News Updates

'Politically Motivated': Sonia Gandhi Opposes Plea For FIR Over Her Inclusion In Voter List Prior To Acquiring Indian Citizenship

Congress leader Sonia Gandhi has opposed before a Delhi Court a plea challenging a magisterial court order refusing to order FIR against her for getting her name added in the electoral rolls of 1980, three years before getting Indian citizenship, allegedly by using forged documents.Gandhi has said that the plea is politically motivated, wholly misconceived, frivolous and abuse of the process of law. The criminal revision petition has been filed by Vikas Tripathi seeking criminal action against...

Delhi Court Denies Bail To Olympian Wrestler Sushil Kumar In Sagar Dhankar Murder Case

A Delhi Court on Friday denied bail to Olympic wrestler Sushil Kumar in relation to the case of murder of 27-year-old former junior national wrestling champion Sagar Dhankar in May 2021.Additional Sessions Judge Sushil Kumar of Rohini Courts rejected the bail plea noting the seriousness of allegations leveled against the Olympian and the fact that his bail was cancelled by the Supreme Court...

Delhi Riots: Court Summons Cops Accused Over Death Of Man Forced To Sing National Anthem

A Delhi Court has summoned two officials of the Delhi Police who are accused for the death of 23 year-old Faizan, who was allegedly forced to sing national anthem during the 2020 North-East Delhi riots. The incident relates to a video that had gone viral on social media wherein Faizan was seen allegedly being beaten by the police, along with four other men, while being forced to sing...

Mumbai Special Court Dismisses Plea Seeking Corruption Probe Against SEBI Chair, Former Chief, NSE & BSE Heads

A special court in Mumbai recently dismissed an application filed by journalist Sapan Shrivastava, who sought investigation against Tuhin Kanta Pandey, the Chairman of Securities Exchange Board of India (SEBI) and its former chief Madhabi Puri Buch along with four lifetime members of SEBI, the Managing Directors of both National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) under...

Over 42,000 Cases Referred For Mediation In Kerala Under 'Mediation For The Nation 2.0'

Kerala has recorded significant progress in reducing judicial backlog through mediation under the nationwide campaign 'Mediation for the Nation 2.0', launched by the Mediation and Conciliation Project Committee (MCPC) of the Supreme Court.According to a press release, more than 42,000 cases across the State have already been referred for mediation, with around 3,400 cases successfully settled...

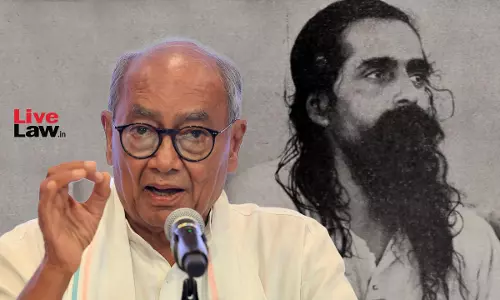

Thane Court Rejects Digvijay Singh's Plea To Dismiss Defamation Suit Filed By RSS Worker For Allegedly Defaming Organisation, MS Golwalkar

A Thane Court recently dismissed an application filed by former Madhya Pradesh Chief Minister and Congress leader Digvijay Singh, who had sought dismissal of a defamation suit filed against him for allegedly defaming Rashtriya Swayamsevak Sangh (RSS) and its founder MS Golwalkar by posting an objectionable post on Twitter (now X).For context, Vivek Champanerkar an RSS worker filed a...

Sabarimala Gold Theft: Kerala Court Grants Statutory Bail To Prime Accused Unnikrishnan Potty

The Court of the Enquiry Commissioner and Special Judge, Kollam on Thursday (February 5) granted bail to Unnikrishnan Potty, former assistant Santhi at Sabarimala, and the prime accused in the Sabarimala gold theft case.Sri. Mohit C.S., Special Judge, passed the order granting him statutory bail. A detailed order is awaited.He was arrested in October 2025 in relation to the cases. Potty...

SCBA Extends Deadline For National Survey of Women Advocates Till February 15, 2026

The Supreme Court Bar Association (SCBA) has extended the deadline for submission of responses to its National Survey of Women Advocates till February 15, 2026, in view of the overwhelming response received from women advocates across the country.As per a revised circular dated January 31 , 2026, issued by the SCBA, the decision to extend the timeline was taken to enable greater participation...

'LiveLaw Essential Companion', Says Lawyer Who Topped Higher Judiciary Exams In Both Punjab & Haryana

In an exceptional feat, Ludhiana-based advocate Prabhjot Singh Sachdeva has secured the top rank in both the Punjab and Haryana Higher Judicial Service Examinations, earning his selection as an Additional District and Sessions Judge.Speaking about his preparation journey, Sachdeva credits LiveLaw as a "constant companion" during his rigorous preparation, underscoring the importance of...

Delhi Court Summons Congress Leaders In Defamation, Forgery Case By Journalist Rajat Sharma

A Delhi Court yesterday summoned Congress leaders Ragini Nayak, Pawan Khera and Jairam Ramesh in a criminal defamation case filed by senior journalist Rajat Sharma. Sharma has accused the Congress leaders of defamation, forgery, creation and use of false electronic records in connection with a purportedly doctored video circulated on social media.Judicial Magistrate First Class Devanshi...

Kerala Court Suspends Sentence Of Former MLA Antony Raju In Evidence Tampering Case

The District and Sessions Court, Thiruvananthapuram has suspended the sentence of former MLA Antony Raju in Evidence Tampering case.Smt. Nazeera S, suspended the execution of sentence, while considering the appeal against the judgment of the Judicial First Class Magistrate -I Nedumangad. Judicial First Class Magistrate -I Nedumangad, convicted Antony Raju, who is arrayed as the second accused...

'Bulldozed' Rights Of Accused: Court Raps Delhi Police Over Shoddy Probe In Delhi Riots Case, Asks Commissioner To Take Action

A Delhi Court has directed the Commissioner of Delhi Police to take action after examining the conduct of investigation in a 2020 North-East Delhi riots case, after flagging serious lapses in collection and proof of evidence. Additional Sessions Judge Praveen Singh of Karkardooma Courts said that the “audacity and impunity” with which the record of the case was “tampered with” reflected...