Borrower Cannot Claim Extension Of Time Period Under OTS Scheme As A Matter Of Right : Supreme Court

Ashok KM

4 Nov 2022 6:25 PM IST

Next Story

4 Nov 2022 6:25 PM IST

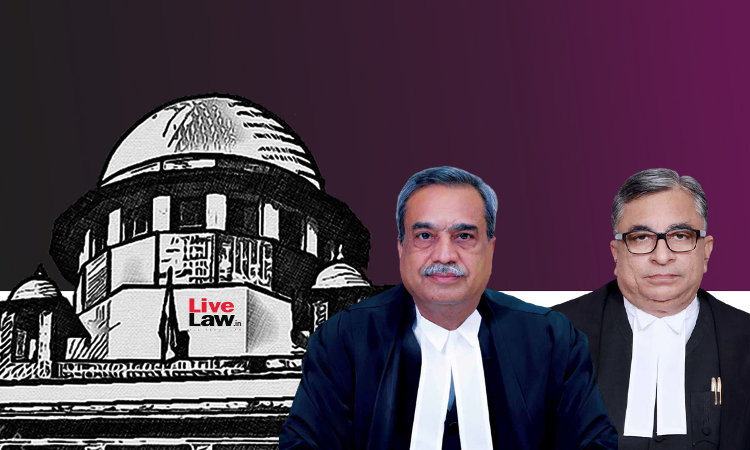

The Supreme Court observed that a borrower cannot claim extension of time period under One Time Settlement Scheme as a matter of right.The bench of Justices MR Shah and Krishna Murari observed said that a High Court cannot invoke writ jurisdiction to extend the time period under the OTS scheme. Directing the Bank to reschedule the payment under OTS would tantamount to modification ...