High Courts

Voluntarily Filed Returns Cannot Be Revised Through Additional Evidence Under Rule 29 ITAT Rules: Kerala High Court

The Kerala High Court held that voluntarily filed returns cannot be revised through additional evidence under Rule 29 of the ITAT Rules (Income Tax (Appellate Tribunal) Rules, 1963). Rule 29 of the Income Tax (Appellate Tribunal) Rules, 1963 permits the Tribunal to admit additional evidence for any substantial cause. Justices A. Muhamed Mustaque and Harisankar V. Menon...

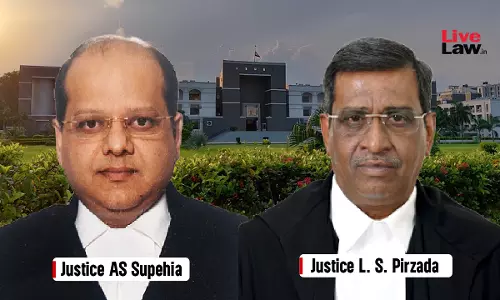

Compulsory Retirement Order Passed In Public Interest Not Punishment: Gujarat High Court Upholds Premature Retirement Of Judge

Upholding the premature retirement of a judicial officer in 2016, the Gujarat High Court observed that an order of compulsory or premature retirement made in public interest or in the interest of administration is not a punishment. The court dismissed a plea moved by a former judicial officer challenging a 2016 notification notifying his premature retirement, who was serving as an...

'Arrest Brings Humiliation, Casts Scars Forever': Bombay High Court Orders Maharashtra Govt To Pay ₹1 Lakh For Illegal Arrest

The Bombay High Court recently imposed a cost of Rs 1 lakh on the Maharashtra government for wrongly invoking offences against a Karnataka-based man and thereafter illegally arresting him and keeping him in custody for nearly 20 days. A division bench of Justices Revati Mohite-Dere and Sandesh Patil noted that two officers - Pradeep Kerkar and Kapil Shirsath, Inspector and Police Sub-Inspector...

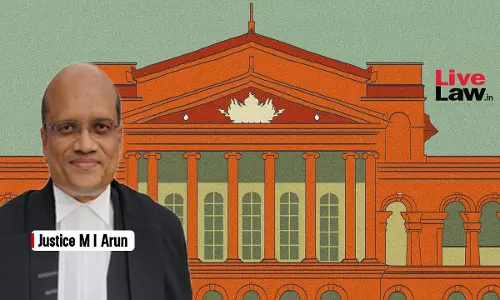

Karnataka HC Upholds Amendments To Civil Courts Act & High Court Act On Jurisdiction To Hear Appeals, Strikes Down Retrospective Operation

The Karnataka High Court has upheld the amendments made to the Karnataka Civil Courts Act, 1964 and the Karnataka High Court Act, 1961 insofar as it relates to appeals from the Civil Judge (Senior Division) lying to the District Court, and the first appeals lying to the High Court from the City Civil Court being heard by a Single Judge irrespective of pecuniary jurisdiction.Justice M I Arun...

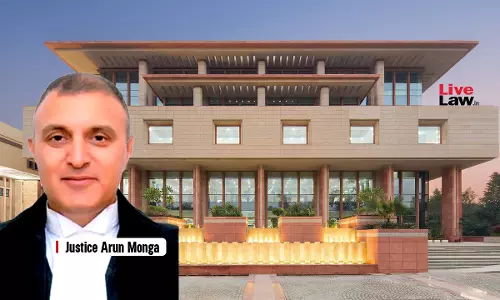

Calling Off Marriage After Courtship Not Necessarily Breach Of Promise: Delhi High Court Grants Bail To Accused

The Delhi High Court has observed that calling off a marriage after the courtship period, after reasoned choice, cannot be termed as breach of promise to marry.Granting bail to a man in a case registered for the offence of sexual intercourse with a woman under a false promise of marriage, Justice Arun Monga said:“It seems to be an unfortunate case where two consenting adults entered into...

FIRC Need Not Match Each Transaction, Periodic Certificate Sufficient If Total Forex Benefit Proven: Delhi High Court

The Delhi High Court has held that a Foreign Inward Remittance Certificate (FIRC) need not correspond to each individual transaction and it may reflect a period as a whole, provided that the overall benefit being claimed is fully substantiated by the total foreign exchange remittance.FIRC is issued by bank as proof of international payments for exports.A division bench comprising...

'Undermines Democracy': Plea In Kerala High Court Challenges BCI's 2400% Nomination Fee Hike For Contesting Elections To State Bar Councils

A writ petition has been filed before the Kerala High Court challenging the Bar Council of India's (BCI) decision to hike the nomination fee for State Bar Council elections from ₹5,000 to ₹1,25,000— a 2400% increase.The petition, filed by Advocate Rajesh Vijayan, enrolled in 1996 and a member of the Bar Council of Kerala (BCK) since 2019, argues that the decision is “arbitrary,...

Gujarat High Court Questions CBDT For Extending Audit Report Deadline Without Extending ITR Filing Due Date

The Gujarat High Court recently sought an explanation from the Central Board of Direct Taxes (CBDT) as to why it had not extended the due date for filing income tax return (ITR) when it had extended the specified date for filing tax audit report for Financial Year 2024-2025.The court sought an explanation after taking note of an earlier decision where it had held that Board cannot extend the...

[S.6 CGST Act] J&K&L High Court Upholds GST Show Cause Notices Based On Intelligence Inputs

The Jammu & Kashmir and Ladakh High Court has held that intelligence-based enforcement actions can be initiated by either the Central or the State tax authorities, irrespective of taxpayer assignment, and such actions do not require a separate notification for cross-empowerment.The court dismissed a batch of writ petitions filed by several companies challenging show cause notices issued...

Delhi High Court Refuses To Interfere With Rejection Of AAI's ₹9.34 Crore CENVAT Credit

The Delhi High Court has refused to interfere with an order of the GST authority rejecting CENVAT Credit to the tune of Rs.9.34 crores claimed by the Airport Authority of India.A division bench comprising justices Prathiba M. Singh and Shail Jain noted that the central authority had failed to furnish documents in support of its claim and said, “there is no jurisdictional error...

'Usual Way To Siphon Off Public Land': High Court Objects To Allotment Of 33 Acres Of Govt Land For Slum Rehabilitation In South Bombay

"We are quite alarmed that such vast land...can just be made available for slum redevelopment, i.e., not only rehabilitation of the slum dwellers in skyscrapers but also large scale private apartments to be constructed in one of the most prime localities in South Mumbai," the court said.

Karur Stampede: Madras High Court Denies Anticipatory Bail To TVK Party Functionaries

The Madras High Court (Madurai bench) on Friday dismissed the anticipatory bail pleas moved by two functionaries of the Tamilaga Vettri Kazhagam (TVK) party apprehending arrest in connection with the stampede that took place during the party's rally in Karur last Saturday.Justice M Jothiraman denied anticipatory bail to party's General Secretary N. Anand @ Bussy Anand and Joint Secretary...

![[S.6 CGST Act] J&K&L High Court Upholds GST Show Cause Notices Based On Intelligence Inputs [S.6 CGST Act] J&K&L High Court Upholds GST Show Cause Notices Based On Intelligence Inputs](https://www.livelaw.in/h-upload/2025/06/10/500x300_604075-sanjeev-kumar-sanjay-parihar.webp)