High Courts

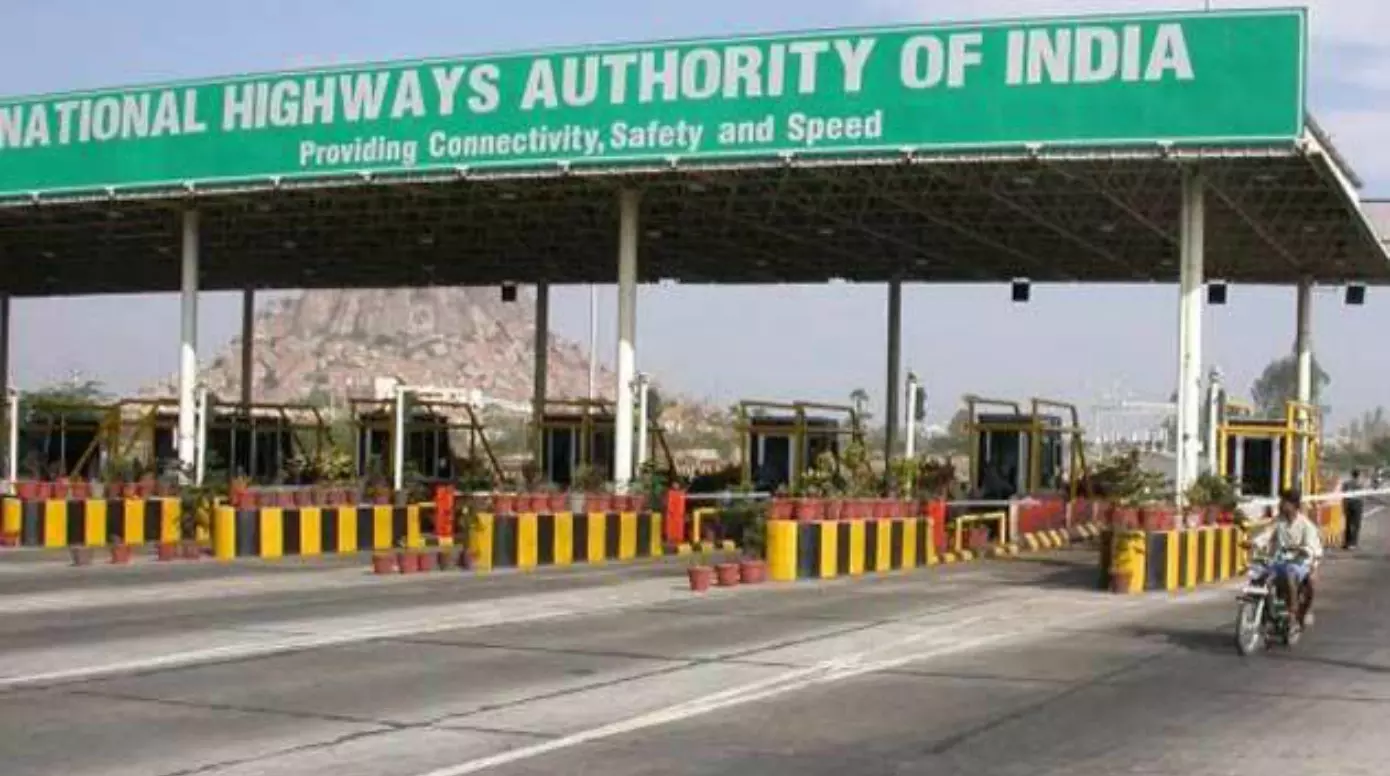

Unfair To Collect Toll If Highway Is In Bad Shape: J&K High Court Orders Reduction In Toll Fees

The Jammu and Kashmir High Court directed 80% reduction in the toll fee at two toll plazas on the National highway-44 until the completion of construction. The court said that the National Highway was in a deteriorated state, making toll collection unfair and unreasonable.“This is based on the principle that tolls are collected to provide users with the benefit of well...

Toll Plazas Should Not Serve Merely As Revenue Generating Mechanism With Sole Purpose Of Minting Money From Public: J&K High Court

The Jammu and Kashmir and Ladakh High Court, comprising Chief Justice Tashi Rabstan and Justice M.A. Chowdhary, on Tuesday, underscored that toll plaza should not merely function as revenue-generating mechanisms to mint money from the public and directed the authorities not to establish any toll within 60 kilometres of the National Highway-44.“Respondents are directed not to establish any...

