All High Courts

S.68 IT Act | Whether Assessee Discharged Burden To Substantiate Identity & Genuineness Of Share Application Money Is 'Question Of Fact', Not Law: Gauhati HC

The Gauhati High Court refused to entertain an appeal with respect to genuineness of credit received by an assessee from share application money, holding that the same would require it to venture into factual matrix of the case which is beyond its jurisdiction under Section 260A of the Income Tax Act, 1961. The appeal was preferred by the Revenue, following CIT(A) reversing the...

Service Tax Not Prima Facie Leviable On Amounts Claimed As Performance Linked Incentives/Commission: Delhi High Court

The Delhi High Court has prima facie observed that service tax is not leviable on amounts claimed by an Assessee as commission or performance linked benefit. A division bench of Justices Yashwant Varma and Dharmesh Sharma cited the decision of a Larger Bench of the CESTAT in Kafila Hospitality & Travels Pvt. Ltd. vs. Commr. Of S.T., Delhi (2023). In that case, the Tribunal...

Salary Of Army Personnel Can't Be Attached To Realise Maintenance Arrears, Only Central Govt Authorised To Make Deductions: Punjab & Haryana HC

The Punjab and Haryana High Court has said that the salary of an Army personnel cannot be attached to realise the arrears of maintenance under Section 125 CrPC, as only the Central government is authorised to make deductions.The Court noted that under Army Act a broad spectrum of rights and protections has been granted to the Army personnel with an intention to ensure that they can duly...

2020 Delhi Riots: High Court Upholds Order Framing Charges Against Accused, Says 'Evidence Will Be Filtered In The Crucible Of Trial'

The Delhi High Court has upheld a trial court order framing charges against one Salim Malik booked in a case related to the 2020 North-East Delhi riots.Justice Anish Dayal rejected Malik's plea against the trial court order that framed charges against him for the offences under Sections 147(Punishment for rioting), 148(Rioting, armed with deadly weapon), 427(Mischief causing damage to the...

Mobile Towers Are Not Immovable Property, They Are Eligible For Input Tax Credit: Delhi High Court Allows Airtel's Plea

The Delhi High Court has held that mobile/ telecommunication towers are movable properties, eligible for availing input tax credit under the Central Goods and Services Tax Act, 2017. A division bench of Justices Yashwant Varma and Girish Kathpalia further held that telecom towers fall outside the scope of Section 17(5) of the CGST Act which sets out various goods and services...

Rule 8D Of IT Rules Can Be Invoked Only If Assessee's Computation Of Expenses Attributable To Earning Exempt Income Is Found Inadequate: Delhi HC

The Delhi High Court has held that recourse to Rule 8D of the Income Tax Rules, 1962 for computing disallowance under Section 14A of the Income Tax Act is available only if the Assessee's computation of expenses attributable to earning exempt income, is found to be inadequate. Rule 8D provides a mechanism to determine the expenditure in relation to exempt income. In the case at...

Delhi HC Deprecates Practice Of GST Authorities Issuing 'Template Orders', Says Rejection Of Reply To SCN Must Be On Merits

The Delhi High Court recently granted relief to a logistics company aggrieved by the decision of Assistant Commissioner, GST, rejecting its reply to a show cause notice by way of a 'template' order. A division bench of Justices Prathiba M. Singh and Amit Sharma observed that a SCN, which seeks to impose further liabilities (including penalties) upon assesses, has to be decided...

RG Kar Rape-Murder | Victim's Parents Move Calcutta High Court Against CBI Probe, Seek Fresh Investigation

In another development arising from the brutal rape and murder of a trainee doctor at Kolkata's RG Kar medical college and hospital, the parents of the victim girl have moved the Calcutta High Court challenging the CBI probe into the incident and seeking a fresh investigation into the case.Notably, while the trial against the main accused Sanjoy Roy is ongoing before the trial court, two...

Lenovo Is Exclusive Proprietor Of “THINK” Family Of Marks: Madras HC Orders Removal Of Trademark Registration For “THINBOOK” Laptop

While hearing a plea moved by computer manufacturer Lenovo protection of its "THINK" Family of Marks, the Madras High Court directed the Registrar of Trademarks to cancel the registration given to a Hyderabad based company for its “THINBOOK” mark finding it deceptive. Justice Abdul Quddhose opined that the petitioner, Lenovo, who had been using the THINK family of marks had obtained...

Regulatory Measures Under GST Laws Necessary To Prevent Tax Evasion, Not Violative Of Fundamental Right To Trade: Calcutta High Court

The Calcutta High Court has held that regulatory measures under the Goods and Services Tax Act cannot be labeled as violative of an assessee's right to trade/ business under Article 19(1)(g) of the Constitution. Justice Rajarshi Bharadwaj reasoned that such regulatory measures are “necessary to ensure compliance and prevent tax evasion”. The observation comes in a petition filed...

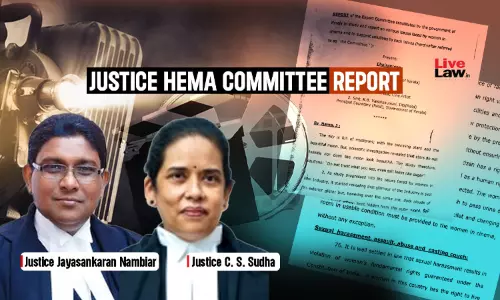

Kerala HC Extends Nodal Officer's Jurisdiction To Receive Complaints Of Victims From Film Industry Who Were Not Before Hema Committee

The Kerala High Court has extended the jurisdiction of the nodal officer to accept the grievances of harassment/abuse from persons in the film industry who were not before the Justice Hema Committee. The Court further ordered that the nodal officer on receipt of such complaints of harassment/abuse can forward it to the Special Investigation Team (SIT) for further investigation.Previously, the...

Kidnapping Case: Karnataka High Court Permits Bhavani Revanna To Enter Her Native Districts Of Mysuru, Hassan For 15 Days

The Karnataka High Court on Thursday relaxed a condition imposed in the anticipatory bail order of Bhavani Revanna, and permitted her to enter her native districts of Mysuru and Hassan for 15 days.In its order dated June 7, the court had while granting interim anticipatory bail to Bhavani in connection with a kidnapping case, had directed her not to hover around Hassan and KR Nagara of...