High Courts

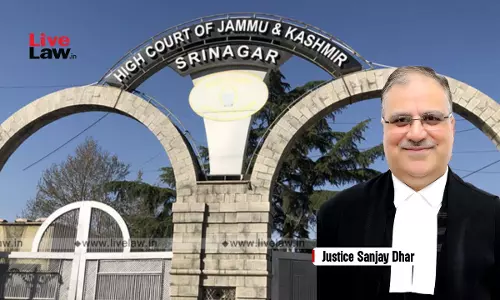

Teacher Selection By Private Unaided Schools Is A Matter Of Private Contract, Not Enforceable Through Writ Jurisdiction: J&K&L High Court

The High Court of Jammu & Kashmir and Ladakh has held that the selection of teachers by a private unaided school culminates in a contract of service governed by private law, and that the rights claimed by candidates participating in such selection processes are purely private rights, which cannot be enforced through a writ petition under Article 226 of the Constitution.Justice Sanjay...

Calcutta High Court Quashes 'Counterblast' FIR In Neighbourhood Dispute, Says S.354B IPC Not Applicable Against Women Accused

Holding that criminal law cannot be weaponised to settle personal scores in a residential dispute, the Calcutta High Court has quashed an FIR lodged by a woman against her neighbours — a mother and daughter — observing that the case appeared to be a “counterblast” to an earlier complaint and was riddled with delay, inconsistencies, and legal infirmities.Justice Chaitali Chatterjee...

Unfavourable Orders Can't Become Basis For Transfer Of Trial, Courts Must Curb Forum Hunting: Punjab & Haryana High Court

The Punjab & Haryana High Court has said that, "judicial error is not synonymous with judicial partiality and hence mere passing of an unfavourable order, or even an order subsequently set aside by a superior Court, does not ipso facto establish a foundation for bias or prejudice."Justice Sumeet Goel said, "Litigants often misinterpret an adverse or unfavourable judicial order as...

Jharkhand High Court Flags 'Parallel Administration' In Sahibganj, Orders Protection Of Pahariya Tribe After Alleged Socio-Economic Boycott

The Jharkhand High Court has directed the police and district administration of Sahibganj District to ensure protection of the constitutional and statutory rights of the Pahariya community, after taking serious note of allegations of social boycott, denial of essential services, and obstruction of religious celebration.A Single Judge Bench of Justice Sanjay Prasad was hearing a criminal...

Madras High Court Seeks ECI's Response On Plea By PMK's Ramadoss Regarding Allotment of Mango Symbol

The Madras High Court has directed the Election Commission of India to respond to a plea filed by Pattali Makkal Katchi founder Dr. S Ramadoss, alleging that the ECI's communication regarding allotment of “Mango “ symbol to the party was wrongly communicated to the party's former President Anbumani, who was no longer in the party. The bench of Chief Justice Manindra Mohan...

Madras High Court Weekly Round-Up: January 26 to February 01, 2026

Citations: 2026 LiveLaw (Mad) 42 To 2026 LiveLaw (Mad) 51 NOMINAL INDEX P Mangaiyarkkarasi v. The Registrar General and Others, 2026 LiveLaw (Mad) 42 A Sarath v. The Commissioner and Others, 2026 LiveLaw (Mad) 43 Central Board of Film Certification and another v. KVN Productions LLP, 2026 LiveLaw (Mad) 44 G Thirukalyanamalar v State Bank of India and Others, 2026...

Aadhaar & Voter ID Not Proof Of Citizenship; Compliance With Visa Rules Mandatory When Records Show Foreign Nationality: Telangana HC

The High Court of Telangana has declined to grant relief to a man who claimed Indian citizenship by birth and sought directions restraining the police and immigration authorities from compelling him to apply for a Long Term Visa (LTV). The Court held that documents such as Aadhaar card, voter ID, PAN card, driving licence and educational certificates cannot, by themselves, establish...

Illegal Adoption Cannot Be Regularised On Grounds Of Emotional Bonding With Child: Telangana High Court

The High Court of Telangana, in a recent judgment, rejected a plea filed by a man seeking restoration of custody of a minor girl child who had been taken from his care after police registered a case alleging illegal adoption and child trafficking. The Court held that custody could not be granted where the child was procured through a process not recognised by law, and that an emotional...

Plea In Kerala High Court Challenges Release Of Movie Stated To Be Inspired By Venjaramoodu Mass Murder Case

A plea has been moved before the Kerala High Court by the father of the accused in the Venjaramoodu Mass Murder case challenging the theatrical release of the Malayalam movie Kaalam Paranja Kadha, which is stated to be inspired by the case.The Venjaramoodu Mass Murder case relates to the alleged murder of five relatives of Afan and the attempted murder of his mother. Afan is arrayed as the...

FIR Against Investigating Officer Cannot Dilute Material Against Accused: J&K&L High Court Rejects Anticipatory Bail In NDPS Case

The Jammu & Kashmir and Ladakh High Court has held that the registration of an FIR against the Investigating Officer for alleged misconduct does not automatically weaken or nullify the material collected against an accused in a criminal case, and cannot by itself be a ground to grant anticipatory bail, particularly in cases involving commercial quantity under the NDPS Act.A bench of...

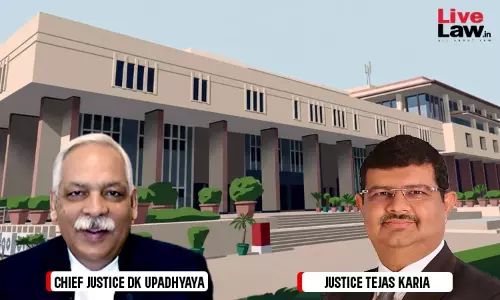

Delhi High Court Orders Survey Of Buildings Around Heritage Properties To Check Illegal Constructions

The Delhi High Court has directed the Municipal Corporation of Delhi (MCD) to conduct a comprehensive survey of buildings located in the vicinity of notified heritage properties in the national capital to check if there are any illegal constructions. A Division Bench comprising Chief Justice Devendra Kumar Upadhyaya and Justice Tejas Karia passed the direction while hearing a batch of...

'No Presumption Of Validity For 30-Year-Old Wills U/S 90 Evidence Act, Execution Must Be Strictly Proved': Chhattisgarh High Court

The Chhattisgarh High Court has explained that the presumption contemplated under Section 90 of Indian Evidence Act (IEA) in respect of documents more than 30 years old does not apply to Wills, as a Will is required to be proved by strict compliance with statutory provisions governing its execution and attestation.Justice Bibhu Datta Guru explained that “a will speaks only from the death of...