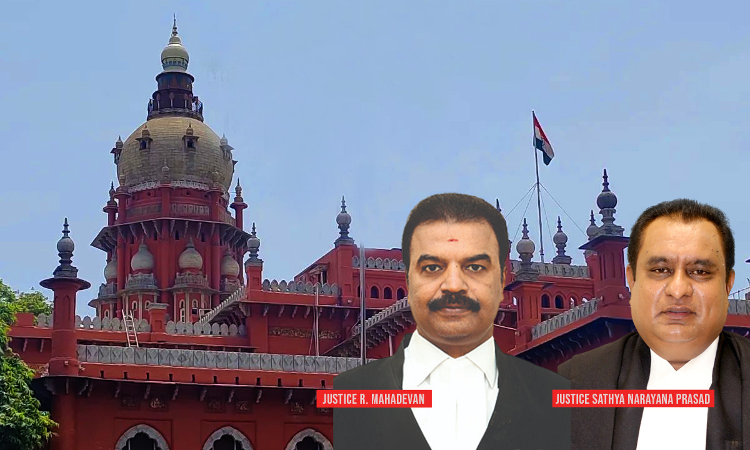

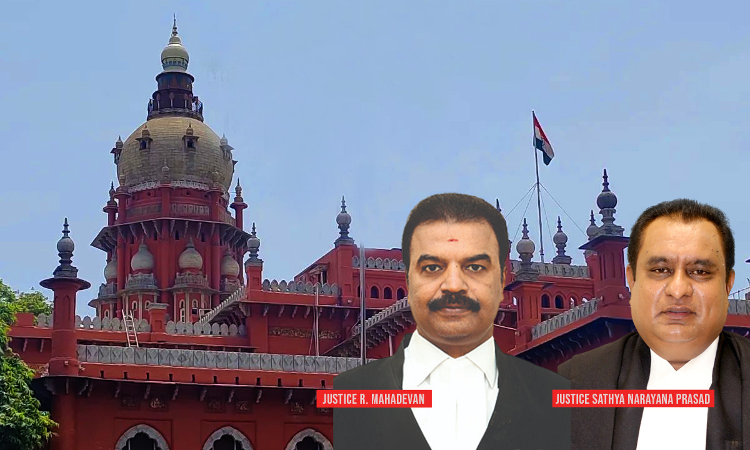

The Madras High Court invalidated the reassessment procedures on the basis that the reopening of the income tax assessment was conducted by an officer without jurisdiction.The division bench of Justice R. Mahadevan and Justice J.Sathya Narayana Prasad has observed that the ACIT Mumbai, who recorded the reasons for reopening the assessment, has no jurisdiction over the appellant, to issue...