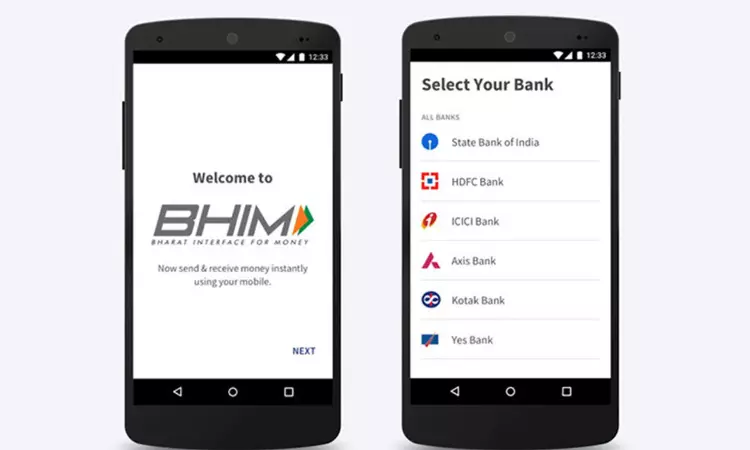

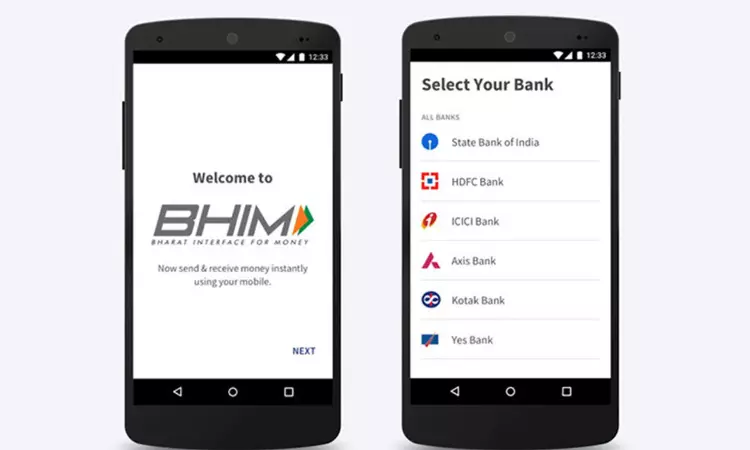

The Kullu (Himachal Pradesh) District Consumer Disputes Redressal Commission, led by Sh. Purender Vaidya as president and Ms. Pooja Gupta as member, allowed a consumer complaint against BHIM APP. The issue was related to a failed transaction of ₹20,000/- from the complainant's State Bank of India (SBI) account to Punjab National Bank (PNB) through BHIM APP. The commission observed...