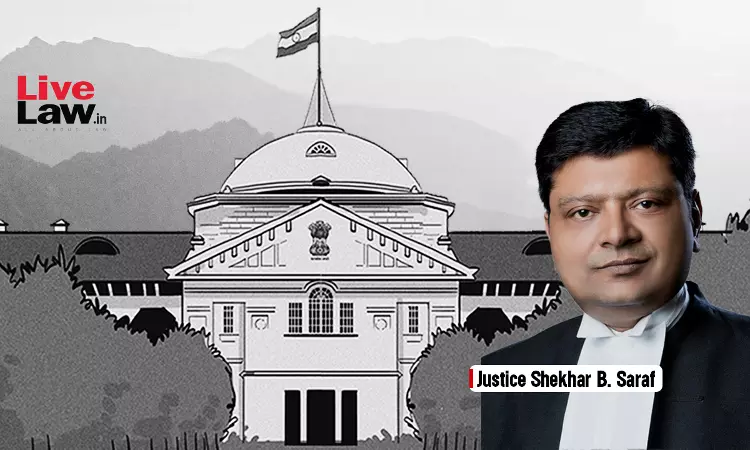

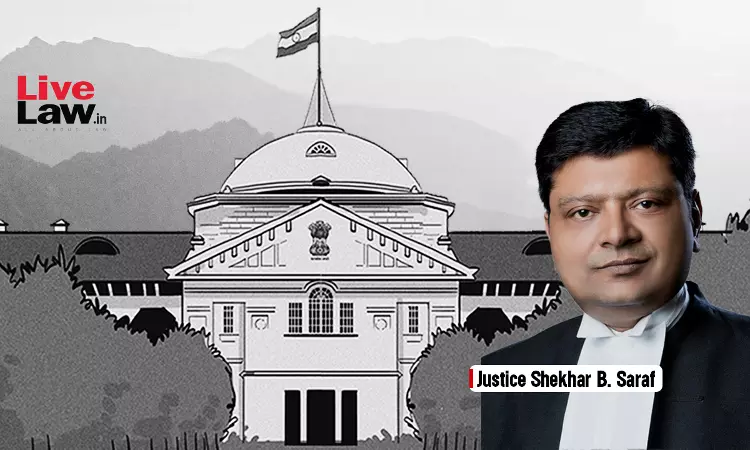

The Allahabad High Court has held that once the Appellate Authority has recorded a specific finding that quantification of stock was based on eye estimate and not in accordance with law, the confiscation order as well as the penalty order are liable to be set aside.“When the Appellate Authority had come to the finding that the officers in the survey did not carry out the quantification of...