NCLT Hyderabad: IBC Overrides The Provisions Of Andhra Pradesh Revenue Recovery Act, 1864

Sachika Vij

19 Jan 2024 5:45 PM IST

Next Story

19 Jan 2024 5:45 PM IST

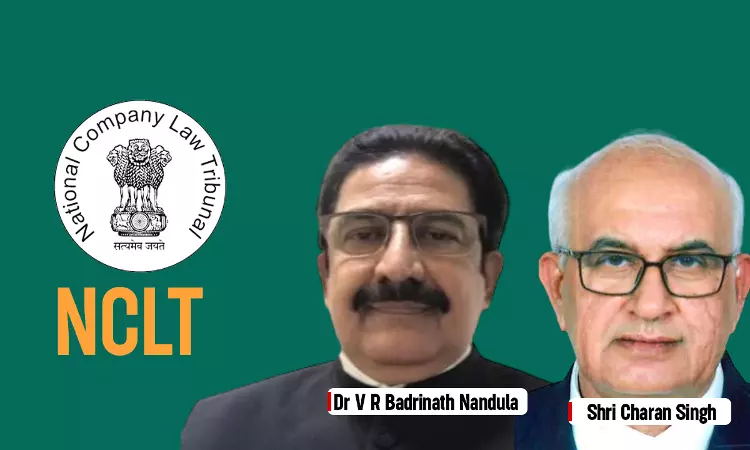

The National Company Law Tribunal ('NCLT') Hyderabad, comprising Dr. Venkata Ramakrishna Badarinath Nandula (Judicial Member) and Shri. Charan Singh (Technical Member) held that the Insolvency and Bankruptcy Code, 2016 ('IBC') overrides the provisions of the Andhra Pradesh Revenue Recovery Act, 1864. Background Facts: NCS Sugars Ltd. (Corporate Debtor) involved in...