High Courts

No Instructions From Centre To Specify Timeline For Decision On Rahul Gandhi's Citizenship Issue: Dy. SG To Allahabad HC

The Central Government on Monday informed the Allahabad High Court that no timeline could be specified within which the citizenship issue concerning Congress leader and LoP in Lok Sabha, Rahul Gandhi, may be brought to its logical conclusion. Deputy Solicitor General of India and Senior Advocate SB Pandey submitted before a bench of Justice Attau Rahman Masoodi and Justice Rajeev...

No Curbs On Religious Activities At Bahraich Dargah, Only Permission For Mela Outside Shrine Campus Denied: UP Govt To Allahabad HC

The Uttar Pradesh Government today informed the Allahabad High Court that its decision to refuse permission for the annual 'Jeth Mela' at the Syed Salar Masood Ghazi Dargah in Bahraich does not interfere with religious practices at the shrine. The restriction, it clarified, applies solely to the Mela held outside the Dargah campus, which is primarily commercial in nature,...

Burden Of Rebutting Presumption That Forest Produce Is State's Property Lies On Accused Booked Under State Forest Act: Karnataka HC

The Karnataka High Court has held that under the State Forest Act there is a presumption that a forest produce belongs to a State government and the burden on rebutting the presumption lies on the accused booked for offences under the Act such as illegally transporting such produce. For context, Section 80 (Presumption that forest produce belongs to Government) when in any proceedings taken...

Amazon Moves Delhi High Court Against Ruling To Pay ₹339.25 Crore To 'Beverly Hills Polo Club' Over Trademark Infringement

Amazon Technologies Inc has moved the Delhi High Court against a single judge ruling asking it to pay Rs. 339.25 crore damages and costs for trademark infringement of the luxury lifestyle brand, Beverly Hills Polo Club.A division bench comprising Justice C Hari Shankar and Justice Ajay Digpaul reserved order on Amazon's plea for stay on the ruling, after hearing both the sides in detail. The...

Gauhati HC Issues Notice To Centre, Arunachal Pradesh Govt On Plea Claiming Denial Of Scheduled Tribe Benefits To Yobin Community

The Gauhati High Court (Itanagar bench) on Monday (May 5) issued notice to Central and Arunachal Pradesh Governments on a PIL claiming that people belonging to the state's YOBIN tribe community are not getting the benefits that are provided to the other Scheduled Tribe Communities. It was contended by the petitioner that YOBIN Tribe of Arunachal Pradesh have their own culture,...

Unauthorisedly Entering Parliament To Show Protest Not Permitted But Will It Attract UAPA? High Court Asks In 2023 Security Breach Case

The Delhi High Court on Wednesday (May 7) questioned the Delhi Police as to whether offence under the stringent UAPA is made out against the accused persons in the 2023 Parliament security breach case.A division bench comprising Justice Subramonium Prasad and Justice C Vaidyanathan Shankar remarked that even though undoubtedly entering inside the Parliament is not a joke and cannot be a form...

Bahraich Dargah Sharif Committee Moves Allahabad HC Over Denial Of Permission For Annual Syed Salar Mela

The Management Committee of Dargah Sharif, Bahraich and four other UP residents have moved the Allahabad High Court against the recent decision of the District Administration to deny permission for the annual 'Jeth Mela' at Syed Salar Masood Ghazi Dargah in Bahraich, citing law and order concerns given the situation in the wake of the Pahalgam terror attack. Challenging the decision...

Rajasthan HC Quashes Order Denying Promotion To Female Lecturer Due To Gender, Directs State To Rectify All Discriminatory Rules & Policies

Expressing "pain" on the prevalence of gender bias, the Rajasthan High Court issued a mandamus to the State to take an immediate policy decision to rectify shortcomings in policies/rules leading to discriminatory practices against women performing the same duties as their male counterparts, but who are denied equivalent benefits.In doing so the court set aside the order of the Rajasthan...

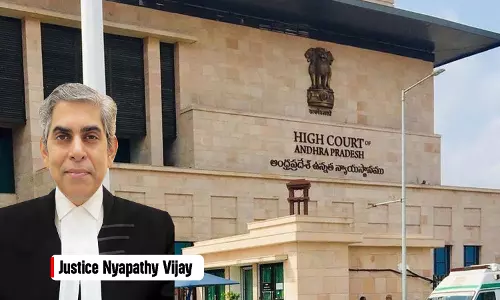

17 Years On, AP High Court Awards ₹3.70 Lakh To Kin Of Deceased Lorry Helper, Crushed To Death While Confronting Negligent Tractor Driver

After seventeen years, the Andhra Pradesh High Court has granted compensation to the dependents of a deceased cleaner on a lorry who was crushed to death after getting off the vehicle to confront a tractor driver who was driving negligently.Holding that the accident occurred out of and in the course of employment, a Justice Nyapathy Vijay held,“…what all is required to make the...

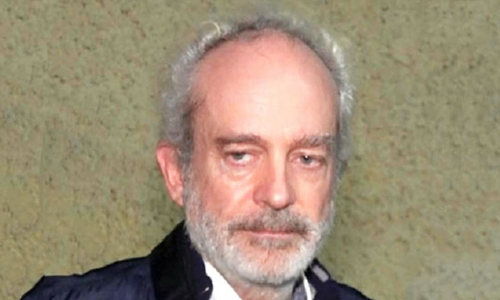

AgustaWestland Scam: Delhi High Court Reserves Order On Christian Michel's Plea To Modify Bail Conditions In ED Case

The Delhi High Court on Wednesday reserved order on a plea filed by British Arms Counsultant Christian James Michel seeking modification of bail conditions in the FIR registered by Enforcement Directorate (ED) in connection with the Agusta Westland chopper scam. Justice Swarana Kanta Sharma reserved the order after hearing the counsels appearing for Michel and ED and said that a detailed...

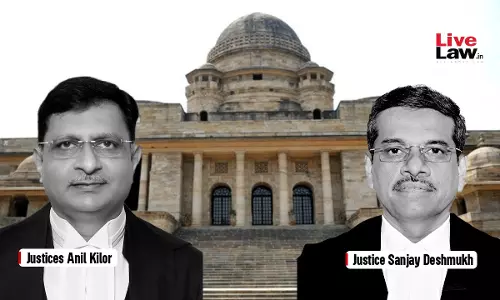

Bombay HC Relief To Banker Who Asked Employee To Convince Clients Like She Convinces Her Husband, Says No Intent To Outrage Modesty

The Bombay High Court recently quashed an 'outraging modesty' FIR lodged against an Assistant General Manager of the State Bank of India (SBI) who was booked for telling a senior woman clerk that "she should convince the clients as she convince her husband." A division bench of Justices Anil Kilor and Pravin Patil while quashing the FIR observed that there was no intention on part of...

Cannot Be Compelled To Work Against His Own Wish: Himachal Pradesh High Court Directs University To Issue NOC To Professor Seeking New Job.

The Himachal Pradesh High Court directed Indira Gandhi Medical College (IGMC), Shimla, to issue a No Objection Certificate (NOC) to a professor who had received a job offer from another institution. Justice Sandeep Sharma: bonds executed by doctors, after their having done MBBS, medical courses, etc., to serve the State are binding and can be enforced, but since petitioner...