Transfer Pricing | Delhi High Court Excludes Comparables On The Basis Of Functional Dissimilarity

Mariya Paliwala

1 Nov 2023 5:30 PM IST

Next Story

1 Nov 2023 5:30 PM IST

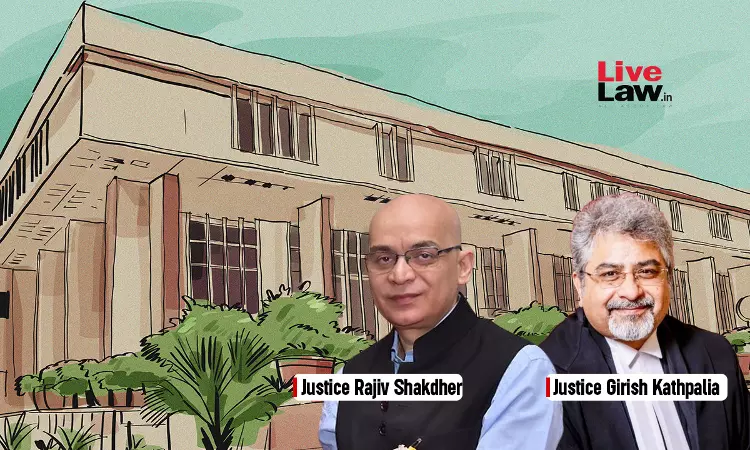

The Delhi High Court has excluded the comparables on the basis of functional dissimilarity in the transfer pricing case.The bench of Justice Rajiv Shakdher and Justice Girish Kathpalia excluded three comparables, namely Infobeans Technologies Ltd., Cybercom Datamatics Information Solutions Ltd., and Infosys BPO Ltd., citing clear reasons for their exclusion.The appellant/department assailed...