High Courts

Tenants Occupying Premises Which Fall Under Development Agreement Cannot Be Evicted U/S 9 Of Arbitration Act: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that Eviction of tenants governed by the Rent Control Act cannot be sought under Section 9 of the Arbitration and Conciliation Act, 1996 (Arbitration Act), particularly when they are not parties to the Development Agreement executed between the Developer and the Landlords and are not being provided upgraded premises in...

Walayar Rape-Death Case: Kerala High Court Grants Interim Protection From Coercive Steps To Victims' Parents

The Kerala High Court on Wednesday (2nd April) passed an interim order protecting the parents of the Walayar victims from any coercive steps.The parents had moved the High Court to quash the CBI chargesheet after they were named accused in the case for allegedly abetting the rape on the children. They have also raised issue with the CBI's conclusion that the children died by suicide.Today,...

Scope Of Judicial Review Very Limited In Transfers Made Due To Administrative Exigencies: Andhra Pradesh High Court

The Andhra Pradesh High Court has held that the Court possesses very limited scope of judicial review in cases relating to transfers made on account of administrative exigencies.A Single Judge Bench of Justice Kiranmayee Mandava, while dismissing a writ petition challenging proceedings of the Tirumala Tirupati Devasthanam (Respondent 2), whereby it refused to transfer a Pradhana Archaka at...

Baseless Allegations Of Communal Bias By Govt Employee To Stall Transfer Would Lead To Serious Breach In Executing Administrative Orders: MP HC

While hearing a petition challenging a transfer order on the ground of religious discrimination, the Indore Bench of Madhya Pradesh High Court said that if such unsubstantiated allegations are allowed to be entertained on their face value, it would lead to serious breach in execution of administrative orders. The Court dismissed the petition noting that the petitioner could not demonstrate...

2002 Riots: Gujarat High Court Upholds 2015 Order Acquitting Six Men Accused Of Killing Three British Nationals

The Gujarat High Court has upheld a 2015 sessions court order which acquitted six men in a case related to the killing of three British Nationals near Prantij, during the 2002 state-wide riots which followed the Godhra Train Burning incident. In doing so the court observed that there had been no test identification parade in the matter and the dock identification was conducted for the first...

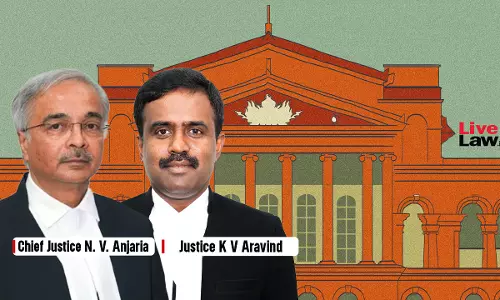

Karnataka HC Asks Authorities To Ensure Smooth Movement Of Traffic And Pedestrians During Ramzan, Other Festive Occasions

The Karnataka High Court has directed the Municipal Corporation, Police Commissioner and all other authorities concerned to ensure the smooth movement of traffic on the road and on the footpath so as not to adversely affect the vehicular, pedestrian and public movement, during the ongoing festivities of Ramzan and other festive occasions. A division bench of Chief Justice N V Anjaria...

Schedule IV Of Arbitration Act On Fees Of Arbitrator Does Not Mandatorily Apply To International Commercial Arbitrations: Delhi High Court

The Delhi High Court bench of Justice Sachin Datta has observed that in an international commercial arbitration in terms of Section 2(1)(f)(ii) of the Arbitration and Conciliation Act, 1996, the IVth Schedule pertaining to fees of the arbitrator will not apply mandatorily in view of Explanation to Section 11(14) of the Act. Facts The disputes between the parties arose out of...

Bar Council Of India Has Power To Inspect Law Schools: Bombay High Court Rejects Challenge To Rules Of Legal Education

In a challenge to an inspection notice issued by the Bar Council of India (BCI), the Bombay High Court has held that the notice is valid and that the Rules of Legal Education 2008 framed by the BCI under which it can inspect law colleges is not ultra vires.A division bench of Chief Justice Alok Aradhe and Justice MS Karnik observed that the Rules under which the BCI is empowered to inspect...

Kerala High Court Directs State To Implement Its Monthly Scholarship Scheme For Disabled Children; Highlights Indifference Of Officers

The Kerala High Court has asked the State government to scrupulously implement its 2015 policy for persons with disabilities under which it had announced a Scheme for distribution of monthly scholarships to eligible students.The Division Bench comprising Chief Justice Nitin Jamdar and Justice S. Manu also flagged the 'reluctance and apathy' of ground-level officers in implementing the Scheme...

Delhi High Court Orders Removal Of Allegedly Defamatory Description Of ANI On Its Wikipedia Page

The Delhi High Court on Wednesday ordered take down or removal of allegedly defamatory content and description of news agency ANI Media Private Limited on its Wikipedia page. Justice Subramonium Prasad directed Wikimedia Foundation, which hosts Wikipedia platform, to remove allegedly defamatory statements published against ANI on its Wikipedia page titled “Asian News International.”The...

Section 25 HMA | Spouse Can't Be Directed To Pay Permanent Alimony In Absence Of An Application: Madhya Pradesh High Court Reiterates

The Madhya Pradesh High Court has reiterated that without filing a formal application–either written or separate–under Section 25 of the Hindu Marriage Act (HMA), a spouse cannot be directed to pay permanent alimony. Section 25 pertains to Permanent alimony and maintenance. It states that any court exercising jurisdiction under HMA may, at the time of passing any decree or at any...

Rajasthan HC Quashes Prosecution Sanction Against E-Commerce Company For Delay In Depositing TDS Due To Late Submission Of Bills By Amazon, E-Bay

Rajasthan High Court set aside prosecution under Income Tax Act, 1961 (“the Act”), against the petitioner-company whose business activity related to e-commerce transactions, and owing to delay on part of the companies like Amazon, Naaptol, Ebay, etc. in submitting the bills, the petitioner got delayed by almost 10 months in submitting the deducted TDS.The division bench of Justice...