Demand Notice Issued By Lawyer On Behalf Of Operational Creditor Can’t Be Treated As Demand Notice Required Under Sec.8(1) Of I & B Code: NCLAT

Rajesh Panayanthatta

11 Oct 2017 3:13 PM IST

The judgment of the National Company Law Appellate Tribunal (NCLAT), in Macquarie Bank Limited vs Uttam Galva Metallilcs Limited (Company Appeal (AT) (Insol) No. 96/2017), which is further followed in Centech Engineers Private Limited & Anr vs Omicron Sensing Private Limited (Company Appeal (AT) (Insolvency) No. 132/2017), gives a strong warning against the dealing of Corporate Insolvency Resolution Process in casual and careless manner by lawyers, chartered accountants, company secretaries and litigants. In the above cases, the NCLAT considered the question that whether a demand notice issued by a lawyer for the operational creditor can be treated as a demand notice under Sec.8(1) of the Insolvency and Bankruptcy Code, 2016, (hereinafter referred to as Code) and answered in negative. In these judgments, the NCLAT settled the law that an advocate / lawyer or chartered accountant or a company secretary or any other person in the absence of any authority by the 'operational creditor', and if such a person does not hold any position with or in relation to the 'operational creditor', cannot issue notice under Section 8 of the Code, which otherwise can be treated only as a lawyer's notice/ pleader's notice as distinct from notice under Section 8 of the Code.

Under Sections 8 and 9 of the I&B Code, an operational creditor can move an application for Corporate Insolvency Resolution Process in case of occurrence of default. Before moving such an application, under Sub-Section (1) of Section 8, the 'operational creditor' is required to deliver a demand notice of unpaid operational debt, copy of invoice, demanding payment of amount involved in the default to the 'corporate debtor' "in such form and manner as prescribed". Under Sub-Rule (1) of Rule 5 of the Insolvency and Bankruptcy (Application to Adjudicating Authority) Rules, 2016, the 'operational creditor' can either deliver the demand notice in Form-3 or the invoice attached with the notice in Form-4 to the 'corporate debtor'. By the demand notice, the corporate debtor is to be informed of particulars of 'operational debt', with a demand of payment, with clear understanding that the 'operational debt' (in default), as claimed, is to be paid, unconditionally within ten days from the date of receipt of demand notice, failing which the operational creditor will initiate a corporate insolvency process in respect of corporate debtor.

In Macquarie Bank Limited case (supra), the demand notice has been issued by the advocate of the operational creditor to the corporate debtor. After elaborate discussions of the section and rules concerned, the NCLAT held that a demand notice issued by the lawyer cannot be treated as a demand notice under Sec.8(1) of the Code and, hence, dismissed the application for Corporate Insolvency Resolution Process moved by the operational creditor.

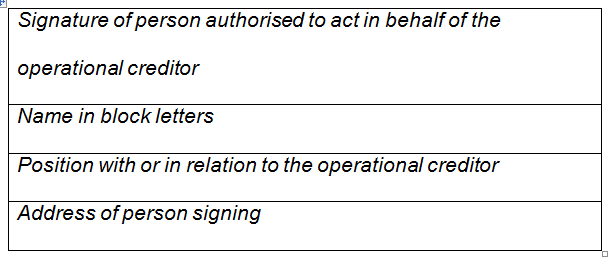

A perusal of the last portion of Form Nos.3 and 4 provided under Sub-Rule (1) of Rule 5 of the Insolvency and Bankruptcy (Application to Adjudicating Authority) Rules, 2016, would make it clear that the demand notice can be issued only by the 'operational creditor' by himself or through a person authorized to act on his behalf who hold some position with or in relation to the 'operational creditor'. The relevant common part of Form Nos.3 and 4 is quoted below:

Yours sincerely,

Considering the language used in both Form Nos.3 and 4, the NCLAT held that only those persons authorised to act on behalf of the operational creditor and also who hold any position with or in relation to the 'operational creditor', can issue a demand notice under Section 8 of I&B Code. Mere giving of authority through Vakalath Nama or any other authority letter by an operational creditor will not entitle a lawyer/ chartered accountant/ company secretary/ any other person to issue a demand notice. Apart from the authority, the person issuing demand notice must have held any position with or in relation to the operational creditor.

In Centech Engineers Private Limited case (supra) also, the notice has been given by the advocates and there was nothing on the record to suggest that the said lawyer was authorised by the operational creditor or was holding any position with or in relation to the operational creditor. Following the judgment in Macquarie Bank Limited case (supra), the NCLAT held that the so-called notice issued by the lawyer cannot be treated as notice under Section 8 of the I&B Code and as such the application was dismissed.

From the above judgments, it is clear that a demand notice under Sec.8 of the Code is totally distinct from a normal lawyer notice or notice under Sec.80 CPC or notice for initiation of proceedings under Sec.433 of the Companies Act, 1956. The purpose of demand notice under Sec.8 of the I&B Code is to give a clear understanding to the corporate debtor regarding the serious consequences of non-payment of ‘operational debt’. In normal cases, the lawyer notices are meant to give warning to the opponent that the client of the lawyer is going to initiate legal proceedings. In that context, the corporate debtor can contest the suit/case if filed against it. But Corporate Insolvency Resolution Process is entirely different from any other legal proceedings because the claim in Sec.9 application cannot be contested by a corporate debtor, except where there is an existence of dispute, prior to the issuance of notice under Sec.8 of the Code.

In essence, a demand notice under Sec.8(1) of the I&B Code is a significant requirement and the same should have to be served to the corporate debtor in the manner prescribed in law or else the operational creditor cannot proceed with the application for Corporate Insolvency Resolution Process.

Rajesh Panayanthatta is an Advocate on Record of the Supreme Court of India as well as a Registered Insolvency Professional in Delhi. You may reach him at his email id: prjlegal@gmail.com

[The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of LiveLaw and LiveLaw does not assume any responsibility or liability for the same].