Investment In Shares In Indian Subsidiary 'Capital Account Transaction', Not Income: Delhi High Court

Upasna Agrawal

8 Jan 2024 9:45 AM IST

Next Story

8 Jan 2024 9:45 AM IST

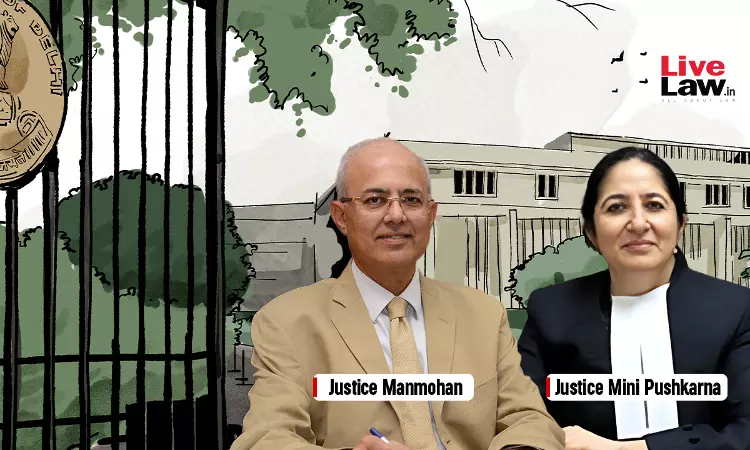

The Delhi High Court has held that investment in shares by a company in its Indian subsidiary is a “capital account transaction” which does not give rise to any income. Therefore, the same cannot be treated as income for taxation.Placing reliance on the earlier decision of Delhi High Court in Nestle SA v. Assistant Commissioner of Income Tax, the bench comprising of Acting Chief...