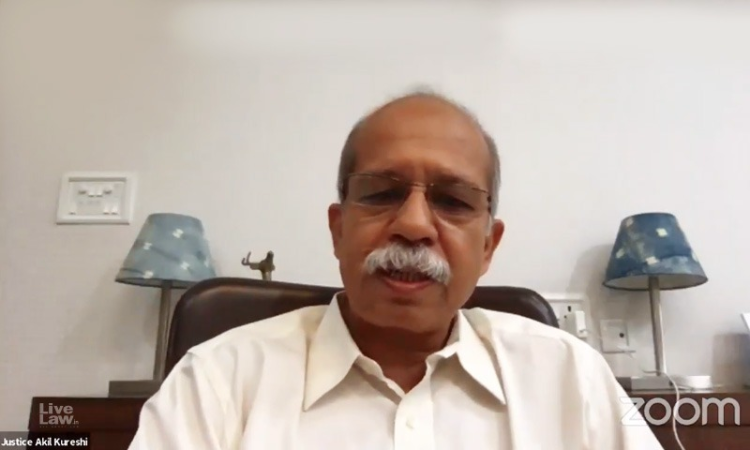

Justice Akil Kureshi Writes : Recent Judgment Of Supreme Court In 'Vikram Bhatia' Sets A Deeply Disturbing Trend

Justice (Retired) Akil Kureshi

8 May 2023 6:52 PM IST

Akil Kureshi, former High Court Chief Justice

Article 265 of the Constitution of India provides that no tax shall be levied or collected except by authority of law. This short Article in a most emphatic manner prevents the State from collecting tax arbitrarily. At the same time, the Courts recognize a great degree of latitude in the legislation in the field of taxation. In a landmark judgment in the case of R.K. Garg, it was observed that every legislation particularly in economic matters is essentially empiric and it is based on experimentation.

In the book Principles of Statutory Interpretation by Justice G.P. Singh, the author has explained the principles of interpretation of taxing statutes thus: -

A taxing statute is to be strictly construed. The well-established rule in the familiar words of Lord Wensleydale reaffirmed by Lord Halsbury and Lord Simons means, “The subject is not to be taxed without clear words for that purpose; and also that every Act of Parliament must be read according to the natural construction of its words”. In a classic passage, Lord Cairns stated the principle thus “If the person sought to be taxed comes within the letter of the law, he must be taxed, however, great the hardship may appear to the judicial mind to be. On the other hand, if the crown seeking to recover the tax, cannot bring the subject within the letter of law, the subject is free, however, apparently within the spirit of law the case might otherwise appear to be. In other words, if there be admissible in any statute, what is called an equitable, construction, certainly such a construction is not admissible in a taxing statute where you can simply adhere to the words of the statute”.

One of the most fundamental requirements of law is that it should be predictable. This gives rise to the principle of stare decisis where the court is reluctant to upset a legal position which has held the field for a long time. The concept of prospective overruling by which the Supreme Court applies the law laid down by it with prospective effect to avoid cascading effect of overruling its earlier judgement owes its origin to this requirement. Yet another manifestation of this requirement of predictability is the rule of interpretation of legislation that unless a contrary intention appears, a legislation is presumed not to be intended to have a retrospective operation. The idea behind this rule is that a current law should govern current activities. Law passed today cannot apply to the event of the past. If we do something today, we do it keeping in view the law of today and in force and not tomorrow’s backward adjustment of it. Our belief in the nature of the law is founded on the bedrock that the human being is entitled to arrange his or her affairs by relying on the existing law and should not find that its plans have been retrospectively upset. A retrospective legislation is contrary to the general principle that legislation by which the conduct of mankind is to be regulated when introduced for the first time to deal with future acts ought not to change the character of the past transactions carried on upon the faith of the then existing law. These are not my words. These are the words of profound wisdom of the Supreme Court in the Constitution Bench judgment in the case of Vatika Township.

