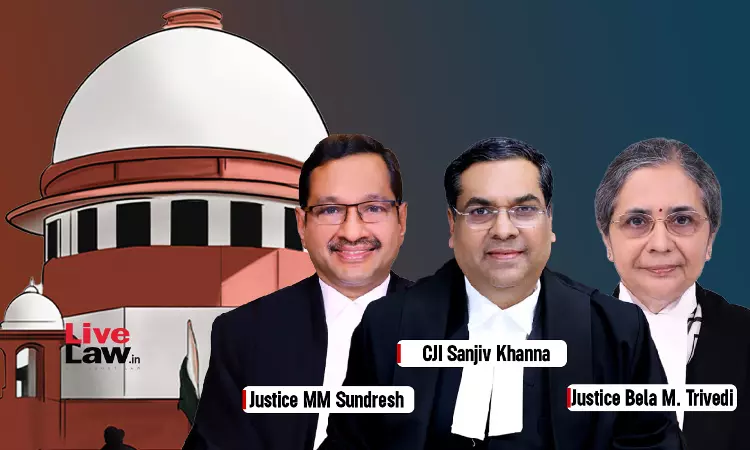

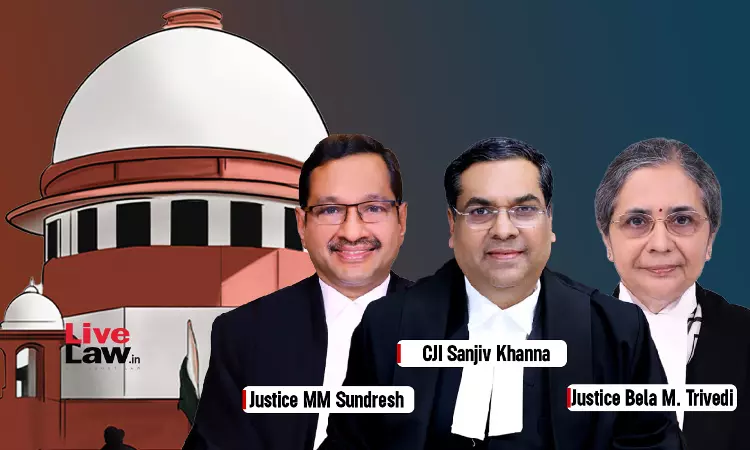

BNSS/CrPC Provisions On Rights Of Arrested Persons Applicable To GST & Customs Acts : Supreme Court

Debby Jain

27 Feb 2025 10:48 AM IST

The Court also held that anticipatory bail provisions are applicable to GST and Customs Acts.

Next Story

27 Feb 2025 10:48 AM IST