Corporate

Income Tax Act | ITAT Mumbai Grants Major Tax Relief To Vodafone; Deletes Depreciation, TDS & S.14A Disallowances

The Mumbai Bench of the Income Tax Appellate Tribunal has held that multiple additions made by the Assessing Officer could not be sustained in law. The Bench held that the transfer of passive telecom tower assets pursuant to a court-approved demerger amounted to a genuine “gift” under Section 47(iii), and the Assessing Officer could not artificially impute consideration...

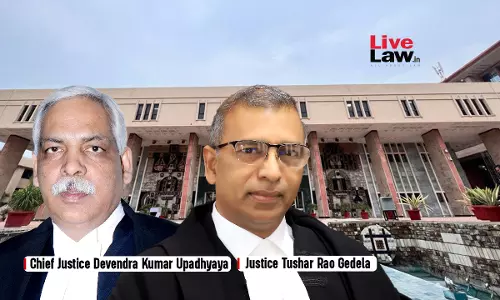

Non-Obstante Clause U/S 13(2) Commercial Courts Act Prevails Over S.10 Delhi HC Act: Delhi High Court Dismisses Arbitral Appeals

The Delhi High Court Bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela while dismissing an appeal under Section 10, Delhi High Court Act (“DHC Act”) and Section 13(2), Commercial Courts Act (“CC Act”) observed that the expression “any other law for the time being in force” used in Section 13(2), CC Act encompasses in its fold the provisions of...

Digitalisation, GIS Mapping And Tech Consultancy For Jal Jeevan Mission Are 'Pure Services', Exempt From GST: West Bengal AAR

The West Bengal Authority for Advance Ruling (AAR) has held that digitalisation, GIS mapping, monitoring, data management and technical consultancy services provided to the Public Health Engineering Department (PHED) in connection with water supply schemes qualify as “pure services” and are exempt from Goods and Services Tax (GST) under Notification No. 12/2017. The...

Fresh Arbitration Notice is Mandatory For Second Round Of Arbitration After Earlier Award Is Set Aside: Kerala High Court

The Kerala High Court has held that a fresh arbitration notice under section 21 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) is mandatory for initiating a second round of arbitral proceedings after an earlier arbitral award has been set aside even when the award was declared as a nullity due to invalid appointment of the arbitrator. Justice S. Manu while...

Bombay High Court Quashes ₹173.72 Cr Arbitral Award Against Thermax, Holds Arbitrator's Findings To Be Based On Lack Of Evidence

The Bombay High Court has recently set aside an arbitral award that mandated engineering giant Thermax Limited to pay ₹173 crore in favor of Rashtriya Chemicals & Fertilizers Ltd. (RCF). The award primarily directed payments towards the additional costs RCF incurred for power due to failure of gas turbine generators. Considering a challenge under Section 34 of the Arbitration...

Mesne Profit Claims After IBC Resolution Can Proceed Only Against Former Management: Calcutta High Court

The Calcutta High Court has recently held that proceedings to calculate mesne profits can continue only against a company's former management once a resolution plan is approved under the Insolvency and Bankruptcy Code.Mesne profits refer to the claim arising from unlawfully occupying someone else's property. The court clarified that such proceedings cannot continue against the company itself...

Intellectual Property Rights Weekly Round-Up: December 15-21, 2025

NOMINAL INDEXDPIIT Working Paper on Generative AI and CopyrightFrankfinn Aviation Services (Pvt.) Ltd. v. M/S Fly High Institute & Ors., 2025 LiveLaw (Del) 1713Lifestyle Equities C.V. & Anr. v. Priyanka Alpeshbhai Polara, 2025 LiveLaw (Del) 1715Au Naturel Beauty Private Limited v. Wet and Dry Personal Care Pvt. Ltd. & Anr., 2025 LiveLaw (Del) 1716Bhavesh Suresh Kataria v....

NCLT Delhi Cancels 9.84 lakh Neel Padam Shares After Finding Company Used Own Funds For Allotment

The National Company Law Tribunal (NCLT) at Delhi has cancelled 9.84 lakh shares and restored promoter control of Neel Padam Builders after finding that the company used its own money to create a false impression of fresh share subscriptions. A coram of Judicial Member Ashok Kumar Bhardwaj and Technical Member Reena Sinha Puri held that Neel Padam Builders withdrew Rs 45 lakh from its own...

Termination Of Employee Solely For Being HIV-Positive Is Arbitrary & Unlawful: Delhi HC

A Division Bench of the Delhi High Court comprising Justice C. Hari Shankar and Justice Om Prakash Shukla held that termination of an HIV-positive employee without compliance with safeguards under the Human Immunodeficiency Virus and Acquired Immune Deficiency Syndrome (Prevention and Control) Act, 2017 is unlawful. Background Facts The petitioner was appointed as a...

Allahabad High Court Directs Criminal Contempt Against GST Official For Filing Misleading Personal Affidavit

On Thursday, Allahabad High Court directed initiation of criminal contempt proceedings against Additional Commissioner, Grade-2(Appeal) First, State Tax, Meerut for filing a misleading personal affidavit before the Court despite being given 2 opportunities. Noting that the impugned order did not show any consideration of the circulars and only quoted a report signed by an...

Municipal Corporations Not Entitled To Unconditional Stay U/S 36 A&C Act; Treated At Par With Private Parties: P&H High Court

The Punjab and Haryana High Court Bench of Chief Justice Sheel Nagu and Justice Sanjiv Berry has observed that being a statutory body does not entitle a party to claim unconditional grant of stay under Section 36, Arbitration and Conciliation Act (“ACA”) as a matter of right. And if a conditional stay is granted, a statutory body is to be treated at par with a private...

Non-Filing Of ITR By Creditor Not Proof For Lack Of Creditworthiness: Patna High Court Deletes Income Tax Additions

The Patna High Court has held that the Income Tax Appellate Tribunal was not justified in restoring an addition of ₹1.91 crore under Section 68 of the Income Tax Act after reversing a reasoned order of the Commissioner of Income Tax (Appeals), where the assessee had produced documentary evidence and the Assessing Officer's remand report did not disclose any adverse material. A...