It can thus be taken as well settled principle that a legislation which creates new liabilities or affects existing rights or imposes new obligations, must be construed to have prospective application unless the legislature has expressly or by necessary implication made it retrospective. This presumption of prospective operation, however, would not apply in case of declaratory, explanatory, or curative statute.

These introductory remarks were necessary, because in the present article, I am trying to analyze the effect of the recent judgment of the Supreme Court in the case of Income Tax Officer Vs. Vikram Sujitkumar Bhatia 2023 LiveLaw (SC) 274 decided on 6.4.2023. To appreciate the controversy involved, we need to take note of the background facts.

As is well known, under Section 132 of the Income Tax Act, 1961, (“the Act” for short), the competent authority can authorize search operation. One of the fallouts of the search operation is to allow the income tax authorities to carry out assessment or re-assessment of the searched person for six assessment years as provided in Section 153A of the Act.

Section 153C enables the revenue to assess the income of a person other than the searched person against whom incriminating material is found during search. Prior to its amendment by the Finance Act 2015, w.e.f. 1.6.2015, under sub-section (1) of Section 153C, if the assessing officer is satisfied that any money, bullion, jewellery or other valuable article or thing or books of accounts or documents seized or requisitioned belongs or belong to a person other than the searched person, then the books of account or documents or assets seized or requisitioned shall be handed over to the assessing officer having jurisdiction over such other person and if that assessing officer is satisfied that the books of account of documents or assets seized or requisitioned have a bearing on the determination of the total income of such other person, he would proceed against such person and assess or re-assess his income for six assessment years immediately preceding the assessment year relevant to the previous year in which search is conducted or requisition is made.

The expression “belongs or belong to” is vitally different from “pertains to” or “relates to”. There is no reason to believe that the expression was not used by the legislature in Section 153C consciously.

Interpretation of this expression came up for consideration before various High Courts. Delhi High Court in the case of Pepsi Foods (P) Ltd., held that before a notice under Section 153C could be issued, the assessing officer is required to arrive at a conclusive satisfaction that documents belonged to a person other than the searched person. In the case of Pepsico Holding India Pvt. Ltd., the Delhi High Court further clarified that the assessing officers should not confuse the expression “belongs to” with the expressions “relates to” or “refers to”. Same view was taken by the Gujarat High Court in the case of Vijaybhai Chandrani (although this judgment was set aside by the Supreme Court, it was on another ground), in the case of Kamleshbhai Dharmshibhai Patel and the Bombay High Court in the case of Sinhgad Technical Education Society. The Supreme Court in the case of Commissioner of Income Tax Vs. Sinhgad Technical Education, by a detailed judgment upheld the decision of the Bombay High Court.

The judgments across the board were thus unanimous that the expression “belongs or belong to” cannot be equated with “refers to” or “relates to”. The revenue, however, desired a lower threshold requirement before the powers under Section 153C of the Act can be exercised. Sub-section (1) of Section 153C was amended under the Finance Act of 2015 w.e.f. 1.6.2015. Under the amended provision what is required is that assessing officer of the searched person is satisfied that (a) any money, bullion, jewellery or other valuable article or thing seized or requisitioned belongs to or (b) any books of accounts or documents seized or requisitioned pertains to or pertain to, or any information contained therein relates to a person other than the searched person.

Thus, the amendment in Section 153C expanded the scope for assessing or reassessing income of the person other than the searched person. A question arose before the Gujarat High Court about the applicability of this provision. The facts in the lead case were that a search operation was conducted on the various premises of one H.N. SAFAL group on 4.9.2013. The panchnama was prepared on 7.9.2013. Based on seized material, the assessing officer-initiated proceedings under Section 153C by issuing a notice on 8.2.2018 against the petitioner who was the person other than the searched person. Thus, the search under Section 132 took place prior to the amendment of Section 153C. Whereas notice under Section 153C was issued after the amendment. The Gujarat High Court held that though the provisions of Section 153C of the Act are machinery provisions, the amendment brings into its fold persons who are otherwise not covered by the said provision and therefore, affects the substantive rights of such persons. It was observed that a statute may be procedural in character, if it affects adversely the vested rights, it is to be applied prospectively.

