High Courts

When Mandate Of Arbitrator Is Terminated U/S 15 Of Arbitration Act, New Arbitrator Can't Be Appointed By Court U/S 11(6) Of Act: Telangana HC

The Telangana High Court bench of Justice N.V. Shravan Kumar has held that when the mandate of an arbitrator terminates under Section 15 of the Arbitration Act, a substitute arbitrator must be appointed in accordance with the original procedure agreed upon by the parties. In such cases, the court cannot appoint a new arbitrator under Section 11, as the appropriate course is to appoint...

State 'Considering' Appeal Against Bail Granted To An Accused Is Not Grounds To Deny Bail To Other Co-Accused: Bombay High Court

The Bombay High Court recently held that a person seeking bail on grounds of parity cannot be denied relief merely because the State is contemplating to challenge the order of bail granted to co-accused and therefore, asked the Maharashtra Law and Judiciary Department to ensure that it approves the proposal for filing appeal against an order, within two weeks. Single-judge Justice Amit...

'Act Was Brutal But Not Committed With Brutality': Madhya Pradesh High Court Commutes Death Penalty In Child Rape Case

The Madhya Pradesh High Court, on Thursday (June 19), commuted death penalty of a 20 year old man belonging to a scheduled tribe convicted of raping a 4 year old child. The trial court had granted capital punishment, noting that the child was left permanently disabled. The high court, while acknowledging the gravity of the offence, held that although the act was undeniably brutal, it was...

Punjab & Haryana High Court Takes Suo Moto Cognisance Of Shortage Of Hospital Staff In Chandigarh's PGIMER Hospital

The Punjab & Haryana High Court on Thursday took suo moto cognisance of the shortage of nursing staff and hospital attendants in Chandigarh's Postgraduate Institute of Medical Education and Research (PGIMER).Justice Anil Kshetarpal and Justice Aman Chaudhary said, “On the basis of news item published in 'Times of India' on 17.06.2025, highlighting the plight of patients and their...

Matrimonial Dispute Is Misconduct Under TN Service Rules, Govt Dept Can Initiate Action Against Employee: Madras High Court

The Madras High Court recently observed that a matrimonial dispute was treated as a misconduct under the Tamil Nadu Government Servants' Conduct Rules, 1973, and the Government departments were empowered to initiate action such misconduct. The bench of Justice SM Subramaniam and Justice AD Maria Clete noted that a public servant was expected to maintain honesty, integrity and good...

"Slum Dwellers Cannot Be Pushed To The Outskirts Of Mumbai": High Court Upholds Scheme For Rehab Of Slums Built On 'Reserved' Open Spaces

In a city where inequality is visible in how space and services are distributed, providing formal housing to slum dwellers within the city and not on its outskirts, is a step towards real equality, the Bombay High Court held on Thursday while refusing to strike down Regulation 17(3)(D)(2) of the Development Control and Promotion Regulations, (DCPR) 2034, which provides for rehabilitation of...

Punjab & Haryana High Court Takes Suo Moto Cognisance Of Felling Of Trees In Gurugram For DLF's Real Estate Project

The Punjab & Haryana High Court on Thursday initiated suo moto Public Interest Litigation (PIL) against the alleged felling of 2000 trees in Gurugram's DLF to develop a new real estate project.Justice Anil Kshetarpal and Justice Aman Chaudhary entertained the suo moto petition on the basis of a newspaper report. “The office is directed to implead the DLF Limited (formerly Delhi Land...

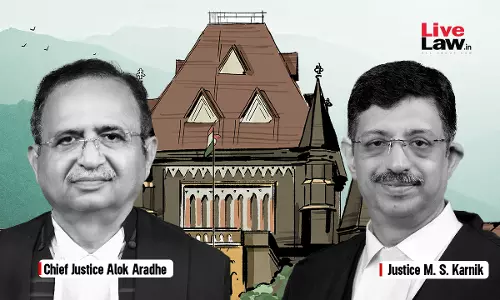

AO Cannot Alter Net Profit In Profit & Loss Account Except Under Explanation To S.115J Of Income Tax Act: Bombay High Court

The Bombay High Court stated that assessing officer do not have the jurisdiction to go behind net profit in profit and loss account except as per explanation to Section 115J Of Income Tax Act. The Division Bench consists of Chief Justice Alok Aradhe and Justice M.S. Karnik observed that “Section 115J of the 1961 Act mandates that in case of a company whose total income as...

Article 285 of Constitution | Railway Property Will Be Exempt From All Taxes Imposed By State Even If Used For Commercial Purpose: Madras High Court

The Madras High Court recently observed that the property belonging to the Union will be exempt from any tax imposed by the State as per Article 285(1) of the Constitution, even if it is put to commercial use. “Merely because the property in question has been put to commercial use, that would not make any difference. The plain language of Article 285(1) of the Constitution of...

'File Movement' & 'Change In Counsel' Not Sufficient Cause For Condonation Of Delay In Filing S.37 Arbitral Appeals: Delhi High Court

The Delhi High Court bench comprising Justice Prathiba M. Singh and Justice Rajneesh Kumar Gupta has held that mere movement of file and change in counsel due to administrative issues does not constitute “sufficient cause” to condone inordinate delay in filing an appeal under Section 37 of the Arbitration and Conciliation Act, 1996.The court reiterated that for appeals under Section 37...

GST | Separate Demands For Reversal Of Availed ITC & Utilisation Of ITC Is Prima Facie Duplication Of Demand: Delhi High Court

The Delhi High Court has observed that demand raised against an assessee qua reversal of availed Input Tax Credit (ITC) and qua utilisation of ITC prima facie constitutes double demand.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta thus granted liberty to the Petitioner-assessee to approach the Appellate Authority against such demand, and waived predeposit qua demand...

[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court

The Bombay High Court stated that a breach of Article 265 of the constitution cannot be alleged or sustained based upon a tentative or inconclusive opinion formed by assessing officer. The Division Bench consists of Justices M.S. Sonak and Jitendra Jain stated that “If the communication dated 29 November 2018 is an order, it being like a preliminary, prima facie, or interlocutory...

![[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court [Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court](https://www.livelaw.in/h-upload/2024/10/17/500x300_566535-justices-mahesh-sonak-and-jitendra-jain-bombay-hc.webp)