MSMED Act Will Prevail Over Arbitration Act In Disputes Pertaining To A Party Which Is An MSME: Delhi High Court

The Delhi High Court Bench of Justice Manoj Kumar Ohri has reiterated that the Arbitration and Conciliation Act, 1996 is a general law governing the field of arbitration whereas the MSMED Act, 2006 governing a very specific nature of disputes concerning MSMEs, is a specific law and being a specific law would prevail over Arbitration and Conciliation Act, 1996. Background...

Not Mandatory To Obtain Sanction To Prosecute Public Servant For Failing To Report POCSO Offences, S. 19 Contains Non-Obstante Clause: Kerala HC

The Kerala High Court has held that it is not mandatory to obtain sanction under Section 197 of CrPC or Section 218 of the BNSS to prosecute a public servant under Sections 19 and 21 of the POCSO Act for failing to report POCSO OffencesThe Court made this ruling on noting that Section 19 which mandates reporting of POCSO offences begins with a non-obstante clause, 'Notwithstanding...

Recovery Of Drugs On Disclosure Statement Does Not Prima Facie Show Conscious Possession Of Contraband: J&K High Court

The Jammu and Kashmir High Court held that a statement leading to the discovery of contraband is not sufficient to prima facie show conscious possession with respect to the concealed material. The court said that mere possession will not be considered as an offence unless it was coupled with the knowledge of what was being possessed.The court held that the statement of an accused under Section...

“Failure To Issue Notice, Denied Fair Hearing”: J&K High Court Quashes Recovery Order Of ₹4 Lakh Against Fair Price Shop Dealer

The Jammu and Kashmir and Ladakh High Court has quashed an order directing the recovery of excess carriage charges amounting to Rupees over 4 Lakhs from a Fair Price Shop dealer, highlighting the violation of natural justice principles.A bench of Justice Wasim Sadiq Nargal observed that the failure to issue notice was an attempt to prevent the petitioner from having an opportunity to present...

Govt Must Be Able To Determine Strength Of Local Bodies In Interest Of Effective Governance: Kerala HC Affirms State's Delimitation Exercise

The Kerala High Court on Monday (24th February) overturned the decision of a Single Bench invalidating the delimitation exercise for 8 municipalities and one panchayat.Background of the CaseThe Kerala Government by virtue of Kerala Municipality (Second Amendment) Act, 2024 and Kerala Panchayat Raj (Second Amendment) Act, 2024 increased the ratio of number of counsellors/ panchayat members to...

Drugs & Cosmetics Act | Only Sessions Court Can Try Offences Punishable Under Chapter IV On Manufacture, Sale And Distribution: Karnataka HC

The Karnataka High Court has held that trial in a case registered for offences pertaining to manufacture, sale and distribution of drugs and cosmetics under Chapter IV of the Drugs and Cosmetics Act is triable only by a sessions court and the magistrate court is required to commit the case to the Sessions Judge for trial.Justice S Vishwajith Shetty held thus while allowing a petition filed...

Cyber Fraud Of ₹474 Crores Reported In Punjab: HC To Decide Accountability Of Financial Losses Suffered By Victims When Accused Is Untraceable

Taking note of the Punjab Government's report that cyber fraud of Rs.474.49. crores have been reported in State in 1 year, the Punjab & Haryana High Court to decide the accountable for the financial losses suffered by victims in cases where accused is not traceable.The Report revealed that in Punjab, cyber frauds have been reported to the tune of Rs.474.49 crore and out of that, "a...

Jharkhand Advocates' Association Urges High Court To Standardize Passover And Adjournment Practices

The General Body of the Advocates' Association, Jharkhand convened a meeting on February 21, 2025 and unanimously passed two resolutions addressing concerns related to the judicial practice of passover of cases and adjournments in the Jharkhand High Court. The resolutions, adopted after detailed deliberations, highlight difficulties faced by advocates and litigants due to inconsistent...

Discontinuing Contract Without Giving Reasons Arbitrary: Bombay HC Quashes MMRDA's Contract Termination Notice For Mumbai Metro Consultancy

The Bombay High Court has set aside a notice issued by the Mumbai Metropolitan Region Development Authority (MMRDA) that terminated a tender contract with Systra MVA Consulting (India) Pvt Ltd for the appointment of General Consultant for Mumbai Metro Line, ruling that the cancellation was arbitrary and unreasonable.The tender concerned the appointment of General Consultant for the purposes...

Delhi High Court Quashes ₹2000 Crore Tax Reassessment Notice Against Maruti Suzuki For Alleged Escapement Of Income In AY 2009-10

The Delhi High Court has quashed the reassessment action initiated by the Income Tax Department against car manufacturer Maruti Suzuki India Ltd for alleged escapement of income in the Assessment Year 2009-10.A division bench of Justices Yashwant Varma and Ravinder Dudeja observed that the company had made full and true disclosure of all facts in the course of the assessment and the...