The revenue carried the matter in appeal before the Supreme Court in the case of Vikram Bhatia. Before the Supreme Court, the revenue counsel had urged that the amendment in Section 153C was necessitated in view of the observations of the Delhi High Court in the case of Pepsico India holding that the expression “belongs or belong to” is much narrower than the expressions “relates to” or “refers to”. The expression “pertains or pertain” to is much wider than the expression “belongs or belong to”. In this background, the revenue counsel had placed in service following aspects for consideration of the court:-

- effect of amendment by substitution;

- legislative intent;

- Section 153C is a machinery provision;

- Interpretation which makes the statute a dead letter should be avoided; and

- Power to legislate includes power to legislature retrospectively.

The Supreme Court reversed the judgment of the High Court and allowed the revenue’s appeal on the following main grounds:-

- Delhi High Court in the case of Pepsico India gave a very narrow and restrictive meaning to the expression “belong to”. In order to remove the basis of the observations made by Delhi High Court, Section 153C was amended.

- First proviso to Section 153C of the Act was inserted under Finance Act 2005 w.e.f. 1.6.2003 which provides that the reference to the date of initiation of the search under Section 132 or making requisition under Section 132A, in the second proviso to sub Section (1) of Section 153A shall be construed as a reference to the date of receiving the books of account or documents seized or requisitioned by the assessing officer having jurisdiction over such other person.

- Section 153C has been amended by substitution. The words “belongs or belong to” have been substituted by words “pertains or pertain to”. The amendment by substitution has the effect of wiping out the earlier provision from the statute book and replacing with the amended provision as if the unamended provision never existed.

- Presumption of prospective application does not apply to a declaratory statute.

- Section 153C is a machinery provision. It has also been so held by the Gujarat High Court in the judgment under appeal. Referring to the decision of the Supreme Court in the case of Calcutta Knitwears, it was held that while interpreting machinery provision in a taxing statute, the court must give effect to its manifest purpose by construing it in such a manner as to effectuate the object and purpose of the statute.

- The contention of the Counsel for the assessees that the amendment brings within its fold new class of persons in whose cases the past assessments could be reopened under Section 153C and that therefore this amendment creates new liabilities was not accepted.

I may try to understand these elements of the decision on which the final conclusions of the court are based.

- As noted earlier, the unanimous judicial opinion on the pre-amended provisions of Section 153C of the Act was that the expression “belongs or belong to” is vitally different and much narrower than the expressions “refers to” or “relates to”. It was perfectly legitimate for the revenue to take the legislative route and amend the provision so as to widen its sweep. However, merely because the need for amendment arose on account of the interpretation of the Court which the revenue was not satisfied with, would it be a ground per-se to hold that the amendment has retrospective effect? As correctly pointed out by the revenue counsel, the legislature had the power to bring the changes with retrospective effect also. But the question is, was such power exercised?

- Reference to the proviso inserted in Section 153C by the Finance Act of 2005 makes interesting reading. This was not even argued by the revenue. This is not to suggest that the court cannot think of an argument in favour of the revenue which does not occur to the revenue itself. It often happens that the court thinks of an angle or an argument which has not been advanced by either side. But it is difficult to appreciate how the first proviso to Section 153C would have a bearing on the question of prospective or retrospective application of the amendment.

- The argument that the amendment substitutes the existing provision and, therefore, shall apply from inception is a most bizarre argument advanced by the revenue and which was unfortunately accepted. By that logic, every amendment in every statute made by way of substitution would have retrospective effect irrespective of the fact whether the amendment extinguishes existing rights or creates new liabilities, irrespective of the fact whether the statute is a charging provision, is a taxing provision or a penal provision. This principle can have far reaching effect. Taken to its logical conclusion, criminal legislation which is by substitution would have retrospective applicability.

- The proposition that presumption of prospective application does not apply to a declaratory statute, is well settled. However, in the present case, even revenue has not argued that the amendment was declaratory in nature. In fact, the revenue counsel as is recorded in the judgment, had highlighted that there is a difference between the phrase “belongs or belong to” and “pertains or pertain to”. Nor the court has held the amendment to be declaratory.

