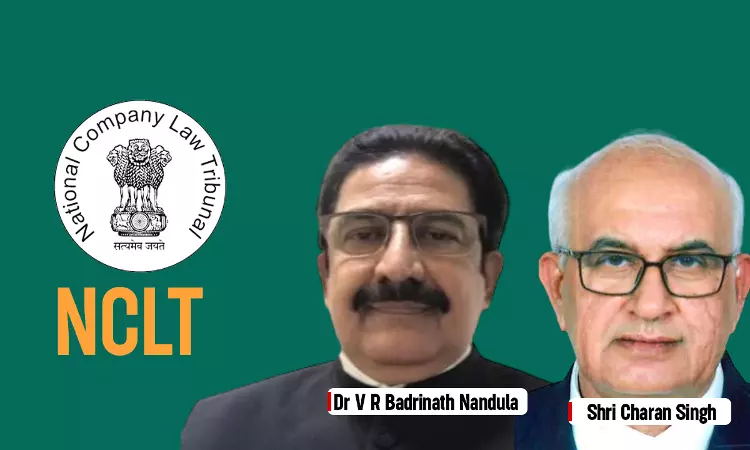

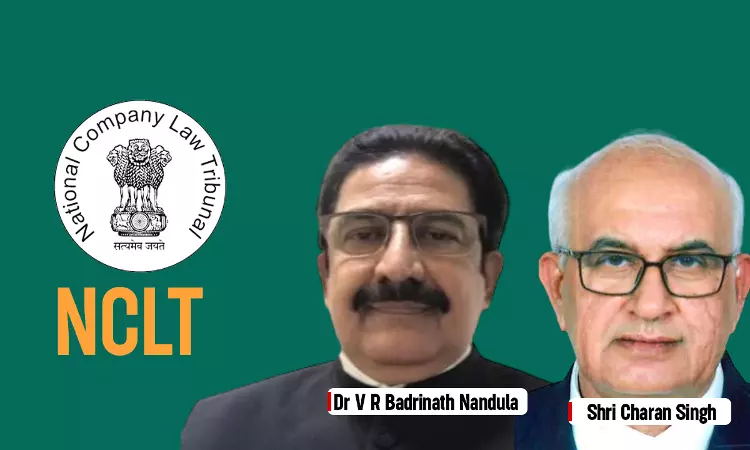

NCLT Hyderabad bench comprising of Dr. Venkata Ramakrishna Badarinath Nandula (Judicial Member) and SH. Charan Singh (Technical Member) in its recent order has cleared that, the provisional order of attachment (POA) under Section 5(1) of the Prevention of Money Laundering Act, 2002, in respect of the properties of the corporate debtor covered under the approved resolution plan, would not...