All High Courts

GST Interest/Penalty Waiver Can't Be Denied For Initial Wrong RCM Payment Through ITC Once Cash Compliance Is Made: Orissa High Court

The Orissa High Court has held that a GST interest and penalty waiver application filed by the petitioner cannot be rejected merely because a portion of tax liability under reverse charge mechanism (RCM) was initially discharged through input tax credit, subsequently pays the amount in cash and complies with legal requirements. A Division Bench comprising the Chief Justice Harish...

'Consumer Cannot Claim Interest On Statutory Deposit Made U/S 127(2) Of Electricity Act': Bombay High Court

The Bombay High Court has held that a consumer has no enforceable statutory right to claim interest on the mandatory pre-deposit made under Section 127(2) of the Electricity Act, 2003, when the assessment of unauthorised use of electricity is set aside in appeal. The Court observed that the deposit under Section 127(2) is a condition precedent for maintaining the statutory appeal and is not...

Elappully Brewery Case: Kerala High Court Quashes Govt Order Granting Preliminary Sanction To Private Company To Set Up Ethanol Plant

The Kerala High Court on Friday (December 19) quashed the government order that gave preliminary sanction to M/s Oasis Commercial Pvt. Ltd. to set up a brewery plant in Palakkad's Elappully grama panchayat.The Division Bench of Justice Satish Ninan and Justice P. Krishna Kumar today allowed a batch of public interest litigations filed by the residents of Elappully. The Bench found that...

Income Tax Act | S.153C Notices Unsustainable When Search For 'Other Person' Initiated After 01.04.2021: Madras High Court

The Madras High Court held that the notices under Section 153C are unsustainable where a search for 'other person' was initiated after 01.04.2021. Section 153C of the Income Tax Act applies when documents or assets belonging to a third party are found during a search, and an assessment is made against that person. Section 153C(3) of the Income Tax Act states that Section...

Highest Individual Sentence Relevant For Deciding Whether Appeal Will Be Heard By Single Or Division Bench: Punjab & Haryana High Court

The Punjab & Haryana High Court has suggested that for the purpose of determining whether an appeal against conviction is to be heard by a Single Bench or a Division Bench, the relevant factor is the highest sentence imposed by the trial court, and not the cumulative total of all sentences awarded for different offences.The Court also held that where a trial court, while awarding...

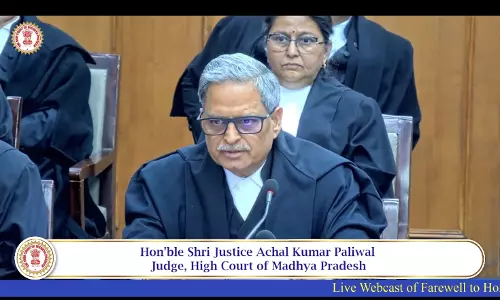

'Destiny Opens Doors, Hard Work Takes You Forward': Justice Achal Kumar Paliwal Bids Farewell To MP High Court

Justice Achal Kumar Paliwal on Friday (December 19) bid farewell to the Madhya Pradesh High Court, bringing a close to a distinguished judicial career spanning 35 years. Born on December 26, 1963, Justice Paliwal joined the MP Judicial Service in 1990. Over the years, he steadily rose through the hierarchy, serving as Civil Jude, Senior Civil Judge and Chief Judicial Magistrate, and...

Rahul Gandhi Citizenship Row | High Court Transfers Case To Lucknow As BJP Worker Alleges 'Death Threats' By Advocates In Raebareli

The Allahabad High Court (Lucknow Bench) on Wednesday directed the immediate transfer of a criminal complaint case filed against the Leader of Opposition in Lok Sabha and Raebareli MP, Rahul Gandhi, from the court of the Additional Chief Judicial Magistrate-IV, Raebareli, to the Special MP/MLA Court in Lucknow. A bench of Justice Brij Raj Singh thus allowed a Transfer Application filed by...

Delhi High Court Upholds Stay On ICC Arbitration In Oman-India Border Security Dispute, Dismisses MSA Global's Appeal

The Delhi High Court has upheld an anti-arbitration injunction issued by a single judge to discontinue an ICC arbitration between Engineering Projects India Ltd (EPIL) and MSA Global LLC (Oman). The Division Bench comprising of Hon'ble Mr. Justice Anil Kshetarpal and Hon'ble Mr. Justice Harish Vaidyanathan Shankar on 12th December, 2025 has affirmed that New Delhi was the arbitral seat and...

Calcutta High Court Quashes Tender Blacklisting Of Pharma Firm; Says Show-Cause Notice Must Clearly Propose Debarment Action

“When it comes to blacklisting, the requirement becomes all the more imperative… it is the harshest possible action,” the Calcutta High Court stressed while setting aside a three-year debarment and forfeiture of performance bank guarantee imposed on Helax Healthcare Pvt Ltd for alleged supply of non-standard Telmisartan tablets.Justice Krishna Rao held that the September 26,...

Mills Cannot Go Back On Price Change Agreed For Sugarcane In Meeting Convened By CM, With Farmers: Karnataka High Court

The Karnataka High Court has permitted the South Indian Sugar Mills Association (Karnataka) and individual members of the association and factory owners to submit a representation to the Sugarcane Control Board, as regards the additional sugarcane price, which has now been fixed.Justice Suraj Govindaraj however noted that after agreeing in the meeting convened by the Chief Minister with regard...

Income Tax Act | Bombay High Court Allows Treaty-Based Cap Of 10% On DDT For Foreign Shareholder; Sets Aside BFAR Ruling

The Bombay High Court (Goa Bench) has held that Dividend Distribution Tax (DDT) paid by an Indian subsidiary to its foreign shareholder must be restricted to the treaty rate of 10% under Article 11 of the India-UK India Double Taxation Avoidance Agreement (DTAA) A Division Bench of Justice Bharati Dangre and Justice Nivedita P. Mehta allowed the appeal filed by the assessee,...

GST | Court Should Not Presume Denial Of Bail Is Rule: Punjab & Haryana High Court Grants Bail In ₹23.66 Cr Fake ITC Case

The Punjab and Haryana High Court held that even in cases involving economic offences under the CGST Act, courts must not proceed on the presumption that “Denial of Bail is the Rule and grant being the exception”. Justice Aaradhna Sawhney stated that even in cases involving economic offences, the Court seized of the matter has to go through the gravity of the offence, the object...