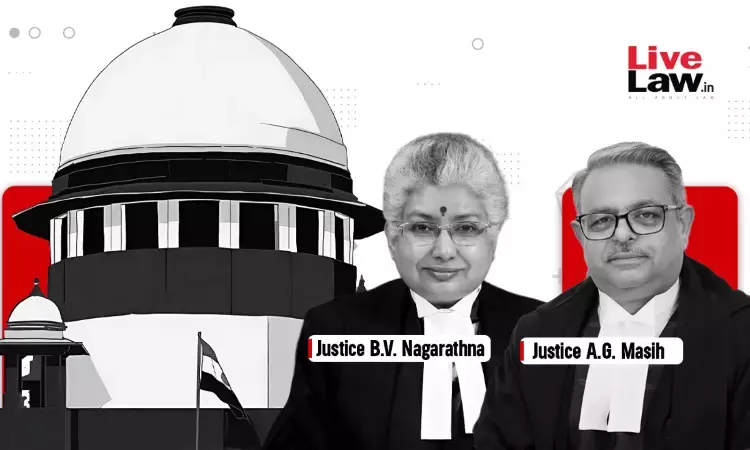

Insurance Law| Insurer's Burden To Prove Insured Suppressed Material Facts : Supreme Court

Yash Mittal

13 April 2024 10:55 AM IST

Next Story

13 April 2024 10:55 AM IST

While upholding the insurance claim repudiated by the insurance company on the ground of suppression of policies already held by the insured, the Supreme Court observed that the insurance company failed to discharge the burden of proof to show that the insurer had other policies existing while taking a policy from it. “The cardinal principle of burden of proof in the law of evidence is...