- It was observed that even the High Court had held that Section 153C is a machinery provision. The Gujarat High Court, however, had further observed that if an amendment in a machinery provision creates new rights or liabilities, it must be given prospective effect. Independently of this, a question comes to one’s mind whether Section 153C can be seen as a purely machinery provision, merely because it is contained in Chapter XIV of the Act pertaining to procedure for assessment. Section 132 which pertains to search and seizure finds place in Part C (pertaining to powers of the Income Tax authorities) of Chapter XIII prescribing the income tax authorities. There are stringent requirements under Section 132 before a competent revenue authority could authorize an officer to carry out search operation. As a consequence of search the assessment of the searched person for six assessment years gets reopened. Section 153C bypasses this requirement of the assessee being subjected to search before his assessments are reopened. This is so, because, during the search incriminating material is found which belongs to the person other than the searched person. The provisions of Section 153C are thus in the nature of squeal to the exercise of powers under Section 153A of the Act which in turn depend on valid search authorization. It would therefore not be accurate to characterize Section 153C as machinery provision. Further, as observed by the Gujarat High Court, if an amendment in a machinery provision creates new liabilities or extinguishes existing rights, can it be given retrospective effect?

- The fact that till amendment in Section 153C by Finance Act, 2015, the assessing officer could not proceed against the person other than the searched person when it was found that any money, bullion, jewellery etc. related to or pertained but did not belong to such person is beyond dispute. The legislature widened the sweep of Section 153C and brought within its fold a new class of assessees who were till then not covered by the unamended provision. Reopening of assessments for six years which assessments have otherwise been closed, completed, or barred by limitation is certainly a new liability which amendment created. Any such amendment to have retrospective effect, had to be so stated by the legislature itself.

The judgement when it advocates giving purposive interpretation to a taxing statute to give effect to the legislative intent, seems to be striking a discordant note. I may refer to two Constitution Bench judgments of the Supreme Court in this respect.

In the case of Kesoram Industries, a Constitution Bench of the Supreme Court had observed that in interpreting a taxing statute, equitable considerations are entirely out of place. Taxing statutes cannot be interpreted by any presumption or assumption. A taxing statute must be interpreted in the light of what is clearly expressed, it cannot imply anything which is not expressed, it cannot import provisions in the statute so as to supply any deficiency. Before taxing any person, it must be shown that it falls within the ambit of the charging section by clear words used in the said section and if the words are ambiguous and open to interpretations, the benefit of interpretation is given to the subject.

Similarly, in another Constitution Bench judgment in the case of Dilip Kumar & Co., while making a clear distinction between a charging provision of a taxing statute and an exemption notification which waives a tax, it was observed that in construing penal statutes and taxation statutes, the court must apply strict rule of interpretation. The State cannot at its whims and fancy burden the citizen without authority of law. In other words, when the competent legislature mandates taxing certain persons / certain objects in certain circumstances, it cannot be extended / interpreted to include those which were not intended by the legislature. These golden words have been lost sight of presumably because these decisions were not cited before the court and therefore not noticed.

Sadly, this is not a one-off occurrence. In the case of Ashish Agarwal, the Supreme Court agreed with the view taken by various High Courts of the country that after amendment in the provisions pertaining to re-opening of assessments, the revenue could not have issued the notices under the unamended provisions. Even after so holding, certain directions were issued on the ground that the revenue cannot be made remediless, and the object and purpose of reassessment proceedings cannot be frustrated, in the process testing the limits of powers under Article 142 and making article 265 – no levy or collection of tax without authority of law - virtually nugatory. But this judgement is not the focus of this article, and I will leave it at that.

In short, the view expressed in the judgement in the case of Vikram Bhatia needs reconsideration.

(The author retired as the Chief Justice of the High Court of Rajasthan in March 2022. Formerly, he was the Chief Justice of the High Court of Tripura, and a judge of the High Courts of Bombay and Gujarat)