NCLT Hyderabad Initiates Insolvency Process Against The Personal Gauartor Of Deccan Chronicle Holdings

Pallavi Mishra

4 July 2022 11:00 AM IST

Next Story

4 July 2022 11:00 AM IST

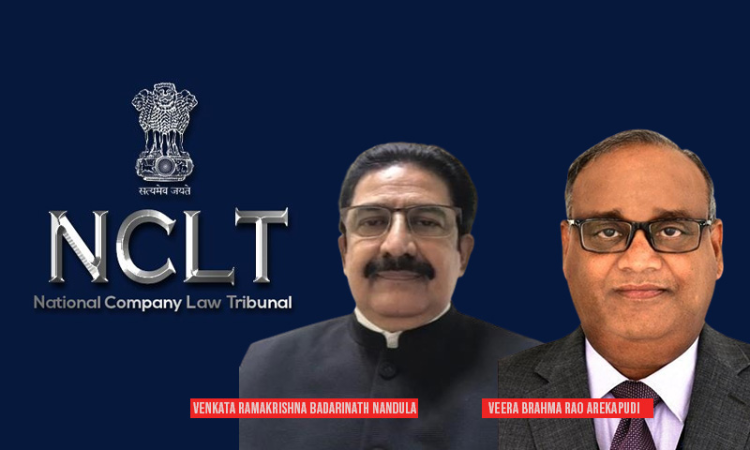

The National Company Law Tribunal, Hyderabad Bench, comprising of Dr. N. Venkata Ramakrishna Badarinath (Judicial Member) Shri Veera Brahma Rao Arekapudi (Technical Member), while adjudicating a petition filed in L&T Finance Limited v Tikkavarapu Venkaram Reddy, has initiated insolvency resolution process against Mr. Tikkavarapu Venkatarami Reddy, who is the Personal Guarantor...