High Courts

Bombay High Court Restrains Entity From Using Trademark 'Deceptively Similar' To Hair Color Brand STREAX

The Bombay High Court on Wednesday (March 5) restrained an entity from using a trade mark which is 'deceptively similar' to hair colour brand - 'Streax.'Single-judge Justice Manish Pitale in his order, noted that the plaintiff - Hygienic Research Institute Private Limited owner of the trademark 'Streax' successfully brought on record the fact that it has been using this trademark since July...

Girls From Punjab Villages Dropping Out Due To Far-Away Schools: High Court Seeks Fresh Affidavit From State Govt On Girls Schools

The Punjab & Haryana High Court sought fresh Affidavit from the Punjab Government on suo moto cognizance of village girl students dropping out of schools due to non-availability of schools and infrastructure along Punjab's Patiala-Rajpura Highway.Chief Justice Sheel Nagu and Justice Sumeet Goel said, "Reply filed by the State of Punjab essentially pertains to co-ed schools, but this...

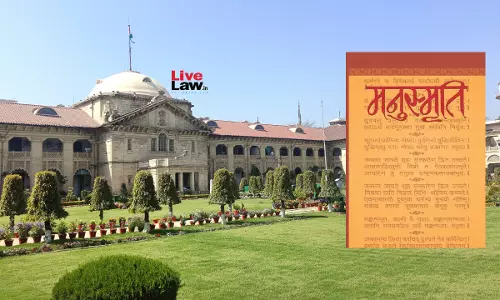

Tearing Pages Of 'Manusmriti' During Live TV Debate Prima Facie A Cognizable Offence: Allahabad HC Denies Relief To RJD Spokesperson

Observing that act of tearing pages of 'Manusmriti' in a live TV debate prima facie amounts to a cognizable offence, the Allahabad High Court last week denied relief to Rashtriya Janata Dal Spokeperson and Jawaharlal Nehru University Ph.D. student Priyanka Bharti by refusing to quash an FIR lodged against her.Bharti has been charged under Section 299 of the Bharatiya Nyaya Sanhita for...

Assessee Entitled To Interest On Refund Under Direct Tax 'Vivad Se Vishwas' Scheme: Gujarat High Court

The Gujarat High Court stated that the assessee is entitled to the interest on refund under Direct Tax Vivad Se Vishwas Scheme. “it is true that the assessee is not entitled to interest under Section 244A of the Income Tax Act, 1961, however, when the assessee has opted for direct tax for Vivad se Visvas Scheme 2020 and filed the application which was approved by...

'Extra Duty Deposit' Different From Customs Duty, Limitation For Seeking Refund U/S 27 Of Customs Act Is Inapplicable: Delhi High Court

The Delhi High Court has held that an Extra Duty Deposit (EDD) does not constitute a payment in the nature of customs duty under the scope of Section 27 of the Customs Act, 1962 and thus, the period of limitation for seeking a refund of customs duty under the provision would not apply qua EDD.Section 27 deals with a person/entity's claim for a refund of Customs duty in certain...

[Compassionate Appointment] Law Prevailing On Date Of Employee's Death Applicable Irrespective Of When Application For Appointment Was Submitted: Rajasthan HC

The Rajasthan High Court has granted relief of compassionate appointment, in a decade-old matter, to the petitioner, affirming that the policy governing such appointment had to be the one that was existing on the date of demise of the concerned person and not on the date of application filed for such appointment.The division bench of Justice Munnuri Laxman and Justice Pushpendra Singh Bhati...

Need To Drive Criminal Law Forward With Data And Evidence, Hope Young Lawyers Will Willingly Join The Field: CJI Sanjiv Khanna

Chief Justice of India Sanjiv Khanna on Thursday said that he hopes many youngsters and young lawyers would join the field of criminal law as their first career choice and not as a second choice or compulsion. CJI said that even though many new lawyers do not want to take up criminal practice, the fact of the matter is that most of the litigation in the district courts is criminal...

Survey Report On Existence Of 'Permanent Establishment' In Tax Year Not Relevant For Previous/Future AYs: Delhi HC Grants Relief To Swiss Co

The Delhi High Court has held that the existence of a foreign entity's Permanent Establishment (PE) in India is required to be determined in law for each year separately on the basis of the scope, extent, nature and duration of activities in each year.A division bench of Justices Yashwant Varma and Ravinder Dudeja made the observation while dealing with a Swiss company's case, which was...

'Ego Issue': Delhi HC Disapproves Of Tax Commissioner Seeking Declaration Against Appointments Committee Of Cabinet Over Delay In Promotion

The Delhi High Court rejected the petition filed by the Principal Commissioner of Income Tax, seeking a declaration against the Appointments Committee Of Cabinet (ACC) which promoted him to the post with purported delay.Calling the petition to have stemmed from the officer's “ego issue”, the division bench of Justices C. Hari Shankar and Ajay Digpaul fell one step short of imposing costs...

Allahabad High Court Dismisses Lawyer's Plea Seeking ₹1 Crore As Legal Fees For 'Saving' Ex-CJI From 'Humiliation'

The Allahabad High Court (Lucknow Bench) today dismissed a lawyers's plea seeking a direction to the Union Ministry of Law and Justice to pay him Rs. 1 crore as fees and expenses, claiming that he filed certain cases in the Supreme Court to save the then Chief Justice of India, Justice Dipak Misra, from "humiliation, insult, torture, and removal."A bench of Justice Rajan Roy and Justice...

EWS Certificate Cannot Be Rejected Based On Mutation Records But Only After Due Inquiry Into Eligibility Criteria: J&K High Court

The Jammu and Kashmir High Court held that the EWS certificate could not be rejected merely by relying on mutation records. The court stated that a due inquiry must be conducted as to the eligibility criteria, wherein the applicant is given the right to a hearing before deciding the said application.Justice Javed Iqbal Wani noted that the mutation records, stating that the ancestral property...

Power Of Attorney Holder Cannot Represent A Party In Court Without Obtaining Its Permission: Kerala High Court Reaffirms

The Kerala High Court has held that a private person cannot appear on behalf of another on the basis of a power of attorney, without prior permission of the Court. The Court observed that only enrolled advocates can appear on behalf of another party without permission. For a private person to do so, he has to get the permission of the Court under Section 32 of the Advocates Act, even if he is...

![[Compassionate Appointment] Law Prevailing On Date Of Employees Death Applicable Irrespective Of When Application For Appointment Was Submitted: Rajasthan HC [Compassionate Appointment] Law Prevailing On Date Of Employees Death Applicable Irrespective Of When Application For Appointment Was Submitted: Rajasthan HC](https://www.livelaw.in/h-upload/2024/03/19/500x300_529100-justice-pushpendra-singh-bhati-and-justice-munnuri-laxman-rajasthan-hc.webp)