Period Of Limitation Under S.153 Of Income Tax Act Applies To Remand Proceedings : Madras HC

Upasana Sajeev

18 Jun 2022 8:45 PM IST

Next Story

18 Jun 2022 8:45 PM IST

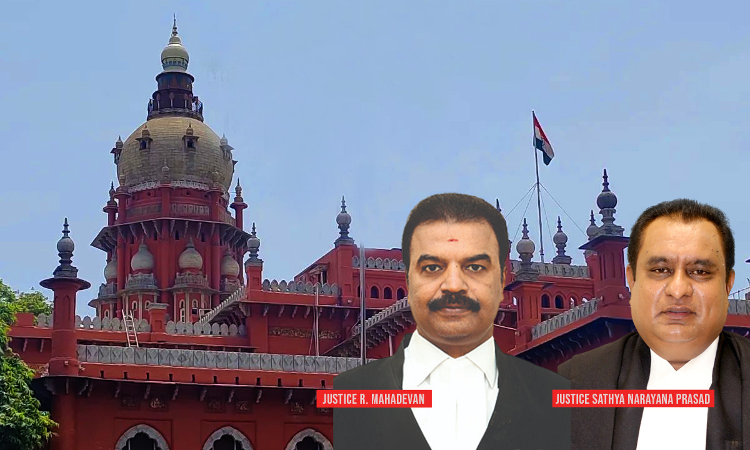

The Madras High Court recently observed that the period of limitation under the Sections 153 (2A) or 153 (3) was applicable even for remad proceedings before the Assessing Officer, Transfer Pricing Officer or the Dispute Resolution Panel. The entire proceedings had to be conducted within a period of 9 months as contemplated under Section 144C (12) of the Income Tax Act. The bench of Justice...