Corporate

Bombay High Court Quashes Prosecution Against Chanda Kochhar, ICICI Bank Officials In Octroi Avoidance Case

The Bombay High Court has recently quashed the prosecution and 2009 summons issued by a Pune court to former ICICI Bank chief Chanda Kochhar and four senior officials in a case alleging octroi avoidance on imported gold coins. However, the case will proceed against the bank itselfA single bench of Justice Neela Gokhale observed that the complaint made by the Pune Municipal Corporation did...

Railway Receipts & STTG Certificates Are Valid Documents For Availing CENVAT Credit Before 27.08.2014: CESTAT Kolkata

The Kolkata Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) held that railway receipts and STTG (Service Tax Certificate for Transportation of Goods) Certificates are valid documents for taking CENVAT (Central Value Added Tax) Credit even prior to 27.08.2014. R. Muralidhar (Judicial Member) and K. Anpazhakan (Technical Member) opined that the STTG...

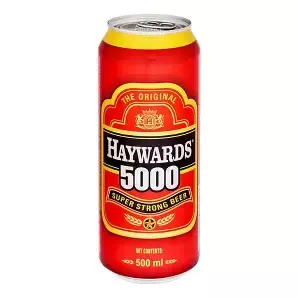

Bombay High Court Bars Use Of 'COX 5000' Mark, Says '5000' Belongs To Haywards 5000 And Imposes ₹10 Lakh Cost

The Bombay High Court has permanently restrained Madhya Pradhesh-based Jagpin Breweries Limited, a manufacturer of mass-market beer brands, from using the mark “COX 5000” or any other beer mark containing the numeral “5000”. The court held that the numeral is the “dominant, essential, and memorable feature” of the famous strong beer brand “HAYWARDS 5000”, now owned by...

NCLT Delhi Admits Canara Bank's Insolvency Plea Against Equinox Over ₹372 Crore Guarantee Default

The National Company Law Tribunal (NCLT) at New Delhi has admitted Canara Bank's insolvency petition against Equinox India Developments Limited, earlier known as Indiabulls Real Estate Limited, for defaulting on Rs 372.35 crore for loans extended to Sinnar Thermal Power Limited for its coal-based thermal power project in Maharashtra. The tribunal rejected the company's claim that the case...

Undertakings To Infuse Equity Or Retain Control Not Guarantees; NCLT Delhi Dismisses CIRP Plea Against RattanIndia

The National Company Law Tribunal at Delhi has dismissed Canara Bank's insolvency petition against RattanIndia Enterprises Limited, holding that promoter undertakings relating to equity infusion and management control do not constitute a corporate guarantee or a financial debt under the Insolvency and Bankruptcy Code. A bench of Judicial Member Manni Sankariah Shanmuga Sundaram and...

NSEL Scam: Bombay High Court Quashes Special Court's 'Mechanical' Summons To Amit Rathi

The Bombay High Court on Wednesday set aside summons issued in 2019 to Amit Rathi and Anand Rathi Commodities Ltd. in a criminal case stemming from the 2013 collapse of the National Spot Exchange Ltd. (NSEL).A single bench of Justice RN Laddha ruled that the Special MPID Court's order in the Economic Offences Wing (EOW) case was mechanical and failed to provide any sufficient reasons for it...

S. 29A Arbitration Act | Arbitrator's Mandate Terminates On Expiry Of Time; Substituted Arbitrator Must Resume After Extension : Supreme Court

The Supreme Court on Wednesday (December 10) held that once the statutory 18-month period for delivering an arbitral award expires, the arbitrator's mandate automatically comes to an end as per Section 29A(4) of the Arbitration and Conciliation Act, 1996, when no application for extension is made. Therefore, when an extension of time is granted by the Court after the mandate of the arbitrator...

Complaints Against Auditors Or Company Secretaries No Ground To Seek Probe Into Company: NCLT Ahmedabad

The National Company Law Tribunal (NCLT) at Ahmedabad recently held that complaints of professional misconduct against auditors or company secretaries cannot form the basis for seeking an SFIO investigation into a company under Sections 212 or 213 of the Companies Act. It said such disciplinary action concerns only the individual professional and does not give the complainant any right...

Bombay High Court Temporarily Restrains Rival From Using Trade Dress Similar To Parachute Jasmine Hair Oil

The Bombay High Court has temporarily restrained Minolta Natural Care and its associated entities from using packaging and bottle designs that the court found deceptively similar to Marico's Parachute Jasmine/ Parachite Advansed Jasmine Hair Oils. A single bench of Justice Sharmila U Deshmukh passed the interim injunction on December 9, 2025, after Marico alleged that Minolta had copied...

Centre Defends Onion Export Ban, Says MEP Was 'Temporary' & Needed To Protect Consumers Amid Price Spikes

The Centre has clarified on Onion export ban and imposition of Minimum Export Price (MEP), were 'temporary' and 'necessary' to protect consumers, especially low-income households, during years when adverse weather conditions and lower arrivals led to sharp spikes in retail prices. On fair-farmer remuneration, the Centre explained that it balanced consumer price stability and...

Municipality Must Accept Only Tax Component, Penal Charges Not Required For Filing Appeal Under Municipal Act: Kerala High Court

The Kerala High Court held that under Section 509(11) of the Municipality Act, only the tax component shown in the demand notice is required to be paid for filing an appeal. The bench clarified that the Municipality cannot insist on payment of penal interest or any other additional charges for entertaining the appeal. Section 509(11) of the Municipality Act, 1994, provides that...

Refund Cannot Be Denied When CA Certificate & Ledger Confirms Excess Excise Duty: CESTAT Kolkata

The Kolkata Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) held that the assessee is entitled to a refund of excess excise duty since both the Chartered Accountant's certificate and the ledger clearly established that the duty was paid in excess and was never passed on to any third party. R. Muralidhar (Judicial Member) and K. Anpazhakan (Technical...