High Courts

Bombay High Court, Magistrate Courts In Mumbai Vacated Following Bomb Scare

The Bombay High Court and various Magistrate Courts in Mumbai have received Bomb threats, leading to the courts premises being vacated.Court complexes at Andheri, Bandra and Esplanade (at Fort) were vacated, court work has been discharged for the day and Bomb Squad has reached the courts.Evacuation at High Court is also ongoing. Session is likely to resume post-lunch, after...

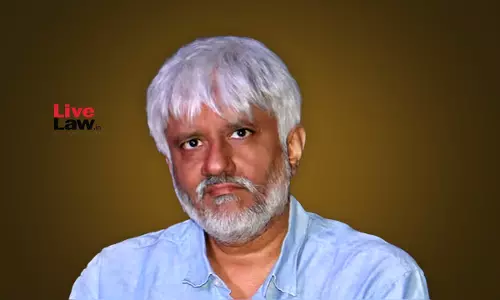

Rajasthan High Court Reserves Verdict On Film-Maker Vikram Bhatt's Plea To Quash FIR Over ₹42 Crore Alleged Cheating Case

The Rajasthan High Court reserved verdict on a plea moved by producer and film-maker Vikram Bhatt seeking quashing of an FIR for allegedly cheating the complainant of Rs. 42 crore and had taken advances under the garb of making films. The FIR was registered against Bhatt following his arrest on December 7. Justice Sameer Jain was hearing pleas by two petitioners Vikram Bhatt and Gangeshwar...

Sabarimala Chemical Kumkum Issue: Kerala High Court Impleads Environmental Engineer & Chief Govt Analyst, Orders Strict Vigilance

The Kerala High Court has suo motu impleaded the Environmental Engineer and the Chief Government Analyst, Drugs and Testing Laboratory in the suo motu proceedings dealing with chemical kumkum in Sabarimala Temple.The Court has also directed the Drug Inspector and Inspection Team to remain vigilant and ensure routine and periodic inspections to identify shops engaged in the sale of...

Service Tax | Windmill Installation, Commissioning Services Construable As 'Input Service', Credit Admissible: Gujarat High Court

The Gujarat High Court has allowed CENVAT credit of service tax paid on input used in setting up of a Windmill, away from factory premises, on the strength of nexus of the inputs with output activity, electricity generation. A Division Bench comprising, Justice Bhargav D. Karia and Justice Pranav Trivedi in twin writ petitions has set aside order of CESTAT Ahmedabad...

Muslim Marriage | Maintaining Second Wife Not Ground To Deny Maintenance To First Legally Wedded Wife: Allahabad High Court

While dealing with maintenance dispute arising in a Muslim marriage, the Allahabad High Court has held that a husband maintaining second wife cannot be a ground to deny maintenance to the lawfully wedded first wife who is wholly dependent on her parents for financial support.Briefly put, husband approached the High Court against a Family Court order awarding Rs. 20,000 monthly maintenance to...

'Mere Conjecture': Kerala High Court Declines For Now Koodathayi Murders Accused Jolly Joseph's Plea To Halt Jio Hotstar Series 'Anali'

The Kerala High Court on Thursday (December 18) issued notice on a plea moved by Koodathayi murder accused Jollyamma Joseph @ Jolly against Jio Hotstar's Malayalam web series 'Anali'. Jolly is accused of murdering six of her family members, including her first husband Roy Thomas, using cyanide, with the motive to take control of the family property. Her trial is under progress before...

Calcutta High Court Orders Written Statement To Be Taken Off Record In Commercial Suit; Says No Extension Possible Beyond 120 Days

The Calcutta High Court on Wednesday refused to accept a written statement filed by a defendant in a commercial suit beyond the statutory timeline, holding that in the absence of a formal written application within 120 days of service of summons, the Court becomes functus officio and cannot extend time.Justice Aniruddha Roy directed that the written statement deposited in the department...

Teachers' Absence In Schools Frustrates RTE Act: Allahabad High Court Directs UP Govt To Frame On-Time Attendance Policy In 3 Months

Observing that the absence of teachers frustrates the very purpose of the Right of Children to Free and Compulsory Education Act, 2009, the Allahabad High Court recently refused to interfere with the suspension of primary school teachers who were found absent from their school during an inspection. A bench of Justice Prakash Padia, while disposing of the writ petitions, also...

Masala Bonds Case: Kerala High Court Stays ED's Show Cause Notice On CM Vijayan's Plea

The Kerala High Court on Thursday (December 18) granted an interim stay of proceedings pursuant to the Enforcement Directorate's complaint and showcause notices against Kerala Infrastructure Investment Fund Board (KIIFB) Chairperson, former Vice-Chairperson and CEO relating to the utilisation of funds raised through Masala Bonds.Justice V.G. Arun was hearing the plea preferred by Chief...

Husband's Attempt To Shift Case After Obtaining Ex-Parte Divorce Reflects 'Ulterior Motive To Delay': Allahabad High Court

The Allahabad High Court has held that the husband himself filing for divorce in one Court and after the decree seeking transfer of recall proceedings to another city shows his ulterior motive to cause delay in conclusion of divorce proceedings.Justice Syed Qamar Hasan Rizvi held,“The conduct of the applicant to prefer the Family Court at Gonda for instituting the proceeding and thereafter...

Severe Dementia Not Enough To Stall Trial Unless Medical Board Certifies: Rajasthan High Court Directs Re-Evaluation Of Accused's Fitness

The Rajasthan High Court directed a fresh medical revaluation of an accused undergoing trial–stated to be suffering from severe dementia, observing that the previous medical board's report did not clearly specify whether the accused was fit enough to understand the proceedings against him. In doing so the court observed that when an accused claims to be suffering from "unsound mind" the...

'Facilitates Access To Justice' : Supreme Court Dismisses Plea Challenging Formation Of Bombay High Court's Kolhapur Bench

The Supreme Court today(December 18) dismissed a writ petition filed by advocate Ranjeet Baburao Nimbalkar, challenging the August 1 notification of the Bombay High Court issued under Section 51(3) of the States Reorganisation Act, 1956, for the creation of the recent Kolhapur Circuit Bench, which became effective from August 18. A bench comprising Justice Aravind Kumar and Justice NV...