections are not removed within seven days, the applicant while refilling the application after removing the objections, file an application in writing showing sufficient case as to why the applicant could not remove the objections within seven days. When such an application comes up for admission/order before the adjudicating authority, it would be for the adjudicating authority to decide as to whether sufficient cause is shown in not removing the defects beyond the period of seven days. Once the adjudicating authority is satisfied that such a case is shown, only then it would entertain the application on merits, otherwise it will have right to dismiss the application.

This case also settled the issue about implication of failure to complete the CIRP within the above period of 180 days, and it was laid down by the Supreme Court that unless extended by a onetime extendable period of 90 days, failure would entail liquidation of the Corporate Debtor under the provisions of the Code. Thereby reconfirming the legal position that the time of 180 days or 270 days (including 90 days extended period) for completion of CIRP is mandatory.

The Supreme Court so far has considered various issues under IBC in about 10 matters out of which two orders pertaining to interim order in the matter of Jaypee Infratech Case. Following issues were clarified by the Apex Court through a mix of judgements:

- Macquarie Bank Limited Vs. Shilpi Cable Technologies Ltd.[8] whether, in relation to an operational debt, the provision contained in Section 9(3)(c) of the Code is mandatory; and whether a demand notice of an unpaid operational debt can be issued by a lawyer on behalf of the operational creditor. the expression "an operational creditor may on the occurrence of a default deliver a demand notice…..", the Code requires that the creditor can only trigger the IRP on clear evidence of default." Nowhere does the report state that such "clear evidence" can only be in the shape of the certificate, referred to in Section 9(3)(c), as a condition precedent to triggering the Code.

Section 8 of the Code must be read as including an operational creditor's authorized agent and lawyer, as has been fleshed out in Forms 3 and 5 appended to the Adjudicatory Authority Rules. …….. Therefore, a conjoint reading of Section 30 of the Advocates Act and Sections 8 and 9 of the Code together with the Adjudicatory Authority Rules and Forms thereunder would yield the result that a notice sent on behalf of an operational creditor by a lawyer would be in order.

- Impex Ferro Tech Limited Vs. Agarwal Coal Corporation Pvt. Ltd[9] - The Apex Court exercised its special powers under Article 142 of the Constitution of India to put a quietus to the matter.

- Uttara Foods and Feeds Private Limited Vs. Mona Pharmachem Civil[10]- National Company Law Appellate Tribunal prima facie could not avail of the inherent powers recognized by Rule 11 of the National Law Appellate Tribunal Rules, 2016 to allow a compromise to take effect after admission of the insolvency petition. We are of the view that instead of all such orders coming to the Supreme Court as only the Supreme Court may utilize its powers under Article 142 of the Constitution of India, the relevant Rules be amended by the competent authority so as to include such inherent powers.

- Alchemist Asset Reconstruction Company L. Vs. Hotel Gaudavan P. L.&Ors[11] The mandate of the new Insolvency Code is that the moment an insolvency petition is admitted, the moratorium that comes into effect under Section 14(1)(a) expressly interdicts institution or continuation of pending suits or proceedings against Corporate Debtors.

- Mobilox Innovations Private Limited Vs. Kirusa Software Private Limited[12]- "dispute" is said to exist, so long as there is a real dispute as to payment between the parties that would fall within the inclusive definition contained in Section 5(6).

- Surendra Trading Company Vs. Juggilal Kamlapat Jute Mills Co. Ltd. & Ors. [CA No. 8400-2017] - Period of 7 seven days for removal of defect in the application is not mandatory.

- Innoventive Industries Ltd. Vs. ICICI Bank & Anr[13]- clarified issue of supremacy of IBC over state law.

