"Intrigued By Articles Written On GST Judgment" : Justice Chandrachud

LIVELAW NEWS NETWORK

26 May 2022 11:21 AM IST

Next Story

26 May 2022 11:21 AM IST

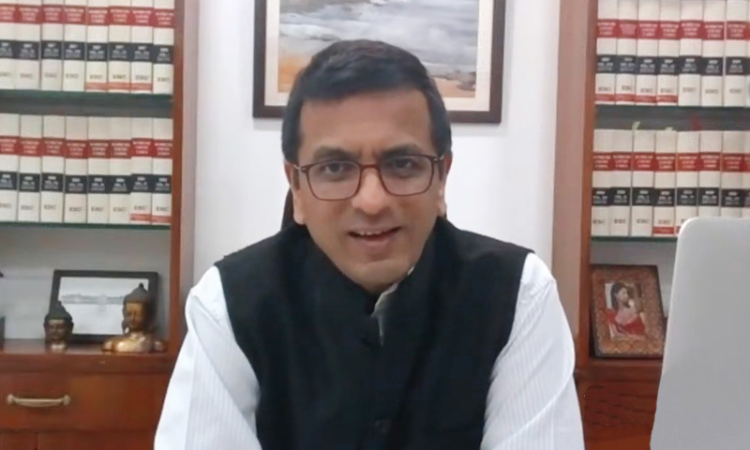

Supreme Court judge Justice DY Chandrachud on Thursday said that he is "intrigued" by articles written on the judgment authored by him which held that the recommendations of the GST council are not binding on the Parliament and the State Legislatures.Justice Chandrachud made this remark addressing Senior Advocate Harish Salve, who was mentioning a petition filed by Jindal Mining group against...