All High Courts

Law Casts Duty Upon Representing Counsel To Report Death Of Litigant During An Ongoing Litigation: J&K High Court

The Jammu and Kashmir High Court held that it would take into account the date on which the death of a litigant was brought on the court's record for the purpose of calculating the limitation period for setting aside the abatement of the suit. The court stated that it is the duty of the counsel representing the party to inform the court about the death of the litigant during the pendency of...

'Flight Risk': ED Opposes Christian Michel's Bail In AgustaWestland Case; Delhi High Court Reserves Judgment

The Delhi High Court on Friday reserved judgment in the bail plea moved by British Arms Counsultant Christian James Michel in the money laundering case registered by Enforcement Directorate (ED) in connection with the Agusta Westland chopper scam case. “Reserved,” Justice Swarana Kanta Sharma said after hearing the counsels appearing for Michel as well as the central probe agency. The...

State Has Taken Substantial Steps On Issue Of Desiltation Of Dams, Reservoirs To Restore Storage Capacity For Flood Mitigation: Kerala HC Closes PIL

The Kerala High Court recently observed that the State Government has implemented various measures like formulating a Standard Operating Procedure (SOP) and establishing Technical and Empowered Committees to facilitate desiltation of dams and reservoirs in the State for restoring storage capacity and flood mitigation.Desiltation is the removal of silt and sediments from dams and reservoirs...

Ramsar Convention: Meghalaya High Court Registers Suo Motu PIL To Ensure Maintenance Of Wetlands In State

The Meghalaya High Court on Thursday (February 27) registered a suo moto PIL to ensure that the Ramsar Convention wetland sites within the State are properly maintained and ensured. The said PIL was registered in pursuance of Supreme Court's direction requesting all High Courts to ensure that the RAMSAR Sites within their jurisdiction are properly maintained. To summarise, the wetlands, if...

'Final Report-I' Confidential Document Of CBI But Can Be Produced Before Court At Cognizance Stage In Exceptional Circumstances: Delhi HC

The Delhi High Court has ruled that production of Central Bureau of Investigation's (CBI) final report for the perusal of the special court cannot be denied at the stage of cognizance, if exceptional circumstances are made out.Justice Anoop Kumar Mendiratta referred to the provisions in Chapter 18 of the CBI Crime Manual which provides that on completion of investigation, every IO is required...

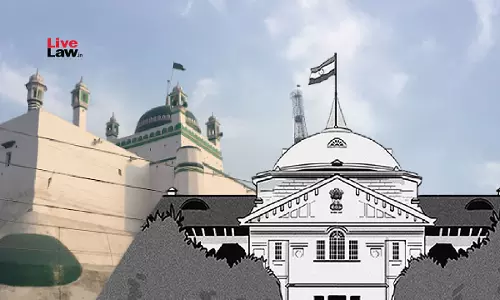

Allahabad HC Orders Cleaning Of Sambhal Mosque Premises As ASI Says Whitewashing Not Needed; Masjid Committee To File Objections

Following the Thursday directions of the Allahabad High Court, the Archaeological Survey of India (ASI) today submitted an inspection report stating that the Shahi Jama Mosque in Sambhal does not require whitewashing ahead of Ramadan/Ramzan, as the entire mosque is covered with enamel paint that is in good condition.On the mosque management committee's insistence that whitewashing is...

Delhi High Court Quashes IOA Order Appointing Ad-Hoc Committee To Look After Affairs Of Bihar Olympic Association

The Delhi High Court has quashed an order passed by the President of Indian Olympic Association (IOA) constituting a five member Ad-Hoc committee to look after the affairs of the Bihar Olympic Association. Justice Sachin Datta said that the decision taken on January 01 did not satisfy the requirements of law and deserved to be set aside. The Court ordered that urgent steps be taken to...

Penalty Of Withholding 100% Pension Gratuity By Disciplinary Authority Is Not Understandable: Karnataka High Court

The Karnataka High Court has come to the aid of a 73-year-old, cancer patient and former employee of Commissioner of Central Excise, Customs and Service Tax, by setting aside an order of the authorities withholding 100 percent of gratuity and pension due to him.Justice M Nagaprasanna allowed the petition filed by Hanumanth N Karkun and quashed the order passed by the authorities and directed...

'Natural Guardian' Under Hindu Minority & Guardianship Act Can Act As 'Manager' Of Joint Family Properties For Herself & Minors: Bombay High Court

The Aurangabad bench of the Bombay High Court recently held that a natural guardian being the eldest member of a Hindu joint family can exercise powers to deal with the rights of the minors in the joint family, keeping in mind the aspect of legal necessity and benefit of the minor.Single-judge Justice Santosh Chapalgaonkar quashed and set aside the December 1, 2023 order passed by District...

Land Classified As 'Shamilat-E-Deh' Is As Good As Proprietary Land: J&K High Court Directs Compensation For Acquisition

The Jammu and Kashmir High Court held that land classified as Shamilat-e-Deh, once shown as vested in the name of any person, is as good as proprietary land, and the owner is entitled to compensation upon its acquisition by the government.The court said that, in view of the revenue records, the respondents cannot dispute or deny the petitioner's ownership over the land in question for the...

Delhi High Court Rejects Plea By Maharaja Karni Singh's Heir Asking Central Govt To Clear Rent Arrears On Bikaner House

The Delhi High Court has dismissed a petition filed by heir of Late Maharaja Dr. Karni Singh, the last one to hold the title of Maharaja of Bikaner, seeking arrears of rent from Central Government for the Bikaner House property in the national capital. Justice Sachin Datta rejected the contentions raised by the petitioner- daughter of the Maharaja and said that she failed to establish any...

Allahabad High Court Denies Bail To Doctor Accused Of Raping Dalit On-Duty Nurse At Midnight

The Allahabad High Court last week denied bail to a doctor accused of committing rape upon a 20-year-old Dalit nurse inside his cabin, at a private hospital. The alleged incident occurred in August last year while the victim was on night duty at the hospital. A bench of Justice Nalin Kumar Srivastava, however, granted bail to the co-accused Mehnaz, a nurse, and Junaid, a ward boy,...