All High Courts

'Kerala Doesn't Have Dignity As Such, Dignity Is Of India': Kerala Story 2 Producer To High Court

Producer of The Kerala Story 2: Goes Beyond has objected to the locus standi of the petitioners who have moved pleas before the Kerala High Court challenging the censor certification granted to the film, over alleged defamation of the State.The senior counsel appearing for the producer submitted before Justice Bechu Kurian Thomas that the pleas are in the nature of public interest and...

“Sending Appellant To Jail After 42 Years Not Expedient”: Calcutta High Court Releases Essential Commodities Act Convict On Probation

Holding that sending a man to jail more than four decades after the alleged offence would serve no meaningful purpose, the Calcutta High Court released an Essential Commodities Act convict on probation while upholding his conviction. Justice Ananya Bandyopadhyay observed that requiring the appellant to undergo imprisonment at this stage, nearly 42 years after the incident, would not...

Procedural Lapse By ICC Can't Extinguish Sexual Harassment Complaint: Gauhati High Court Orders Fresh Inquiry Under POSH

The Gauhati High Court has held that procedural lapses or inaction on the part of an Internal Complaints Committee (ICC) cannot defeat an aggrieved woman's substantive statutory right to seek redress under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 (POSH Act). Dismissing a challenge to the revival of ICC proceedings, Justice Devashis Baruah...

J&K&L High Court Issues Notice On PIL Alleging Non-Implementation Of Public Service Guarantee Act, Seeks Response From UT Govt

The Jammu & Kashmir and Ladakh High Court issued notice in a Public Interest Litigation seeking effective implementation of the Jammu & Kashmir Public Service Guarantee Act, 2011 (PSGA) and the Rules framed thereunder.A Division Bench comprising Chief Justice Arun Palli and Justice Rajnesh Oswal was hearing the PIL filed by Sheikh Ghulam Rasool, a doctor, environmentalist and...

Periodical Medical Checkup Is Right Of Every Prisoner Under Article 21: Madras High Court

The Madras High Court recently observed that every prisoner has a right to periodical medical check-ups and the same forms part of the fundamental rights enshrined in Article 21 of the Constitution. “We hold that every prisoner has a right to have a periodical medical check up which would fall within the scope of Article 21 of the Constitution of India. Such check ups...

'People Need Open Spaces': Kerala High Court Pulls Up Development Authority Over Kiosks On Queen's Walkway, Orders Status Quo

The Kerala High Court on Tuesday (February 24) orally remarked that the people in Ernakulam are being harmed with the conversion of areas kept aside for public benefit into commercial spaces, including the proposed construction of 20 kiosks in the Queen's Walkway.Justice Bechu Kurian Thomas was considering a plea preferred by the Tritvam Apartment Owners Association and its President,...

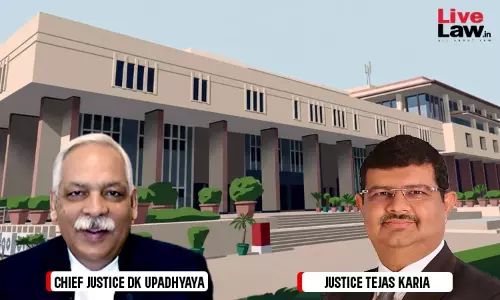

Delhi High Court Seeks Centre, NCRB Response On Plea Against Law Allowing Police To Collect DNA, Biometrics Of Accused

The Delhi High Court on Wednesday issued notice on a plea seeking to declare the Criminal Procedure (Identification) Act, 2022, to be void and unconstitutional for being ultra vires Articles 14, 20(3) and Article 21 of the Constitution of India.A division bench comprising Chief Justice DK Upadhyaya and Justice Tejas Karia sought response of Union Government through Ministries of Law &...

Karnataka High Court Upholds Husband's Murder Conviction, Life Term For Setting Man Ablaze Over Suspicion Of Affair With Wife

The Karnataka High Court upheld a trial court order convicting a husband for murder who poured petrol and set ablaze a man over suspicion of affair with his wife, observing that he had the intention to commit the offence. In doing so the court affirmed the dying declaration of the deceased as well as the evidence of the eye-witnesses, finding it credible and without any material...

Right To Education | Govt Can't Deny Distance Education To Employees For Want Of Minimum 3 Years Service: Punjab & Haryana High Court

The Punjab and Haryana High Court has held that a government employee cannot be denied permission to pursue higher education through distance mode merely on the ground of not having completed three years of service, observing that the right to education is an inalienable human right flowing from Article 21 of the Constitution.Justice Harpreet Singh Brar said, "The right to education has...

Family Property Dispute Given Criminal Colour: Calcutta High Court Quashes Defamation, Intimidation Case Against Cousin

Observing that criminal law cannot be used as a pressure tactic in what is essentially a family property dispute, the Calcutta High Court has quashed defamation, insult and intimidation proceedings initiated against a private company executive, holding that the complaint did not disclose the basic ingredients of offences under the IPC. Justice Chaitali Chatterjee Das held that the...

'Single Injury' In Rage Of Sudden Quarrel Not Murder: Tripura High Court Converts Husband's Conviction to Culpable Homicide

The Tripura High Court held that a single blow inflicted during a sudden quarrel, without prior intention does not amount to murder under Section 302 of the Indian Penal Code. Further the Court observed that the relationship between the husband and his wife was strained and they often got into fights and that the act on the part of the appellant was in course of sudden quarrel and and in the...

Tenant Cannot Evade Eviction By Avoiding Notice; 'Not Claimed' Postal Endorsement Deemed Valid Service: Calcutta High Court

The Calcutta High Court has upheld concurrent eviction decrees passed in favour of a landlord, reiterating that a registered ejectment notice returned with the postal endorsement “not claimed” amounts to valid service, and that a reasonably foreseeable future requirement of the landlord constitutes bona fide need under the rent control law.Dismissing the second appeal, Justice Sugato...