To be fair to NCLT, in the absence of clear jurisprudence on the subject, as they had to tackle divergent issues that may have perhaps resulted in difference of approach by different NCLTs like on the issue of applicability of limitation, settlement/ compromise of cases/enforcement of third party guarantee during moratorium period and so on. However, a few orders are worth mentioning one being the order in the case of Nikhil Mehta & others v AMR Infrastructures Ltd[14], where NCLT laid down that key ingredient of financial debt is that it must be disbursed against consideration for the time value of money. The NCLT referred to a dictionary meaning of 'time value', being 'the price associated with the length of time that an investor must wait until an investment matures or related income is earned'. The Tribunal also observed that the underlying financial transaction must be in the nature of debt and not equity. The other case being in the matter of Uttam Galva Steel Ltd [15] which really attempted to capture the real essence of the Code.

Pendency: Economic Survey 2017-18 indicate that "there is a high level of pendency across the six tribunals, estimated at about 1.8 lakh cases. Second, pendency has risen sharply over time. Nearly every tribunal started with manageable caseloads, disposing instituted cases every year, but that soon spiraled out of control. Compared to 2012, there is now a 25 percent increase in the size of unresolved cases. The average age of pending cases across these tribunals is 3.8 years. It is noteworthy that in two cases—telecommunications and electricity—the explosion in pendency resulted from interventions by the Supreme Court".

Overall, with huge pendency looming large, method adopted by some of NCLTs before admission of application on the pattern of civil proceedings, which consume whole lot of time of Tribunal both in hearing and thereafter in passing of final order where they have to address all those legal and factual issue raised in pleadings, has only added to the problem of delay and is not helping cause of either of the parties. This needs to be addressed and arrested before the things go out of hand and the scenario of pendency analyzed by IGDR in its report[16] becomes a reality.

IBC is a unique law, it has conceptualized and implemented the principle of "separation of power" in implementation of fiscal and economic legislation. The Code has prescribed different roles for the different authorities established under the Code. The entire Corporate Insolvency Resolution Process (CIRP) is divided into four stages, Ist being admission of application by AA, Consideration of Resolution Plan before the Committee Creditors, Consideration of report of RP by AA and finally Liquidation under Professionals. All such functions and powers were previously vested with a single authority viz High Courts. This, along with the strict time frame, are the USPs of the Code and also sine quo non for its success. All authorities need to recognize the legislative intent and implement it in letter and spirit.

IBBI and Government also needs to look into the infrastructure and staffing requirements of NCLTs and also set up additional Tribunals. Though commendable achievements will put this category on a high pedestal but it would still miss full points because rising and avoidable pendency of cases and absence of uniformity of approach.

[1] 124th Report of Law Commission on the High Court Arears – A Fresh Look (1988)

[2] WP 7144(W) of 2017

[3] Company Appeal (AT) (Insolvency) No. 1 & 2 of 2017, decided on 15.05.2017

[4] Oder of NCLT Hyderabad in CA No. 123 of 2017 in CP (IB) 1 HYD/2017 passed on 02.08.2017

[5] CP (IB)No. 1 1/10/HDB/2017

[6] Company Appeal (AT) No. 09 of 2017

[7] CIVIL APPEAL NO. 8400 of 2017 decided on September 19, 2017.

[8] CIVIL APPEAL NO.15135 OF 2017

[9] SPECIAL LEAVE PETITION (C) NO. 33687 OF 2017 decided on December 11, 2017

[10] CIVIL APPEAL NO. 18520 OF 2017 (Arising out of SLP(C) No. 26824 of 2017

[11] CIVIL APPEAL NO. 16929 OF 2017 (Arising out of S.L.P. (C) No. 18195/2017)

[12] CIVIL APPEAL NO. 9405 OF 2017 decided on September 21, 2017

[13] Civil Appeal Nos.8337-8338 of 2017 decided on August 31, 2017

[14] CP(IB) 03/7/NCLT/PB/2017 decided on January 23, 2017

[15] CP no 45/I&BP/NCLT/MAH/2017

[16] Watching India's insolvency reforms: a new dataset of insolvency cases- August 2017 and The FRG insolvency cases dataset

[The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of LiveLaw and LiveLaw does not assume any responsibility or liability for the same]