Corporate

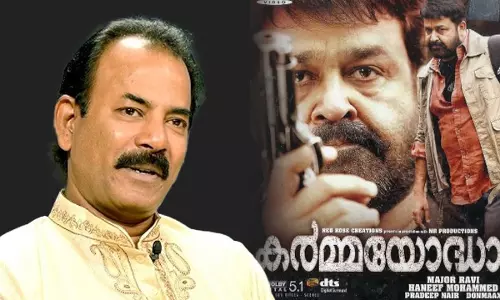

'Karmayodha' Film Plagiarism: Kerala Court Orders Major Ravi & Makers To Pay ₹30L To Scriptwriter Regi Mathew

The Commercial Court, Kottayam recently passed a judgment against Major Ravi and Mohammed Haneef, who are the director and producer of the 2012 Mohanlal-starrer movie 'Karmayodha', to pay a compensation of Rs. 30 lakhs to scriptwriter Regi Mathew.Sri. Manish D. A., Principal Sub-Judge, decided the suit preferred by Regi Mathew seeking permanent prohibitory injunction, declaration, damages and...

Income Tax Act | Reassessment U/S 147 Valid If Original Order Did Not Consider S. 80HHC Claim Earlier: Madras High Court

The Madras High Court held that reassessment under Section 147 of the Income Tax Act is valid if the original order is completely silent on the assessee's claim for deduction under Section 80HHC of the Income Tax Act. Section 147 of the Income Tax Act, 1961, empowers the Assessing Officer (AO) to assess or reassess income that has escaped assessment. Justices Anita Sumanth...

IGST Act | Place Of Supply Depends On Where Movement Terminates, Not Where Goods Were Handed To Carrier: Karnataka High Court

The Karnataka High Court held that for the purpose of determining the place of supply under Section 10(1)(a) of the IGST Act, the factor is the location where the movement of goods terminates for delivery to the recipient and not the place where the goods are handed over to the common carrier. Section 10(1)(a) of the Integrated Goods and Services Tax (IGST) Act, 2017, provides that...

GST Authorities Have No Power To Seal Cash During Search: Calcutta High Court Orders De-Sealing Of ₹24 Lakh

The Calcutta High Court held that the GST authorities do not have the power under Section 67 of the CGST Act to seal or seize cash. Accordingly, the bench directed the immediate de-sealing of Rs. 24 lakhs. Section 67 of the Central Goods and Services Tax (CGST) Act, 2017, grants tax authorities the powers of inspection, search, and seizure to prevent tax evasion and...

Packing Materials Are Integral Part Of Cement Sales, Cannot Be Taxed Separately At Different Rates: Patna High Court

In a ruling on sales tax valuation under the Bihar Finance Act, 1981, the Patna High Court has held that packing materials used for cement, such as gunny bags and HDPE bags, form an integral part of cement sales and cannot be subjected to separate tax rates distinct from the cement itself. The Division Bench of Justice Bibek Chaudhuri and Justice Dr. Anshuman dismissed a...

NCLT Ahmedabad Clears First Stage Of Adani Harbour–Adani Ports Merger

The National Company Law Tribunal (NCLT) at Ahmedabad on Tuesday cleared the first stage of the proposed merger between Adani Harbour Services Limited and its holding company Adani Ports and Special Economic Zone Limited, allowing the companies to move forward with the amalgamation process while dispensing with meetings of shareholders and creditors. A coram comprising Judicial Member...

Appointment Of SEBI Adjudicating Officer To Conduct Inquiry Is An Administrative Step, Not Finding Of Guilt: Delhi High Court

The Delhi High Court has recently held that the appointment of an adjudicating officer by the Securities and Exchange Board of India (SEBI) is only an administrative step to initiate an inquiry and does not amount to finding of guilt at that stage. A Division Bench of Justices Anil Kshetarpal and Harish Vaidyanathan Shankar overturned a Single Judge's decision that had halted SEBI's...

CESTAT Delhi Cancels Customs Broker's Licence For Helping Export Prohibited Goods Using Another Person/Firm's Name

The Customs, Excise & Service Tax Appellate Tribunal (CESTAT), New Delhi, has upheld the cancellation of a Customs Broker's licence after finding that the broker helped export prohibited goods by filing documents in the name of a firm that had never hired it. A Bench of Justice Dilip Gupta (President) and P.V. Subba Rao (Member–Technical) dismissed the appeal filed by...

GST | Cannot Seek Pre-Arrest Bail At Stage Of Summons, Delhi High Court Dismisses Plea By Tobacco Trader

The Delhi High Court has dismissed Writ Petitions challenging GST Summons issued by the Enforcement Agency, Directorate General of Goods and Services Tax Intelligence (DGGI) alleging clandestine trading of tobacco on 'merits'. In a judgment delivered on December 16, 2025, Justice Neena Bansal Krishna, deliberated on the interplay between Section 70 of the CGST Act, 2017 and Section 193...

NCLT Mumbai Admits Tata Capital's Insolvency Plea Against Dharan Infra Over ₹28 Crore Default

The National Company Law Tribunal (NCLT) at Mumbai has admitted an insolvency application filed by Tata Capital Housing Finance Ltd against Dharan Infra EPC Ltd, a real estate and infrastructure company, holding that the lender had established debt and default exceeding Rs 28 crore and initiating the corporate insolvency resolution process. The bench of Judicial Member Nilesh Sharma...

Employee Moving To Another Cadre Can't Later Claim Regular Promotion In Former : Calcutta High Court

A Division Bench of the Calcutta High Court comprising Justice Madhuresh Prasad and Justice Prasenjit Biswas held that the employee who availed Career Advancement Scheme and subsequently left the cadre cannot claim regular promotion benefits granted later to Bhumi Sahayak cadre. Background Facts The petitioner was appointed as a Bhumi Sahayak in 1984. After completing ten years...

Appellate Jurisdiction Confined To Orders Determining Rights Of Parties, Not Procedural Directions: NCLAT

The National Company Law Appellate Tribunal (NCLAT) at Chennai on Tuesday held that appellate jurisdiction under the Insolvency and Bankruptcy Code is confined to examining orders of the National Company Law Tribunal (NCLT) that adjudicate or determine the rights of parties, and does not extend to purely procedural or interlocutory directions such as issuance of notice. The Bench of...