Should Penal Provisions Of Customs Act, GST Act Etc. Be Compatible With CrPC? Supreme Court Starts Hearing

Debby Jain

1 May 2024 9:38 PM IST

Next Story

1 May 2024 9:38 PM IST

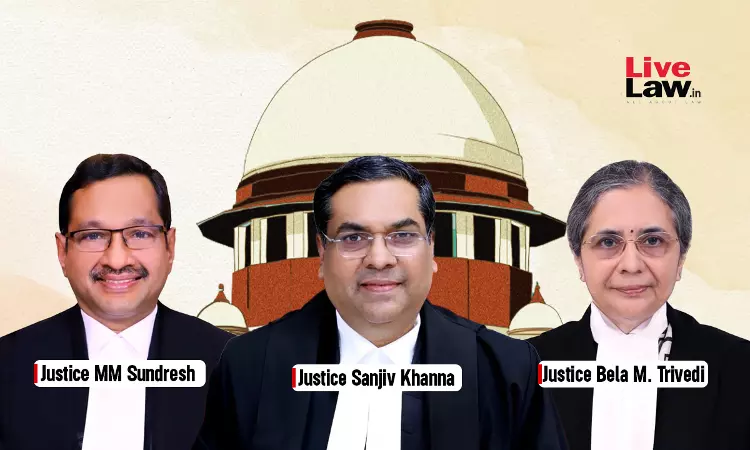

The Supreme Court today(May 1) started hearing a batch of 281 petitions challenging penal provisions of various laws such as the Customs Act, Excise Act and GST Act as non-compatible with the Code of Criminal Procedure (CrPC) and the Constitution.The pleas were listed before a Bench of Justices Sanjiv Khanna, MM Sundresh and Bela M Trivedi. After a day-long hearing, the same would again be...