Corporate

ITAT Allows ₹772 Crore Business Loss Claim Of Flipkart Group Firm Instakart

The Bengaluru Bench of the Income Tax Appellate Tribunal (ITAT) has allowed Instakart Services Pvt. Ltd., a Flipkart group logistics company, to claim Rs 772.25 Crore in business losses. The ruling sets aside tax disallowances for Assessment Years 2016-17 to 2018-19. In an order dated December 18, 2025, Judicial Member Keshav Dubey and Accountant Member Waseem Ahmed held that the losses...

GST Payable On Reimbursed Foreign Patent Attorney Fees For Overseas Patent Filings: West Bengal AAR

The West Bengal Authority for Advance Ruling (AAR) has clarified that reimbursement of fees paid to foreign patent attorneys for overseas patent filings constitutes a taxable 'import of legal services' and attracts GST in India.A coram comprising Shafeeq S, Joint Commissioner (Member- Central Tax) and Jaydip Kumar Chakrabarti was examining a dispute arising from patent filings made in Japan,...

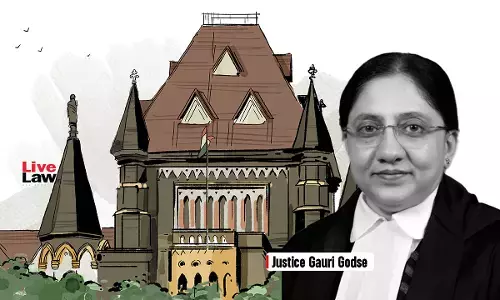

Landowner Who Enjoyed Planning Benefits For Decades Barred From Reclaiming Land Surrendered Under Development Plan: Bombay High Court

The Bombay High Court has held that where a landowner voluntarily agrees to surrender land reserved for a public purpose under a sanctioned Development Plan, free of cost but in consideration of tangible planning benefits such as waiver of compulsory open space requirements or grant of higher Floor Space Index (FSI), such surrender constitutes a valid acquisition by agreement under...

Arbitration Clause Cannot Be Invoked Once Loan Contract Is Exhausted: Himachal Pradesh High Court

The Himachal Pradesh High Court has held that a civil suit seeking damages for harassment and mental agony on account of non-issuance of a No Objection Certificate could not be linked to the original loan agreement once the loan was fully repaid. The Court remarked that the loan contract had been exhausted upon complete repayment of the loan amount, and therefore, the subsequent claim for...

Employer Retains Right To Disciplinary Action Even After POSH Conciliation Settlement: Gauhati High Court

A Division Bench of the Gauhati High Court comprising Chief Justice Ashutosh Kumar and Justice Arun Dev Choudhury held that conciliation under Section 10(4) of the POSH Act bars only further inquiry by the Internal Complaints Committee and does not prevent the employer from initiating independent disciplinary proceedings under the service rules in light of new evidence to ensure a...

Rehabilitation Component Outside RERA, MahaRERA Dismisses Housing Society Members' Complaint

The Maharashtra Real Estate Regulatory Authority (MahaRERA) dismissed a complaint against the developer of a rela estate project in Pune clarifying that the RERA Act does not apply to disputes involving the "rehabilitation component" of redevelopment projects.The authority, presided by Member Mahesh Pathak, held that because rehabilitation members are not "allottees" in a commercial sense,...

MahaRERA Fines Akola Developer ₹10,000 For Blurred RERA Number And QR Code In Newspaper Advertisement

The Maharashtra Real Estate Regulatory Authority's (MahaRERA) Nagpur Bench has imposed a penalty of Rs 10,000 on a real estate developer after holding that a newspaper advertisement carried mandatory RERA details in a manner that “appears blur and beyond recognition”, defeating the very purpose of statutory disclosure for homebuyers. The order was passed by Deputy Secretary Sanjay...

GST Not Payable On Waste Management Services Provided To Govt-Owned Clean Kerala: AAR

The Kerala Authority for Advance Ruling (AAR) has ruled that solid waste management work carried out for Clean Kerala Company Limited is not taxable under GST, after finding that Clean Kerala is a government-owned company performing municipal functions. The ruling came on an application filed by Tiffot Private Limited, which handles the collection, transport, processing and disposal...

Lateral Movement Between Posts Carrying Same Grade Pay Not A Promotion: Chhattisgarh HC

A Division Bench of the Chhattisgarh High Court comprising Justice Rajani Dubey and Justice Amitendra Kishore Prasad held that movements between posts with the same Grade Pay (like Goods Guard to Passenger Guard) are lateral inductions, not promotions. Therefore, such movements should not be counted against the limited number of MACP upgradations. Background Facts The...

GST Payable On Payment Made By VSSC To Manpower Supplier During Lockdown Despite No Work: Kerala AAR

The Kerala Authority for Advance Ruling (AAR) has ruled that GST is payable on payments made by the Vikram Sarabhai Space Centre to a manpower supplier during the COVID-19 lockdown, even though no physical services were rendered. The ruling came on wages and interim payments received between 23 March 2020 and 31 May 2020, when work was suspended due to the nationwide lockdown. A...

GST Leviable On Exam Fees Collected By Devaswom Recruitment Board : Kerala AAR

The Kerala Authority for Advance Ruling has ruled that examination fees collected by the Kerala Devaswom Recruitment Board attract GST. It said the Board must register under GST once its annual turnover crosses Rs 20 lakh. The ruling was delivered by a coram comprising Jomy Jacob, Additional Commissioner of Central Tax, and Mansur M. I., Joint Commissioner of State Tax. The Recruitment...

GST | Wrong-State Tax Payment Triggers ₹10.91 Lakh Refund Fight For Vodafone Idea

What began as a wrong-State GST payment has snowballed into a Rs 10.91 lakh refund dispute for Vodafone Idea Ltd. (Vi), after the Delhi GST Department rejected its refund claim. On Wednesday, the Delhi High Court declined to intervene, noting that the dispute turned on how the refund period was selected while filing the application. The case arose after Vi mistakenly paid State GST under...