High Courts

Delhi High Court Bars Non-Advocates From Appearing Before Consumer Courts

The Delhi High Court has barred the practise of permitting non-Advocates or agents to appear before the Consumer Courts here on the basis of authority letters issued by lawyers, with immediate effect.Justice Sanjeev Narula directed all Consumer Commissions in Delhi to ensure that the parties are represented by Advocates or by the agents or representatives or non-advocates strictly in terms of...

Interest Earned On Borrowed Funds Kept For Acquiring Coal Mine Is Not Revenue Receipt If Coal Mine Is Aborted, Borrowings Are Repaid: Delhi HC

The Delhi High Court recently accepted that the interest received on borrowed funds, which were temporarily held in interest bearing deposit, is a part of the capital cost and is required to be credited to Capital Work In Progress.The Division Bench of Acting Chief Justice Vibhu Bakhru and Justice Swarana Kanta Sharma observed that if the interest is earned on the amounts temporarily kept...

ITO Acted On Complete Change Of Opinion On Same Material With Intent To Review Assessment Order Passed By Him: Bombay HC Quashes Reopening

While setting aside the reassessment proceedings, the Bombay High Court held that 'change of opinion' or 'review of already completed assessment', is not permitted to AO.While holding so, the Division Bench of Justice G.S Kulkarni and Justice Advait M Sethna observed that there is no whisper of allegations against the assessee that income that has escaped assessment was attributable to...

No Penalty Can Be Levied U/S 271B Of IT Act If No Prejudice Is Caused To Dept On Account Of Belated Furnishing Of Audit Report: Kerala HC

The Kerala High Court held that circumstances under which AO can absolve a taxpayer from payment of penalty u/s 271B are discernible from a reading of Sec 273B, which states that no penalty can be imposed on an assessee u/s 271B for breach of the provisions, if he proves that there was "reasonable cause" for the said failure.The provision of Section 44AB of Income tax Act prescribes a...

Amendment In Finance Act Can't Retrospectively Affect Vested Right Of Taxpayer To Adjudicate Settlement Application U/S 245(D): Calcutta HC

The Calcutta High Court recently reiterated that when the settlement applications were filed before the date on which the Finance Act 2021 did not come into effect, then taxpayers had vested right of preferring the application in absence of any statute prohibiting the said application.The Division Bench of Justice Harish Tandon and Justice Hiranmay Bhattacharyya reiterated that...

Madras High Court Grants Interim Bail To Temple Activist, Asks Him To Refrain From Making Objectionable Comments Against Women

The Madras High Court has granted bail to temple activist Rangarajan Narasimham for allegedly making derogatory comments against a woman on social media. While granting interim bail, Justice V Lakshminarayanan asked Narasimham to delete all the offensive messages and refrain from making any vituperative comments against women in any of the social media forums. The court also...

Prima Facie State Human Rights Commission Has No Jurisdiction To Deal With Child Custody Issues: Allahabad HC

In a prima facie view, the Allahabad High Court has observed that the jurisdiction of the State Human Rights Commission doesn't extend to dealing with child custody matters. A bench of Justice Rajan Roy and Justice Brij Raj Singh took exception to and ultimately stayed the Commission's orders, which included directions to present the children before the commision for recording of...

J&K High Court Reaffirms Quranic Injunctions, Secures Muslim Daughter's Inheritance Rights After 43-Year Legal Battle

Underscoring the sanctity of Quranic injunctions concerning inheritance rights the Jammu and Kashmir and Ladakh High Court has ruled in favor of a Muslim woman's right to inherit her father's property, resolving a 43-year-long legal battle initiated by the late Mst. Mukhti. The court reaffirmed that the inheritance rights of daughters, as ordained in Surah An-Nisa of the Holy Quran,...

BSF Personnel Entitled To MACP Benefits Based On Notional Service Till 60 Years: Delhi HC

Delhi High Court: A Division Bench of Justices Navin Chawla and Shalinder Kaur upheld BSF personnel's right to the third Modified Assured Career Progression (MACP) benefit. It noted that Dev Sharma v. Indo Tibetan Border Police had mandated uniform retirement at 60 years for all officers of Central Armed Police Forces. Thus, it held that notional service until 60 years must also be...

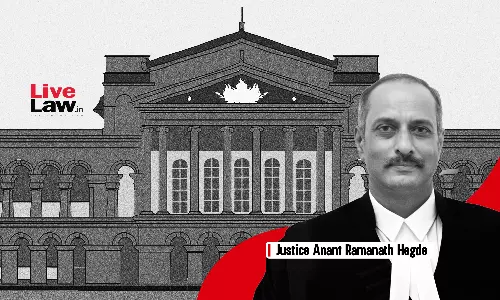

Election Petition Questioning Caste Certificate Of Elected Representative Maintainable Before High Court: Karnataka HC

The Karnataka High Court has held that Karnataka Scheduled Castes and Scheduled Tribes and Other Backward Classes (Reservation of Appointments, etc.) Act, 1990, does not take away the jurisdiction of the High Court to decide an election dispute questioning the caste of a returned candidate to the Legislative Assembly.Justice Anant Ramanath Hegde dismissed the application made under Order VII...

Pappanji Burning: Kerala High Court Questions Police Over Notice Issued To Stop Burning Of Effigy During New-Year Celebrations

The Kerala High Court on Tuesday (24th December) asked the Government pleader to inform court specifically about the provision under which the police issued stop memo against burning of 'Pappanji' in Fort Kochi. Justice Easwaran S. made this observation in a petition filed by Gala de Fort Kochi, the club which erected the Pappanji this year.'Pappanji burning' is an annual ritual conducted as...

Assets And Liabilities Of Public Servant Cannot Be Shielded From Public Scrutiny, Be Completely Exempted U/S 8 Of RTI Act: Madras High Court

The Madras High Court recently held that the service register of a public servant could not be completely exempted under Section 8 of the Right to Information Act. Section 8(j) of the RTI Act exempts personal information from disclosure. Justice CV Karthikeyan observed that the service register of the public servant contains details of the assets and liabilities of the employee which...