Surplus Temple Funds Cannot Be Used For Constructing Shopping Complexes: Madras High Court Restrains HR&CE

Upasana Sajeev

11 Jan 2025 11:30 AM IST

Next Story

11 Jan 2025 11:30 AM IST

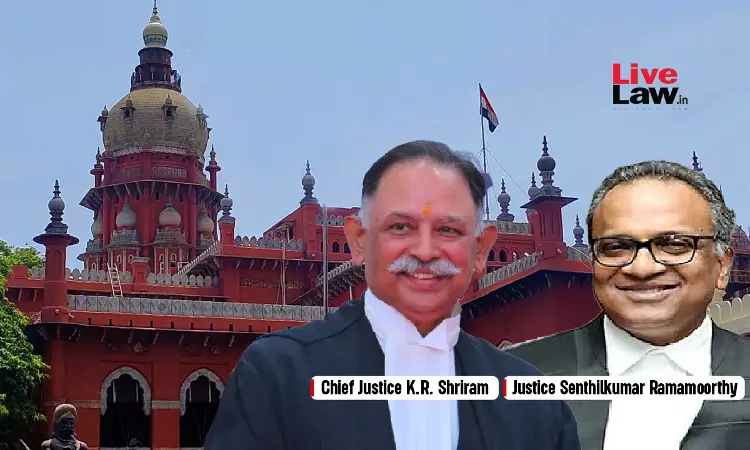

The Madras High Court recently restrained the Hindu Religious and Charitable Endowment Department from constructing a shopping complex in a land belong to the Arulmighu Nandeeswaram Thirukoil using the surplus temple fund. Commenting that temples should be kept out of litigation as much as possible, the bench of Chief Justice KR Shriram and Justice Senthilkumar Ramamoorthy observed...