All High Courts

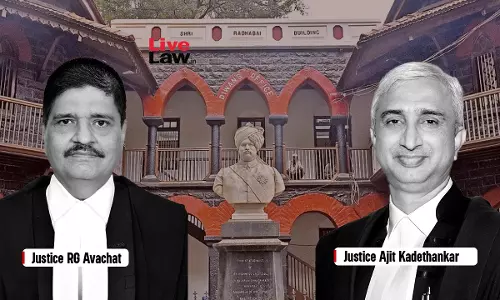

Assault To Dissuade Love Relationship Against Family Wishes Not Against 'Public Order': Bombay High Court Quashes Preventive Detention

Assaulting a boy to dissuade him from continuing a love relationship which is objected by the girl's family is an 'individualistic' act and cannot be considered to be against 'public order' to detain a person under 'preventive detention' laws, held the Bombay High Court earlier this month. Sitting at the Kolhapur circuit seat, a division bench of Justice Ravindra Avachat and Justice...

Police Protection Has Become More Of A 'Status Symbol', Courts Can't Create Privileged Class: Allahabad High Court

In a petition seeking CRPF protection for life, the Allahabad High Court held that having police protection has become more of a status symbol at the cost of taxpayers' money. The bench of Justice Saral Srivastava and Justice Sudhanshu Chauhan observed “..it can very well be held that the nature of threat perception and the liability to provide security has to be left to be decided by...

Temple Festivals Conducted By State Can't Perpetuate Caste Names, Effort Must Be To Annihilate Caste : Madras High Court

The Madras High Court recently observed that the temple festivals conducted by the State through the Hindu Religious and Charitable Endowment Department could not perpetuate caste. Justice Bharata Chakravarthy noted that the very purpose of India becoming a republic was to treat everyone equally. The court added that the endeavour of every authority in the country should be to annihilate...

Denying Public Burial/ Cremation Ground Access To Marginalised Community Constitutes Untouchability; Collector Can Take Action: Madras High Court

The Madras High Court recently observed that a person from the marginalised community cannot be denied access to public burial or cremation ground and the same is a criminal offence under the SC/ST Act. Justice V Lakshminarayanan added that denying public burial or cremation ground to a person from marginalised community is a form of practicing untouchability which is...

'One Incident' Of Husband Slapping Wife For Staying Overnight At Parent's Home Without Telling Him Not Cruelty: Gujarat High Court

The Gujarat High Court has observed that "one incident" of a husband slapping his wife on the ground of her staying overnight at parental home without informing him would not amount to cruelty under Section 498A IPC.Acquitting the husband accused of cruelty and abetment to suicide after 23 years, the court further said that allegation of persistent, unbearable continuous beatings by husband...

'Tum Log Police Se Ghir Chuke Ho': Why Allahabad High Court Equated This UP Police FIR With A 'Movie Script'

The Allahabad High Court (Lucknow Bench) on Monday strongly deprecated the growing trend of Uttar Pradesh Police FIRs containing highly exaggerated content that appear to be borrowed heavily from "movie scripts". "Time and again this Court has pointed out that the language being used in the FIRs does not reflect the ground position, rather appears to be hearsay, scripted and appears to...

Will Hold State Liable For Victim Compensation If 'Chinese Manjha' Sales Continue Unabated, Warns Allahabad High Court

The Allahabad High Court has taken strong note of the failure of the Uttar Pradesh authorities to effectively curb the unabated manufacture, sale and use of deadly synthetic kite strings, commonly referred to as “Chinese Manjha”. Observing that state functionaries "wake up and start taking some action" only when tragic injuries or fatalities hog newspaper headlines, the Court...

'Silence Of Grave' Can't Be Substituted By Signatures Of Heirs: P&H High Court Refuses To Quash Death By Negligence Case On Compromise

The Punjab and Haryana High Court has held that criminal proceedings under Section 304-A IPC involving loss of human life cannot be quashed merely on the basis of a compromise between the accused and the deceased's relatives, observing that “the silence of the grave cannot be substituted by the signatures of the heirs on a compromise deed.”Justice Sumeet Goel said, "The essential edifice...

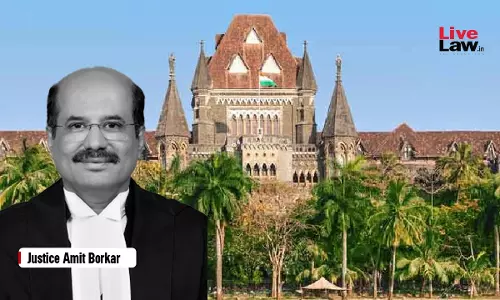

Section 9 MEPS Act Cannot Be Expanded To Cover Pay, Increment Or Monetary Claims By School Employees: Bombay High Court

In a significant ruling, the Bombay High Court on Friday (Feb 6) held that section 9 of the Maharashtra Employees of Private Schools (Conditions of Service) Regulation Act, 1977 (MEPS) cannot be invoked in disputes pertaining to 'salary scale' as it would result in expanding the provisions' scope and also make the School Tribunals, a general forum to hear all kinds of financial claims...

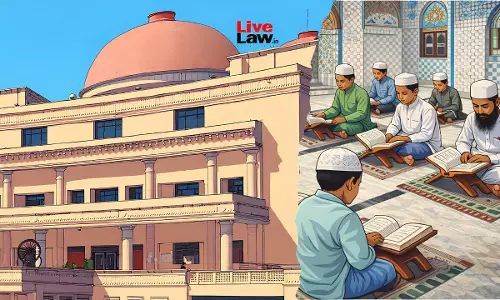

Allahabad High Court Seeks UP Govt Reply To PIL Alleging Selective Continuation Of Grant-In-Aid To Suspended Madrasas

The Allahabad High Court (Lucknow Bench) has sought the response of the Uttar Pradesh Government to a Public Interest Litigation (PIL) plea, which alleges that there is no uniform State policy for continuing to grant aid to Madrasas despite their recognition having been suspended. The PIL plea filed by social worker Azaj Ahmad, through Advocates Asok Pande and Vindeshwri Pandey,...

Jharkhand High Court Orders No Coercive Action Against Advocate In Road Accident Cross-FIR

The Jharkhand High Court has granted interim protection to Advocate Manoj Tandon, who is accused in cross-FIRs arising out of a road accident incident in Ranchi, and stayed further proceedings in the case while observing that both cross-cases arising out of the same occurrence must be investigated by a single investigating officer.A Single Judge Bench of Justice Sanjay Kumar Dwivedi was...

Arnesh Kumar Guidelines Flouted: Punjab & Haryana High Court Issues Notice To Both State's Chief Secretaries, DGPs In Contempt Plea

In a significant order highlighting continued non-compliance of the Supreme Court's landmark ruling in Arnesh Kumar v. State of Bihar, the Punjab and Haryana High Court has issued notice to the Chief Secretaries and Director Generals of Police (DGPs) of the States of Punjab and Haryana to show cause why contempt proceedings should not be initiated against them.Justice Sudeepti Sharma noted...