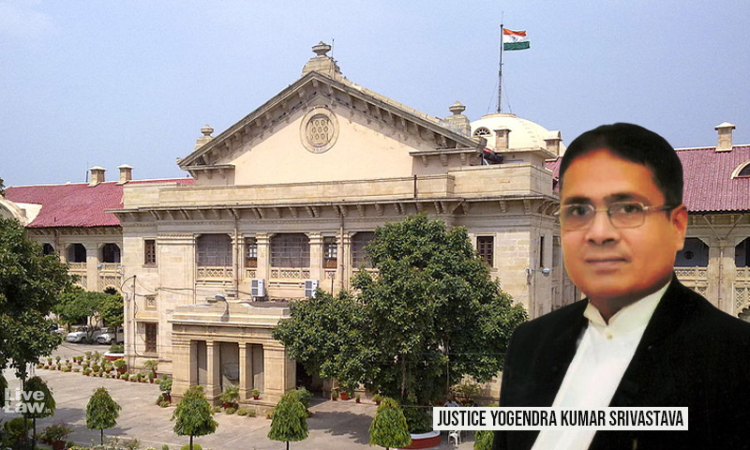

UP Revenue Code 2006 | Final Order In First Appeal Can Be Challenged In Revision U/S 210: Allahabad High Court

Upasna Agrawal

21 Aug 2023 10:52 AM IST

Next Story

21 Aug 2023 10:52 AM IST

The Allahabad High Court has held that remedy of revision under Section 210 of the U.P. Revenue Code, 2006 is available against the final order passed by the Commissioner in appeal under Section 207 of the Code, 2006.The bench comprising of Justice Dr. Yogendra Kumar Srivastava held that the ‘proceeding decided’ in Section 210 (Power to call for the records) of the Code would include...