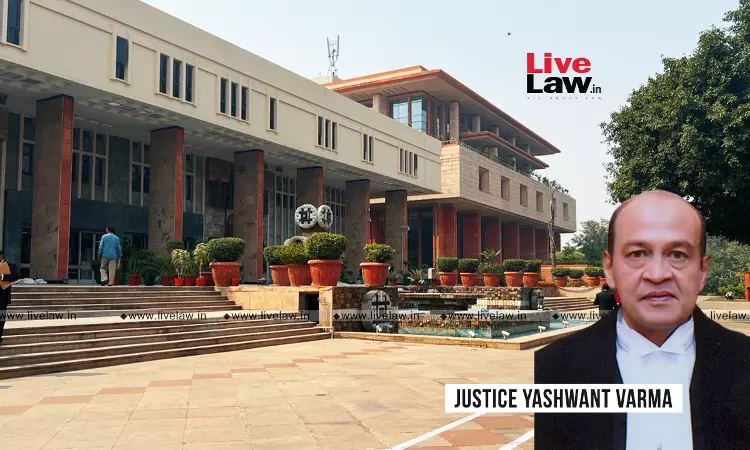

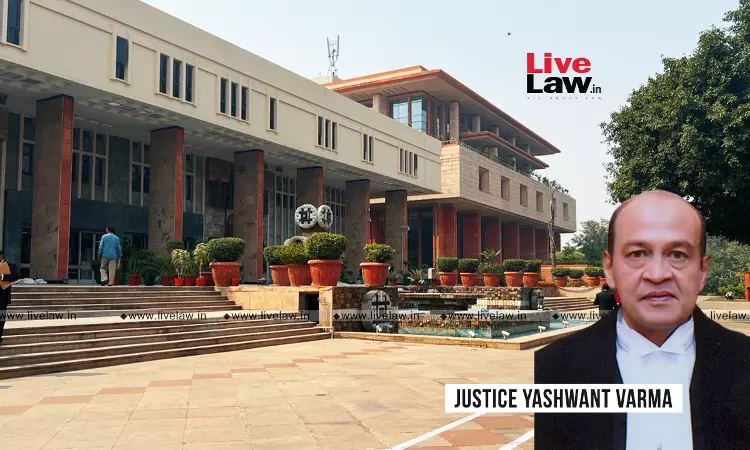

Delhi High Court Allows Daiichi Sankyo To Withdraw Rs. 20.5 Crores, Imposes A Cost Of 10 Lakh On IHFL For Abuse Of Process Of Court In 4000 Crore Foreign Arbitral Award Case

Parina Katyal

25 April 2023 8:01 PM IST

Next Story

25 April 2023 8:01 PM IST