Corporate

Punjab & Haryana High Court Appoints Arbitrator In Shareholder Dispute Over Chairmanship Rotation In KPH Dream Cricket

The Punjab and Haryana High Court, on 23rd December 2025, appointed Justice Harinder Singh Sidhu as the sole arbitrator to resolve a dispute over the "rotational chairmanship" of KPH Dream Cricket Private Limited, the company that owns and administers the IPL franchise - Punjab Kings. Additionally, the Court noted that when appointing an arbitrator under Section 11 of the Arbitration...

Limitation Not “Extinguishing Engine' For Substantive Rights: Calcutta High Court Condones 2262 Day Delay In Filing Appeal

The Calcutta High Court held that the law of limitation is not meant to extinguish substantive rights and must be applied with a liberal approach where delay is caused by bona fide conduct. The bench condoned the delay of 2262 days in filing the CESTAT appeal, holding that the assessee's bona fide pursuit of settlement under the Sabka Vishwas (Legacy Dispute Resolution) Scheme,...

Arbitrator Can't Rewrite Contract By Linking Repayment To Commercial Success Contrary To TDA Terms: Delhi High Court

The Delhi High Court has set aside an arbitral award, holding that the arbitrator travelled beyond the contractual terms by making repayment of financial assistance contingent upon commercial success of the project contrary to the express stipulations of the Technology Development Assistance Agreement (TDA). Justice Jasmeet Singh held that “No doubt the Arbitrator has the power...

NCLT Mumbai Grants Interim Protection To Provogue Liquidator From Arrest Over IBC Actions

The National Company Law Tribunal (NCLT) at Mumbai recently protected a liquidator from arrest by the Economic Offences Wing in a dispute arising from actions taken under the Insolvency and Bankruptcy Code. The tribunal said that section 236 of the Code bars courts from taking cognisance of IBC offences unless a complaint is filed by the Insolvency and Bankruptcy Board of India or the...

Disputes Over Oppressive Extraordinary General Meetings Lie Outside Civil Courts: Calcutta High Court

The Calcutta High Court has held that disputes alleging oppression of a member through an Extraordinary General Meeting are company law disputes that fall squarely within the jurisdiction of the National Company Law Tribunal. The court reiterated that these disputes cannot be examined by a civil court. Bhaskar Gupta, a long-standing member of Calcutta Club Ltd for over four decades and a...

Remuneration Paid To Whole-Time Directors Treated As 'Salary'; Service Tax Not Leviable: CESTAT Chennai

The Chennai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) held that remuneration paid to whole-time directors does not constitute a taxable service. Consequently, service tax under the reverse charge mechanism (RCM) is not leviable. P. Dinesha (Judicial Member) and Vasa Seshagiri Rao (Technical Member) opined that the remuneration paid to the...

Delhi High Court Removes 'DECA-NEUROPHEN' Trademark From Register Over Similarity With Reckitt's 'NUROFEN'

The Delhi High Court has ordered the removal of the trademark “DECA-NEUROPHEN” from the Trade Marks Register, holding that the name is similar to “NUROFEN”, a well-known pain-relief brand, and could confuse consumers. Justice Tejas Karia passed the order on December 24, 2025. The court allowed an appeal filed by Reckitt and Colman Overseas Health Limited and set aside an earlier...

Works Contract Service Provided To CESC For Transmission Or Distribution Of Electricity Not Liable To Service Tax: CESTAT Kolkata

The Kolkata Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) held that works contract service provided to Calcutta Electricity Supply Corporation (CESC) for transmission or distribution of electricity is not liable to service tax. Ashok Jindal (Judicial Member) and K. Anpazhakan (Technical Member) examined whether the works contract service provided by...

Arbitration Petition Seeking Stay Of Eviction Over Immovable Property Is “Suit For Land”; Outside Jurisdiction Of Original Side: Calcutta HC

The Calcutta High Court has held that a petition filed under Section 9 of the Arbitration Act, seeking a stay on eviction notice in respect of immovable property would amount to a suit for land and is not maintainable if the property is situated outside the territorial jurisdiction of the court's original side. The court said proceedings which directly impact possession of land cannot...

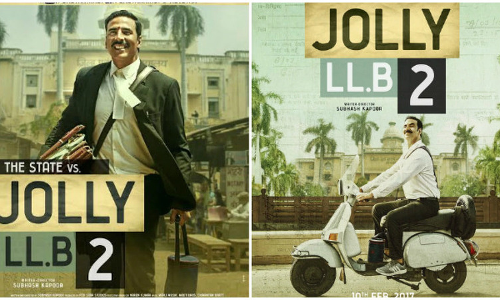

Delhi High Court Refuses To Drop Akshay Kumar, PVR and INOX From Bata's Defamation Suit

The Delhi High Court registrar's court has refused to delete Bollywood actor Akshay Kumar and mutiplexes- PVR and INOX from the array of parties in a defamation suit filed by Bata India Ltd. in connection with the film Jolly LLB 2. The registry has held that their presence is necessary for proper adjudication of the dispute.The order was passed by the Joint Registrar (Judicial) Ajay Gulati,...

Business Law Daily Round-Up: December 26, 2025

Tax GST Registration Can Be Restored If Returns And Dues Are Cleared: Gauhati High CourtRevenue Cannot Reclassify Input Services Or Deny CENVAT Credit While Sanctioning Refund: CESTAT ChandigarhCentre Imposes Anti-Dumping Duty On 2-Ethyl Hexanol Imports From EU, US, Korea, Others Till June 2026Service Tax | Sale Of Popcorn & Beverages At Cinema Counters Is Not Service, No Service Tax...

Plea To Shift Hindustan National Gas's Registered Office Can Proceed Despite Pending Appeal: NCLAT

The National Company Law Appellate Tribunal (NCLAT) at Delhi recently clarified that an application filed by insolvent Hindustan National Gas & Industries Limited for changing its registered office from Kolkata to Mumbai can be considered by the Regional Director in accordance with law, despite an appeal challenging approval of the resolution plan being pending before it.A coram...