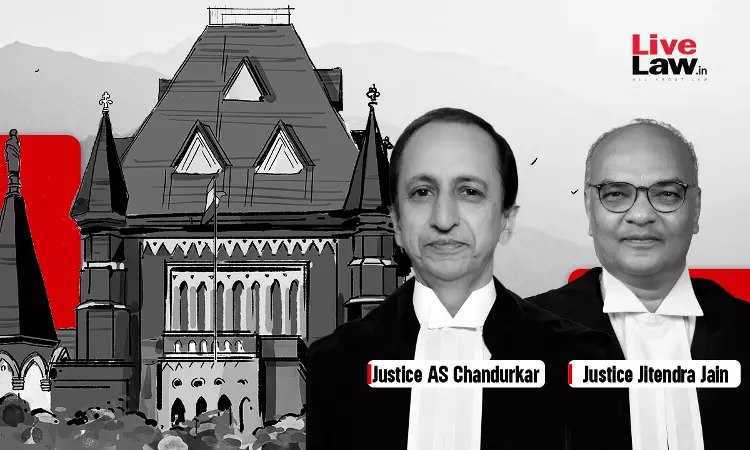

Bombay High Court Grants Relief To Advocate Put On Indian Bank Association's 'Caution List' For Alleged Negligence In Vetting Properties

Amisha Shrivastava

17 Feb 2024 10:58 AM IST

Court noted the advocate was not responsible for conducting inspection of properties against which loans in question were granted.

Next Story