Corporate

Buyer Cannot Reject Goods After Putting Them To Use: Bombay High Court Upholds Arbitral Award Against Godrej & Boyce Manufacturing

The Bombay High Court dismissed a petition under section 34 of the Arbitration and Conciliation Act, 1996 ("Arbitration Act"), holding that once goods are put to use by the buyer, such conduct amounts to deemed acceptance under section 42 of the Sale of Goods Act, 1930 ("SOGA"), the buyer cannot later reject the goods on the ground of alleged defects. A claim for damages can be filed...

Tree Plantation & Maintenance In Non-Forest Areas By Charitable Trust Exempt From GST: Gujarat AAR

The Gujarat Authority for Advance Ruling (AAR) has granted exemption to tree plantation and maintenance of them by a Trust in non-forest arears like unutilized barren lands, roadsides, amidst lane dividers, on private lands and every other available patch in its reach. In a recent ruling Mr. Vishal Malani (Member- Central Tax) and Ms. Sushma Vora (Member- State Tax) has held that...

Gujarat High Court Grants Relief After Transfer Pricing Objections Were Mistakenly Filed Before Wrong Authority, Quashes Final Assessment

The Gujarat High Court recently granted relief to a company which had inadvertently filed its objections to a proposed transfer pricing adjustment for Assessment Year 2022-23 before the jurisdictional assessing officer instead of filing it before the faceless authority.The petitioner had sought quashing of final Assessment Order dated 02.05.2025 passed under Section 143(3) read with Section...

CBI Court Convicts Central Excise Inspector In Disproportionate Assets Case, Awards 5 Yrs Imprisonment & ₹63 Lakh Fine; Wife Jailed For Abetment

The Central Bureau of Investigation (CBI) Court in Ahmedabad on December 29, 2025, convicted and sentenced an Inspector, Central Excise and Service Tax, Bhavnagar, to five years' rigorous imprisonment along with a fine of ₹63 lakh in a disproportionate assets case. The court also sentenced his wife to one year's imprisonment with a fine of ₹50,000 for abetment of the...

Employment Agreement Is Valid Proof of Right: Delhi High Court Sets Aside Patent Rejection After Inventor's Death

The Delhi High Court has set aside a Patent Office order that refused a patent application filed by Nippon Steel Corporation for a “high-strength steel sheet and its manufacturing method.” The court held that the Patent Office wrongly rejected the application on the ground that Nippon Steel had failed to establish “proof of right.” It also found fault with the Patent Office's view...

Common Resolution Professional For Group Companies Not Barred Under IBC: NCLT Mumbai

The National Company Law Tribunal (NCLT) at Mumbai recently held that the Insolvency and Bankruptcy Code, 2016 does not prohibit the appointment of a single resolution professional for companies belonging to the same corporate group. According to the tribunal, such an appointment does not by itself create a conflict of interest. A coram of Judicial Member Lakshmi Gurung and Technical...

SEBI Cancels Research Analyst Registration After Holder Says He Runs Grocery Shop, Not Market Activities

The Securities and Exchange Board of India (SEBI) has cancelled the registration of a research analyst who told the regulator that he runs a small grocery shop and is not engaged in securities market activities, after proceedings relating to the misuse of his SEBI registration details by an unregistered investment advisory firm. The noticee had been registered with SEBI as a...

Business Law Daily Round-Up: December 31, 2025

TAX Kerala High Court Grants Bail To Accused Caught In ₹5,000 Land Tax Bribery Trap By VigilanceCustoms | I-STAT Blood Gas Cartridges Are Accessories Of Analyser And Not Diagnostic Reagents; No Differential Duty Payable: CESTAT MumbaiNo Interest On Excise Duty Payable In Revenue-Neutral Situation Even Though Duty Demand Attained Finality: Calcutta High CourtCustoms | Barcode Scanners...

"Health Security Se National Security" Cess On Pan Masala, Tobacco Manufacturing Enforceable From Feb 01

The Ministry of Finance, Department of Revenue has notified February 01, 2026, as the date for enforcement of the Health Security Se National Security Cess Act, 2025 levying a Health Security se National Security Cess on machines used in manufacture of pan masala and similar items. The Health Security Se National Security Cess Act, 2025 (the Act) requires a manufacturer to...

Income Tax Act | Long Term Capital Gains Exemption Available Even If Residential House Was Demolished Before Sale: Madras High Court

The Madras High Court held that the Long-Term Capital Gains exemption under Section 54 of the Income Tax Act cannot be denied merely because the residential house was demolished before its sale. The bench stated that since the sale took place later and the assessee reinvested the capital gains in another house within the prescribed time, the exemption is allowable. Section 54 of...

MCA Extends Deadline For Filing Financial Statements, Annual Returns Under Companies Act Till January 31, 2026

The Ministry of Corporate Affairs, on 30th December, 2025, extended the deadline for filing Financial Statements and Annual Returns under the Companies Act, 2013, up to 31st January, 2026. Initially, the due date for filing financial statements and annual returns for F.Y. 2024-25 was till 31st December, 2025. The decision was taken after representations were received from...

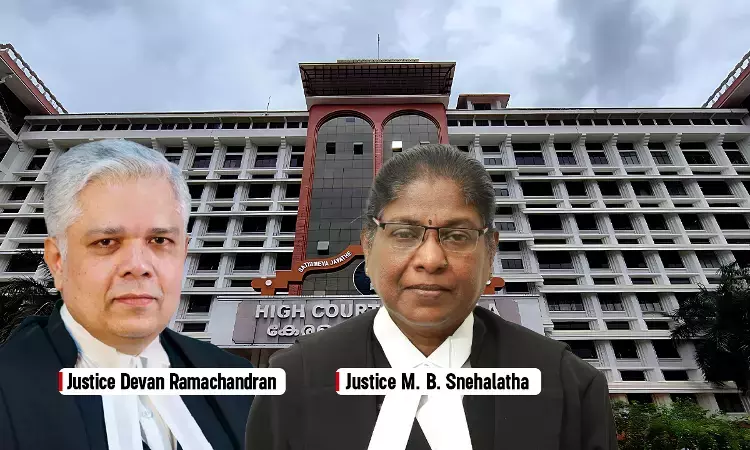

Kerala High Court Asks Centre To Decide Whether SNDP Yogam Is Governed By Companies Act Or Kerala NTC Act

The Kerala High Court, in a recent decision, directed the Union government to comply with a 2009 Delhi High Court order and decide if the Sree Narayana Dharma Paripalana Yogam (SNDP Yogam) is governed by the Companies Act or the Kerala Non-Trading Companies Act.The Division Bench comprising Justice Devan Ramachandran and Justice M.B. Snehalatha set aside the Single bench judgment, which had...